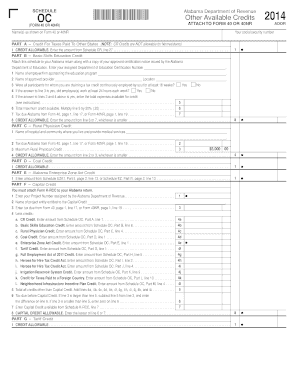

Other Available Credits Form

What is the Other Available Credits

The Other Available Credits form is a crucial document used in various tax situations, allowing taxpayers to claim credits that may not fall under standard categories. These credits can reduce the overall tax liability, providing financial relief to eligible individuals and businesses. Understanding this form is essential for maximizing potential tax benefits and ensuring compliance with IRS regulations.

How to use the Other Available Credits

Using the Other Available Credits form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary information related to their financial situation, including income, expenses, and any relevant documentation that supports the claim for credits. Once the information is compiled, the form can be filled out, ensuring that all sections are completed accurately to avoid delays or rejections.

Steps to complete the Other Available Credits

Completing the Other Available Credits form requires careful attention to detail. Here are the steps to follow:

- Gather all required documentation, including income statements and previous tax returns.

- Review the eligibility criteria for the specific credits being claimed.

- Fill out the form, ensuring all information is accurate and complete.

- Double-check for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Other Available Credits

The legal use of the Other Available Credits form is governed by IRS guidelines, which outline the proper procedures for claiming credits. It is important for taxpayers to ensure that they meet all eligibility requirements and maintain accurate records to support their claims. Failure to comply with these regulations can result in penalties or denial of credits, making it essential to approach the process with diligence.

Eligibility Criteria

Eligibility for the Other Available Credits varies based on the specific credits being claimed. Generally, taxpayers must meet certain income thresholds, filing status, and other criteria set forth by the IRS. It is advisable to review the latest IRS guidelines to determine eligibility, as these can change annually based on tax laws and regulations.

Required Documents

When completing the Other Available Credits form, taxpayers should prepare several key documents to support their claims. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for qualifying expenses related to the credits.

- Previous tax returns for reference.

- Any additional documentation specified by the IRS for specific credits.

Quick guide on how to complete other available credits

Prepare [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed materials, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without hold-ups. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your method of delivery for your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Other Available Credits

Create this form in 5 minutes!

How to create an eSignature for the other available credits

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are Other Available Credits in airSlate SignNow?

Other Available Credits refer to various discounts and incentives that users can take advantage of when using airSlate SignNow. These credits may include seasonal promotions or loyalty discounts that lower your overall costs. Exploring these credits can help maximize your savings on eSigning services.

-

How can I apply Other Available Credits to my airSlate SignNow account?

Applying Other Available Credits to your account is a simple process. During the checkout, input the discount code associated with your credits in the designated field. Ensure you review the terms and conditions to verify that your credits are eligible for the selected subscription plan.

-

Are Other Available Credits stackable with existing discounts?

Typically, Other Available Credits can be combined with specific promotions, but conditions apply. It's essential to review the guidelines provided on airSlate SignNow’s website or contact customer support for clarification on stacking policies. This way, you can maximize your benefits when signing up.

-

What features do I gain access to with Other Available Credits?

Using Other Available Credits can grant you access to enhanced features in airSlate SignNow, depending on the type of subscription you choose. These may include advanced document templates and integrations with third-party applications. Overall, credits allow you to tailor your eSigning experience to better meet your business needs.

-

Do Other Available Credits expire?

Yes, Other Available Credits may have an expiration date. It is important to check the validity period when you receive your codes or discounts. This ensures you utilize the credits before they expire and helps save money on your airSlate SignNow services.

-

Can I transfer Other Available Credits to another user?

No, Other Available Credits in airSlate SignNow are typically non-transferable and are linked to the account they were issued to. This policy is in place to prevent misuse and ensure that credits are used by the intended recipient. If you have questions, consider signNowing out to customer support for further assistance.

-

Will I be notified about Other Available Credits?

Yes, airSlate SignNow notifies users about Other Available Credits through email updates and notifications on your account dashboard. Subscribing to the newsletter is a great way to stay informed about new discounts and promotions. Turn on notifications in your account settings to receive these updates directly.

Get more for Other Available Credits

Find out other Other Available Credits

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later