FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY for the Year Jan Revenue Alabama

What is the FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

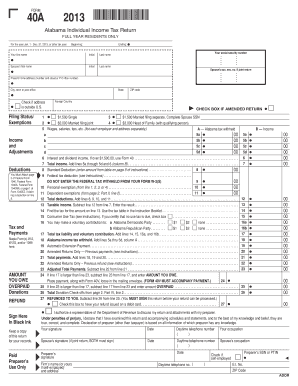

The FORM *1300014A* 40A Alabama Individual Income Tax Return is a tax document specifically designed for full-year residents of Alabama. This form is used to report income, calculate tax liability, and claim any applicable credits or deductions for the tax year. It is essential for individuals who have earned income within the state and are required to file their state income taxes. Understanding this form is crucial for compliance with Alabama tax laws and ensuring accurate reporting of financial information.

Steps to complete the FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

Completing the FORM *1300014A* involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand specific requirements and eligibility criteria.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include all taxable income.

- Calculate your total tax liability using the provided tax tables or software.

- Claim any deductions or credits for which you qualify, ensuring you have the necessary documentation.

- Review the completed form for accuracy before submitting it.

How to obtain the FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

The FORM *1300014A* can be obtained through several methods. It is available on the official Alabama Department of Revenue website, where you can download and print the form. Additionally, physical copies may be available at local tax offices or public libraries. For convenience, many tax preparation software programs also include this form, allowing users to complete it electronically.

Legal use of the FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

The FORM *1300014A* is legally binding when filled out correctly and submitted to the Alabama Department of Revenue. It must be signed and dated by the taxpayer to validate the information provided. Compliance with state tax laws is critical, as failure to file or inaccuracies can lead to penalties, interest, or legal action. Understanding the legal implications of this form helps ensure that taxpayers meet their obligations responsibly.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the FORM *1300014A*. Typically, the filing deadline for Alabama state income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to check for any updates or changes to deadlines annually to avoid late filing penalties.

Required Documents

To complete the FORM *1300014A*, taxpayers should gather several key documents:

- W-2 forms from employers detailing wages and tax withholdings.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Records of any deductions or credits claimed, such as receipts for charitable donations or medical expenses.

- Previous year's tax return for reference and consistency.

Quick guide on how to complete form 2013 1300014a 40a alabama individual income tax return full year residents only for the year jan revenue alabama

Effortlessly Prepare FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any holdups. Handle FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama with Ease

- Find FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama and click Get Form to initiate the process.

- Leverage the tools we provide to fill in your document.

- Emphasize important sections of your documents or obscure confidential information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2013 1300014a 40a alabama individual income tax return full year residents only for the year jan revenue alabama

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama is a tax document required for full-year residents of Alabama to report their annual income. This form allows taxpayers to detail their income and claim deductions or credits, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help me with FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

airSlate SignNow simplifies the process of preparing and eSigning FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama. Our platform provides a user-friendly interface that allows you to fill out, sign, and submit your tax form securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for tax forms like FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs when using FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama. We provide cost-effective solutions that ensure you can manage your tax documents without breaking the bank.

-

What features does airSlate SignNow offer for handling tax returns like FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

Our platform includes features such as document templates, eSigning capabilities, and secure cloud storage, making it easy to manage FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama. Additionally, you can track the signing process and receive notifications, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other software for tax-related tasks including FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

Absolutely! airSlate SignNow offers integration options with various accounting and tax software. This allows you to streamline your workflow when managing FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama, ensuring data accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

Using airSlate SignNow for FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our solution helps individuals focus more on their finances instead of paperwork.

-

How does airSlate SignNow ensure the security of my FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama?

airSlate SignNow prioritizes security by implementing advanced encryption and secure access controls. Your FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama is stored safely and is only accessible to authorized users, protecting your sensitive information.

Get more for FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

- Answer mississippi 497315370 form

- Response to interrogatories by defendant mississippi form

- Response to request for production mississippi form

- Response admissions form

- Complaint mississippi 497315374 form

- Answer mississippi 497315375 form

- Intervening complaint mississippi form

- Mississippi summary judgment form

Find out other FORM *1300014A* 40A Alabama Individual Income Tax Return FULL YEAR RESIDENTS ONLY For The Year Jan Revenue Alabama

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online