Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What is the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

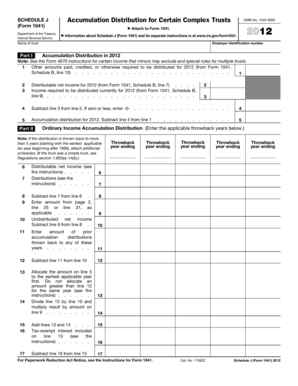

The Form 1041 Schedule J is specifically designed for certain complex trusts that accumulate income rather than distribute it to beneficiaries. This schedule allows trustees to report the accumulation distribution and calculate the tax implications for beneficiaries receiving distributions from the trust. Understanding this form is crucial for ensuring compliance with IRS regulations and accurately reporting income to avoid potential penalties.

How to use the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

Using the Form 1041 Schedule J involves several steps. First, trustees must determine if the trust qualifies as a complex trust and if it has accumulated income. Next, the trustee should gather all necessary financial information related to the trust's income and distributions. The completed Schedule J should be attached to the Form 1041 when filing the trust's income tax return. Accurate completion is essential to reflect the trust's financial activities correctly.

Steps to complete the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

Completing the Form 1041 Schedule J requires careful attention to detail. Here are the steps to follow:

- Gather financial records related to the trust's income and distributions.

- Determine the total accumulated income for the tax year.

- Calculate the distribution amounts to beneficiaries.

- Fill out the Schedule J form, ensuring all figures are accurate.

- Attach the completed Schedule J to the Form 1041.

- Review the entire tax return for accuracy before submission.

Key elements of the Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

Key elements of the Form 1041 Schedule J include the identification of the trust, the total accumulated income, and the amounts distributed to beneficiaries. It also requires detailed calculations to determine the tax liability associated with the accumulated distributions. Each section must be completed accurately to ensure compliance with IRS regulations and to provide clarity for beneficiaries regarding their taxable income.

Filing Deadlines / Important Dates

Trustees must be aware of specific filing deadlines for the Form 1041 Schedule J. Generally, the form is due on the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this typically means April 15. It is important to file on time to avoid penalties and interest on any taxes owed.

IRS Guidelines

The IRS provides detailed guidelines for completing the Form 1041 Schedule J. These guidelines outline eligibility criteria, reporting requirements, and instructions for calculating accumulated distributions. Trustees should refer to the latest IRS publications and instructions to ensure compliance with current tax laws and regulations.

Quick guide on how to complete 2012 form 1041 schedule j accumulation distribution for certain complex trusts

Prepare [SKS] effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your desktop.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1041 schedule j accumulation distribution for certain complex trusts

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts?

Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts is used by complex trusts to report income accumulation and distributions made to beneficiaries. This form helps ensure that the tax obligations related to accumulated income are calculated accurately. Understanding this form is crucial for trustees to comply with IRS regulations and avoid penalties.

-

How can airSlate SignNow assist in managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts?

airSlate SignNow simplifies the process of managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts by allowing users to create, send, and eSign necessary documents efficiently. With its intuitive platform, you can ensure that all documents are collected and stored securely, which helps maintain organization and compliance.

-

What are the pricing options for using airSlate SignNow for my trust documents?

airSlate SignNow offers several pricing plans tailored to the needs of businesses of all sizes. The plans provide various features including eSigning capabilities and document templates, which can assist in preparing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts. You can choose a plan that best fits your requirements and budget.

-

Is it easy to integrate airSlate SignNow with other tools I use for trust management?

Yes, airSlate SignNow provides seamless integrations with popular applications and tools that you may already use for trust management. This compatibility allows you to streamline workflows and save time when handling Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts. Check our integration options to find out more.

-

Can I track the status of documents related to Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts?

Absolutely! airSlate SignNow includes a document tracking feature that allows you to monitor the status of all documents, including those related to Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts. This transparency ensures you stay informed about who has signed and when, enhancing accountability.

-

What security measures are in place for documents related to Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts?

airSlate SignNow employs robust security measures including encryption and secure data storage to protect your documents. This is especially vital for sensitive information associated with Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts. Your data’s privacy and security are paramount, ensuring peace of mind.

-

How does eSigning save time when dealing with Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts?

eSigning with airSlate SignNow drastically reduces the time needed to obtain signatures on Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts. Instead of mailing documents back and forth, you can send them electronically, allowing for quick access and immediate signing, which accelerates the overall process.

Get more for Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

Find out other Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe