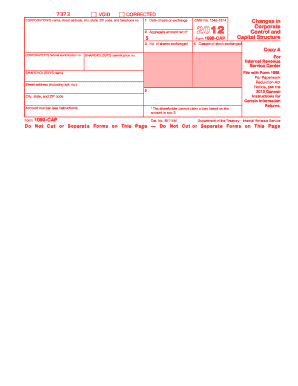

Form 1099 CAP Irs

What is the Form 1099 CAP Irs

The Form 1099 CAP is a tax document used by the Internal Revenue Service (IRS) in the United States. It is specifically designed to report certain types of income that are not classified as wages, salaries, or tips. This form is typically issued to individuals or entities that have received payments from a corporation or partnership, particularly in relation to the cancellation of debt or certain types of distributions. The information reported on this form helps the IRS track income that taxpayers may need to report on their tax returns.

How to use the Form 1099 CAP Irs

Using the Form 1099 CAP involves several steps to ensure accurate reporting of income. First, the payer must complete the form with the necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, the payer should report the amount of income paid during the tax year, along with any applicable taxes withheld. Once completed, copies of the form must be distributed to both the recipient and the IRS. Recipients should then use the information on the form to accurately report their income on their tax returns.

Steps to complete the Form 1099 CAP Irs

Completing the Form 1099 CAP requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the recipient, including their name, address, and TIN.

- Fill in the payer's information, including name, address, and TIN.

- Report the total amount paid to the recipient during the tax year in the appropriate box.

- If applicable, indicate any federal income tax withheld from the payments.

- Ensure all information is accurate and free from errors.

- Provide copies to the recipient and submit the form to the IRS by the deadline.

Legal use of the Form 1099 CAP Irs

The legal use of the Form 1099 CAP is crucial for compliance with IRS regulations. This form must be filed accurately to avoid penalties. The IRS requires that all payments reported on the 1099 CAP be legitimate and properly documented. Failure to file the form, or filing incorrect information, can lead to fines and potential audits. It is essential for both payers and recipients to understand their responsibilities regarding this form to ensure proper tax reporting and compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 CAP are critical for both payers and recipients. Generally, the form must be submitted to the IRS by the end of February if filed by paper, or by the end of March if filed electronically. Additionally, recipients should receive their copies by January 31 of the following year. Staying aware of these deadlines helps avoid penalties and ensures timely reporting of income.

Who Issues the Form

The Form 1099 CAP is typically issued by businesses, corporations, or partnerships that have made qualifying payments to individuals or other entities. These payers are responsible for accurately completing and filing the form with the IRS. It is important for issuers to maintain accurate records of payments made throughout the year to ensure compliance with reporting requirements.

Quick guide on how to complete 2012 form 1099 cap irs

Easily prepare [SKS] on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Retrieve Form to begin.

- Utilize our provided tools to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive information using the tools airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as an ink signature.

- Review all the details and click on the Complete button to save your modifications.

- Choose your preferred method for delivering your form: email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and eSign [SKS] to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1099 CAP Irs

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1099 cap irs

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is Form 1099 CAP Irs and why is it important?

Form 1099 CAP Irs is a tax form used to report capital gains distributions to investors. It is essential for accurate tax reporting and helps you minimize your tax liability by ensuring all income is declared. Understanding this form can streamline your tax preparation process.

-

How can airSlate SignNow help me with Form 1099 CAP Irs?

airSlate SignNow allows you to easily prepare, send, and eSign your Form 1099 CAP Irs electronically. Its user-friendly interface simplifies the process, making it easier to complete required forms without delay. This ensures compliance and saves you time during tax season.

-

What features does airSlate SignNow offer for managing tax forms like Form 1099 CAP Irs?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure document storage specifically designed for handling tax forms like Form 1099 CAP Irs. These features enhance efficiency and ensure that your documents are properly managed and easily retrievable.

-

Is airSlate SignNow cost-effective for businesses needing multiple Form 1099 CAP Irs filings?

Yes, airSlate SignNow offers competitive pricing plans that are ideal for businesses needing to file multiple Form 1099 CAP Irs documents. This cost-effective solution includes various tiers to suit different business sizes, providing great value for your eSignature and document management needs.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099 CAP Irs?

Absolutely! airSlate SignNow supports integrations with many popular accounting software solutions, allowing seamless management of Form 1099 CAP Irs. This capability ensures that all your tax-related data is easily accessible and reduces the likelihood of errors in document preparation.

-

How does using airSlate SignNow improve accuracy for Form 1099 CAP Irs submissions?

Using airSlate SignNow signNowly improves the accuracy of your Form 1099 CAP Irs submissions by minimizing manual data entry errors. The automated features and validation checks ensure that all information is correct before submission, enhancing compliance with IRS requirements.

-

Is it secure to send Form 1099 CAP Irs through airSlate SignNow?

Yes, airSlate SignNow prioritizes security, using advanced encryption protocols to safeguard your Form 1099 CAP Irs documents. Your sensitive financial information is protected during transmission and storage, ensuring that your business remains compliant and secure.

Get more for Form 1099 CAP Irs

Find out other Form 1099 CAP Irs

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe