Schedule H United States Department of Labor Dol Form

What is the Schedule H United States Department Of Labor Dol

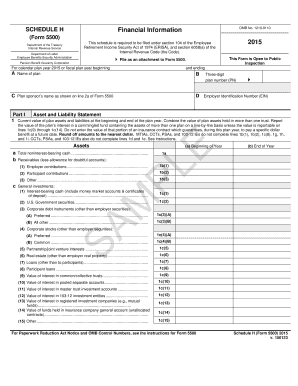

The Schedule H form is a document required by the United States Department of Labor (DOL) for employers who provide household services. This form is used to report wages paid to household employees and to calculate the employer's share of Social Security and Medicare taxes. It is essential for ensuring compliance with tax obligations related to domestic employment. The Schedule H is typically filed with the employer's annual tax return, providing a clear record of employment and tax responsibilities.

How to use the Schedule H United States Department Of Labor Dol

Using the Schedule H involves several steps to ensure accurate reporting of household employment. First, gather all necessary information about your household employees, including their names, addresses, and Social Security numbers. Next, calculate the total wages paid to each employee during the year. This information will be used to fill out the form accurately. Once completed, the Schedule H must be attached to your Form 1040 when filing your federal income tax return. It is important to keep a copy of the completed form for your records.

Steps to complete the Schedule H United States Department Of Labor Dol

Completing the Schedule H requires careful attention to detail. Follow these steps:

- Gather employee information: Collect names, addresses, and Social Security numbers of all household employees.

- Calculate wages: Determine the total wages paid to each employee throughout the year.

- Fill out the form: Enter the calculated wages and any applicable taxes on the Schedule H form.

- Attach to Form 1040: Include the completed Schedule H with your annual tax return.

- Keep records: Retain a copy of the form for your personal records in case of future inquiries.

Legal use of the Schedule H United States Department Of Labor Dol

The Schedule H serves a legal purpose by documenting the employment of household workers and ensuring compliance with federal tax laws. Properly completing and filing this form helps protect employers from potential legal issues related to tax evasion or misclassification of workers. It is crucial for employers to understand their obligations under the law and to use the Schedule H to fulfill these responsibilities accurately.

Filing Deadlines / Important Dates

Filing the Schedule H is tied to your annual tax return, which is typically due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Employers should be aware of any changes to deadlines and ensure timely submission to avoid penalties. Additionally, if you need to file for an extension, it is important to do so before the original deadline to maintain compliance.

Penalties for Non-Compliance

Failure to file the Schedule H or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filing or for failing to pay the required taxes. Additionally, employers may face legal repercussions for misclassifying employees or not adhering to labor laws. It is essential to complete the Schedule H accurately and submit it on time to avoid these potential issues.

Quick guide on how to complete schedule h united states department of labor dol

Accomplish [SKS] effortlessly on any gadget

Online document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule H United States Department Of Labor Dol

Create this form in 5 minutes!

How to create an eSignature for the schedule h united states department of labor dol

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Schedule H from the United States Department of Labor (DOL)?

Schedule H is a specific report required by the United States Department of Labor that outlines the financial details of a fund's operations. It assists employers in providing essential information regarding their employee benefit plans. Understanding Schedule H is crucial for compliance and effective plan management.

-

How does airSlate SignNow help with Schedule H compliance?

airSlate SignNow provides businesses with a streamlined platform to manage and eSign documents necessary for Schedule H compliance. With its easy-to-use interface, you can ensure that all required documentation is signed and securely stored, minimizing the risk of errors. This ultimately aids in meeting the standards set by the United States Department of Labor.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers a range of pricing plans to meet different business needs, starting from a basic plan to more advanced options. Each plan includes features that support Schedule H compliance, allowing you to effectively manage your documents at a cost-effective rate. For further details, visit the pricing section on our website.

-

What features does airSlate SignNow offer for managing Schedule H documents?

airSlate SignNow includes features like customizable templates, automated reminders, and secure storage to assist in managing Schedule H documents. These tools make it easier to complete and sign essential forms in compliance with the United States Department of Labor's requirements. Additionally, bulk sending and real-time tracking enhance the document management process.

-

Can airSlate SignNow integrate with other software for Schedule H processing?

Yes, airSlate SignNow can easily integrate with various software applications, allowing for seamless workflow management during Schedule H processing. This means you can connect your existing systems with our platform, streamlining the documentation and eSigning process according to the United States Department of Labor guidelines.

-

What are the benefits of using airSlate SignNow for Schedule H documentation?

Using airSlate SignNow for Schedule H documentation offers several benefits, including enhanced efficiency and security in managing sensitive information. The platform ensures that your documents are signed electronically within a secure environment, signNowly reducing turnaround time and improving compliance with United States Department of Labor regulations.

-

Is airSlate SignNow user-friendly for Schedule H document management?

Absolutely! airSlate SignNow is designed with user experience in mind, making it incredibly accessible, even for those who may not be tech-savvy. With an intuitive interface and straightforward navigation, managing Schedule H documents becomes a simple and efficient task for everyone in the organization.

Get more for Schedule H United States Department Of Labor Dol

- Bir 1901 form download

- Form 18 a

- Bir form 1702qpdffillercom

- Invisalign consent form

- Nanny self evaluation form

- Wr 702 processing sheet form

- Seattlegov picnic brochure fillable online 2013 picnic brochure form

- Vendor registration form contact information name use this form if you are purchasing vending space for the sale of automotive

Find out other Schedule H United States Department Of Labor Dol

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure