Form 4952a

What is the Form 4952a

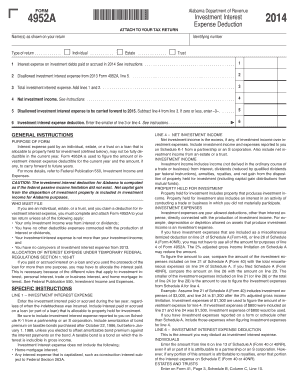

The Form 4952a is a specific tax form used in the United States, primarily associated with the reporting of investment interest expenses. This form allows taxpayers to calculate the amount of investment interest expense that can be deducted on their tax returns. It is essential for individuals and businesses that have incurred interest on loans taken out to purchase investments. Understanding the purpose and requirements of Form 4952a is crucial for accurate tax reporting and compliance.

How to use the Form 4952a

Using Form 4952a involves several steps to ensure accurate reporting of investment interest expenses. First, gather all relevant financial documents, including interest statements from lenders and records of your investments. Next, fill out the form by providing details about the interest expenses incurred and the investments associated with those expenses. It is important to accurately report the amounts to avoid discrepancies with the IRS. Once completed, the form should be submitted along with your tax return.

Steps to complete the Form 4952a

Completing Form 4952a involves a systematic approach:

- Start by entering your personal information, including your name and Social Security number.

- Report your total investment interest expense for the tax year.

- Detail the investments for which the interest was incurred, including the type of investment and the amount of interest paid.

- Calculate the allowable deduction based on the information provided, ensuring compliance with IRS guidelines.

- Review the form for accuracy before submission.

Legal use of the Form 4952a

The legal use of Form 4952a is governed by IRS regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding the reporting of investment interest expenses. This includes maintaining accurate records of interest payments and investments. Failure to use the form correctly can result in penalties or disallowed deductions during an audit. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of using Form 4952a.

Filing Deadlines / Important Dates

Filing deadlines for Form 4952a align with the general tax return deadlines. Typically, individual taxpayers must file their tax returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, which generally provides an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates is crucial for timely and compliant tax filing.

Required Documents

To complete Form 4952a, several documents are necessary:

- Interest statements from lenders detailing the amount of investment interest paid.

- Records of investments that incurred the interest, such as purchase agreements or brokerage statements.

- Previous tax returns, if relevant, to reference any carryover of investment interest from prior years.

Having these documents organized will streamline the process of completing the form and ensure accuracy in reporting.

Quick guide on how to complete form 4952a

Complete form 4952a effortlessly on any device

Web-based document handling has gained traction among companies and individuals alike. It offers a superb eco-conscious substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents quickly and smoothly. Manage form 4952a on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign form 4952a with ease

- Locate form 4952a and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that task.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign form 4952a and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 4952a

Create this form in 5 minutes!

How to create an eSignature for the form 4952a

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask form 4952a

-

What is the purpose of the form 4952a?

The form 4952a is designed to help businesses track and report specific financial data related to their operations. This form is essential for maintaining compliance and ensuring accurate financial reporting, which is crucial for any business looking to optimize their financial performance.

-

How do I fill out the form 4952a using airSlate SignNow?

Filling out the form 4952a with airSlate SignNow is straightforward. Simply upload your document, fill in the necessary fields, and use our user-friendly interface to complete the form and eSign it. This process ensures you can efficiently manage your documentation without hassle.

-

Is there a cost associated with using the form 4952a on airSlate SignNow?

Using the form 4952a on airSlate SignNow is part of our cost-effective pricing plans. We offer various subscription options to suit different business needs, ensuring that you can access essential document services without breaking your budget.

-

What features does airSlate SignNow offer for form 4952a?

AirSlate SignNow provides several features for form 4952a, including customizable templates, electronic signatures, and secure cloud storage. These features streamline the documentation process, making it easier for businesses to manage and share their important forms.

-

Can I integrate other applications with the form 4952a in airSlate SignNow?

Yes, airSlate SignNow offers robust integrations with various applications, allowing seamless use of form 4952a alongside your existing tools. This capability enhances your workflow by connecting with CRM systems, cloud storage platforms, and more for efficient document management.

-

What benefits can I expect from using form 4952a with airSlate SignNow?

By using form 4952a with airSlate SignNow, you gain access to a hassle-free and efficient document signing process. This leads to time savings, enhanced accuracy, and improved compliance, all of which contribute to better productivity for your business.

-

Is airSlate SignNow secure for handling sensitive forms like the 4952a?

Absolutely! AirSlate SignNow employs advanced security measures to ensure that your form 4952a and other sensitive documents are protected. Our platform complies with industry standards for data privacy and security, giving you peace of mind while you manage your documents.

Get more for form 4952a

- Declaration assets liabilities form

- Printable safety patrol certificates form

- Coverage selection form if you can see this page check your url

- Two year registration hazardous consumer products texas dshs state tx form

- Dh 726 2010 form

- Extended form ppq

- Incident notification form worksafe victoria worksafe vic gov

- Gaylaw fellowship application wordpress com form

Find out other form 4952a

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template