Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction 7,500 0 20,499 20,500 20,999 7,32 Form

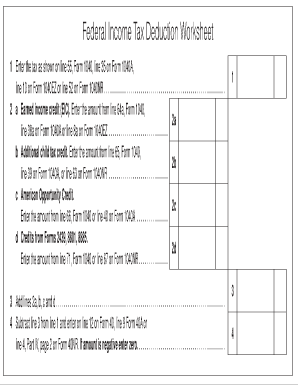

Understanding the Standard Deduction for Married Filing Jointly in Alabama

The standard deduction for married couples filing jointly in Alabama is a crucial aspect of tax preparation. For the tax year, the deduction amounts vary based on adjusted gross income (AGI). The deduction starts at $7,500 for AGI up to $20,499 and decreases incrementally as income rises. For instance, couples earning between $20,500 and $20,999 can claim $7,325. As income increases, the deduction continues to decrease until it reaches $6,450 for those earning between $23,000 and $23,499.

Steps to Utilize the Standard Deduction Married Filing Jointly

To effectively use the standard deduction for married filing jointly in Alabama, follow these steps:

- Determine your adjusted gross income (AGI) by totaling all income sources and subtracting allowable deductions.

- Refer to the deduction chart to identify the appropriate deduction amount based on your AGI.

- Complete your tax return, ensuring to include the standard deduction in the appropriate section.

- Review your return for accuracy before submission to avoid any potential issues.

Key Elements of the Standard Deduction Married Filing Jointly

Several key elements define the standard deduction for married couples filing jointly in Alabama:

- The deduction amount is contingent on the couple's adjusted gross income.

- It provides a simplified method for reducing taxable income without itemizing deductions.

- Eligibility for the standard deduction is generally available to all married couples filing jointly unless specific circumstances apply.

State-Specific Rules for the Standard Deduction in Alabama

Alabama has specific rules regarding the standard deduction for married couples. It is important to note that while the federal standard deduction may differ, Alabama's state tax regulations dictate its own limits and eligibility criteria. Couples should ensure they are aware of any state-specific adjustments or requirements that may affect their tax filings.

Examples of Using the Standard Deduction Married Filing Jointly

Consider a married couple with an adjusted gross income of $21,000. They can claim a standard deduction of $7,150. This reduces their taxable income significantly. Another example includes a couple with an AGI of $22,500, who would qualify for a deduction of $6,800. These examples illustrate how the deduction can provide substantial tax savings.

IRS Guidelines for the Standard Deduction

The IRS provides clear guidelines regarding the standard deduction for married filing jointly. Taxpayers should refer to IRS publications for the most current information on deduction amounts and eligibility. Compliance with IRS regulations ensures that taxpayers maximize their deductions while adhering to federal tax laws.

Quick guide on how to complete standard deduction married filing joint al adjusted gross standard income al line 10 deduction 7500 0 20499 20500 20999 7325

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among corporations and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction 7,500 0 20,499 20,500 20,999 7,32

Create this form in 5 minutes!

How to create an eSignature for the standard deduction married filing joint al adjusted gross standard income al line 10 deduction 7500 0 20499 20500 20999 7325

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Standard Deduction for Married Filing Joint in Alabama?

The Standard Deduction for Married Filing Joint in Alabama varies based on your Adjusted Gross Income. For income between $20,500 and $20,999, the deduction is $7,325. Understanding these figures can help maximize your tax benefits when using the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction.

-

How does airSlate SignNow help with managing tax documents?

With airSlate SignNow, businesses can easily send and eSign tax documents securely and efficiently. This ensures that you can promptly handle important paperwork related to the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction without any hassle.

-

What features does airSlate SignNow offer to streamline the eSignature process?

airSlate SignNow provides features like customizable templates, team collaboration, and real-time tracking of document status. These features simplify the signing process, making it easier to manage documentation related to the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore all features without any upfront cost. This is a great opportunity to understand how the platform can assist you in managing documents related to the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow provides various pricing plans to fit the needs of small to large businesses. Pricing is competitive, allowing you to choose a plan that aligns with your interests in managing documents for the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easy to streamline your workflows. Whether you require assistance with documentation for the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction or other tasks, integration enhances efficiency.

-

How can I ensure the security of my documents with airSlate SignNow?

airSlate SignNow implements top-notch security protocols to protect your documents, including encryption and robust authentication methods. This ensures that all your sensitive information, like those relevant to the Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction, remains safe.

Get more for Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction 7,500 0 20,499 20,500 20,999 7,32

Find out other Standard Deduction Married Filing Joint AL Adjusted Gross Standard Income AL Line 10 Deduction 7,500 0 20,499 20,500 20,999 7,32

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien