Alabama Tax Table Revenue Alabama Form

What is the Alabama Tax Table Revenue Alabama

The Alabama Tax Table Revenue Alabama is a crucial document used for determining the amount of state income tax owed by individuals and businesses in Alabama. This table provides a structured format that outlines tax rates based on various income brackets, ensuring that taxpayers can accurately calculate their tax liabilities. It is essential for both residents and non-residents who earn income in Alabama to understand how to utilize this table effectively to comply with state tax regulations.

How to use the Alabama Tax Table Revenue Alabama

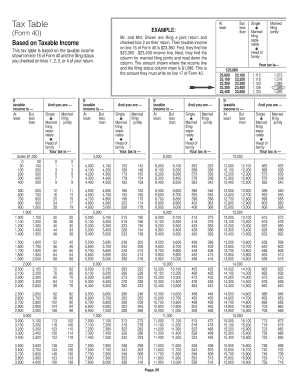

To use the Alabama Tax Table Revenue Alabama, taxpayers should first identify their taxable income, which is the amount of income subject to state tax after deductions and exemptions. Once the taxable income is determined, individuals can refer to the tax table to find the corresponding tax rate. This process typically involves locating the income bracket that matches the taxpayer's income and applying the indicated rate to calculate the total tax owed. Understanding this process is vital for accurate tax filing and compliance.

Steps to complete the Alabama Tax Table Revenue Alabama

Completing the Alabama Tax Table Revenue Alabama involves several key steps:

- Gather all necessary financial documents, including W-2 forms and any other income statements.

- Calculate your total taxable income by summing all sources of income and subtracting allowable deductions.

- Consult the Alabama Tax Table to identify your income bracket and the corresponding tax rate.

- Apply the tax rate to your taxable income to determine your total state income tax liability.

- Ensure that all calculations are accurate before submitting your tax return.

Legal use of the Alabama Tax Table Revenue Alabama

The Alabama Tax Table Revenue Alabama is legally recognized as a valid tool for determining state income tax obligations. Its use is mandated by Alabama tax laws, which require taxpayers to calculate their tax liabilities based on the rates provided in the table. Compliance with these regulations is critical, as failure to accurately report income and taxes owed can result in penalties or legal consequences. Utilizing this table correctly ensures that taxpayers meet their legal obligations while also benefiting from any applicable deductions or credits.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Tax Table Revenue Alabama typically align with federal tax deadlines. For most individuals, the deadline to file state income tax returns is April 15 of each year. However, it is essential to verify specific dates each tax year, as they may vary. Additionally, taxpayers should be aware of extension deadlines and any applicable penalties for late filing or payment. Staying informed about these dates helps ensure compliance and avoid unnecessary fees.

Examples of using the Alabama Tax Table Revenue Alabama

Examples of using the Alabama Tax Table Revenue Alabama can illustrate how different income levels affect tax liabilities:

- A single filer with a taxable income of $40,000 would refer to the tax table to find the applicable rate and calculate their tax owed accordingly.

- A married couple filing jointly with a combined income of $80,000 would follow a similar process, ensuring they reference the correct brackets for their filing status.

These examples highlight the importance of accurately identifying income and understanding the tax table to ensure proper tax calculations.

Quick guide on how to complete alabama tax table revenue alabama

Complete Alabama Tax Table Revenue Alabama effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without any delays. Handle Alabama Tax Table Revenue Alabama on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and eSign Alabama Tax Table Revenue Alabama effortlessly

- Obtain Alabama Tax Table Revenue Alabama and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Alabama Tax Table Revenue Alabama and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama tax table revenue alabama

How to generate an e-signature for your PDF document in the online mode

How to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Alabama Tax Table Revenue Alabama, and how does it work?

The Alabama Tax Table Revenue Alabama is a comprehensive resource that outlines the state income tax rates for individuals and businesses. It serves as a guide to help taxpayers calculate their tax liabilities accurately. By understanding the Alabama Tax Table Revenue Alabama, you can ensure compliance with state tax laws while maximizing potential deductions.

-

How can I access the Alabama Tax Table Revenue Alabama?

You can access the Alabama Tax Table Revenue Alabama through the Alabama Department of Revenue's official website. They provide downloadable forms and tables for public use. Utilizing these resources allows you to easily reference and apply the necessary tax information for your filings.

-

Is there a cost associated with using the Alabama Tax Table Revenue Alabama?

Using the Alabama Tax Table Revenue Alabama is free, as it is published by the state for public use. However, the costs associated with filing taxes may vary based on the tax bracket you fall into. It’s advisable to consult a tax professional if you have further inquiries regarding tax implications.

-

How often is the Alabama Tax Table Revenue Alabama updated?

The Alabama Tax Table Revenue Alabama is typically updated annually to reflect any changes in tax laws or rates. For the most accurate and current information, check the Alabama Department of Revenue's website for the latest updates and announcements. Staying informed will help you make better financial decisions.

-

Can I use the Alabama Tax Table Revenue Alabama for my business taxes?

Yes, the Alabama Tax Table Revenue Alabama can be used for both personal and business tax calculations. Businesses must adhere to the same tax brackets as individual taxpayers, ensuring compliance with state revenue regulations. Familiarizing yourself with the Alabama Tax Table Revenue Alabama can aid in accurate tax reporting.

-

What are the benefits of understanding the Alabama Tax Table Revenue Alabama?

Understanding the Alabama Tax Table Revenue Alabama brings numerous benefits, such as ensuring accurate tax calculations, maximizing deductible expenses, and strategizing tax-saving initiatives. Knowledge of the tax table enables individuals and businesses to plan their finances better. Informed taxpayers are less likely to face penalties or unexpected tax bills.

-

Are there any specific resources available for interpreting the Alabama Tax Table Revenue Alabama?

Yes, various resources are available for interpreting the Alabama Tax Table Revenue Alabama, including tax preparation software, guidance from tax professionals, and online educational materials. The Alabama Department of Revenue also provides FAQs and guidelines to aid taxpayers in understanding the tax table. Taking advantage of these resources can simplify the tax filing process.

Get more for Alabama Tax Table Revenue Alabama

Find out other Alabama Tax Table Revenue Alabama

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile