Schedule D Amp E Revenue Alabama Form

What is the Schedule D Amp E Revenue Alabama

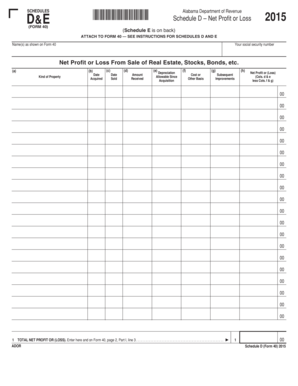

The Schedule D Amp E Revenue Alabama form is a tax document used by individuals and businesses in Alabama to report specific types of income and expenses. This form is essential for accurately calculating tax liabilities and ensuring compliance with state tax regulations. It typically includes details about various revenue sources, including rental income, royalties, and other earnings that may be subject to taxation in Alabama.

How to use the Schedule D Amp E Revenue Alabama

Using the Schedule D Amp E Revenue Alabama form involves several steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, accurately fill out the form by entering your income and expenses in the designated sections. Ensure that all information is complete and correct to avoid delays or issues with processing. Finally, submit the completed form as part of your overall tax return, either electronically or by mail, as per Alabama state guidelines.

Steps to complete the Schedule D Amp E Revenue Alabama

To complete the Schedule D Amp E Revenue Alabama form, follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Begin filling out the form by entering your personal information, including your name and Social Security number.

- Report all sources of income in the appropriate sections, ensuring accuracy in amounts.

- Detail any deductible expenses related to the reported income, providing supporting documentation where necessary.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Schedule D Amp E Revenue Alabama

The legal use of the Schedule D Amp E Revenue Alabama form is crucial for compliance with Alabama tax laws. This form must be filled out accurately to reflect true income and expenses, as misrepresentation can lead to penalties or audits. Additionally, eSignatures can be used to validate the form electronically, provided that the eSignature solution meets the legal requirements established by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Amp E Revenue Alabama form typically align with the overall state tax return deadlines. Generally, individual tax returns are due by April fifteenth of each year. It is important to stay informed about any changes to these dates, as extensions may be available under certain circumstances, but they must be requested in advance.

Required Documents

When completing the Schedule D Amp E Revenue Alabama form, several documents are required to ensure accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements reflecting income deposits

- Any other relevant financial documentation

Examples of using the Schedule D Amp E Revenue Alabama

Examples of using the Schedule D Amp E Revenue Alabama form include reporting rental income from real estate properties, royalties received from intellectual property, or income generated from side businesses. Each of these scenarios requires careful documentation of income and related expenses to ensure compliance with state tax laws and accurate tax reporting.

Quick guide on how to complete schedule d amp e revenue alabama

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven task today.

The Simplest Way to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Put an end to misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign [SKS] and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule D Amp E Revenue Alabama

Create this form in 5 minutes!

How to create an eSignature for the schedule d amp e revenue alabama

How to make an e-signature for a PDF online

How to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF document on Android

People also ask

-

What is Schedule D Amp E Revenue Alabama?

Schedule D Amp E Revenue Alabama refers to the specific documentation required for reporting income from any entity or business in Alabama. It provides clarity on revenue streams and helps ensure compliance with state regulations. Understanding this schedule is crucial for accurate financial reporting.

-

How can airSlate SignNow assist with Schedule D Amp E Revenue Alabama documentation?

airSlate SignNow simplifies the process of sending and eSigning documents related to Schedule D Amp E Revenue Alabama. Our platform allows users to quickly prepare and modify templates to meet specific needs, saving time and enhancing accuracy. With our system, businesses can ensure they stay compliant while managing their documentation efficiently.

-

What features does airSlate SignNow offer for managing Schedule D Amp E Revenue Alabama?

airSlate SignNow offers powerful features like customizable templates, real-time collaboration, and secure eSignature capabilities. These tools streamline the process of handling Schedule D Amp E Revenue Alabama documents, making it easy to gather necessary signatures and approvals directly through our platform. Additionally, the system is designed for seamless workflow management.

-

Is airSlate SignNow cost-effective for businesses needing Schedule D Amp E Revenue Alabama solutions?

Yes, airSlate SignNow is a cost-effective solution for businesses needing assistance with Schedule D Amp E Revenue Alabama. Our pricing plans are designed to accommodate different business sizes, providing excellent value for the features offered. This makes it easier for organizations to manage their documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my Schedule D Amp E Revenue Alabama needs?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to streamline your processes related to Schedule D Amp E Revenue Alabama. This includes accounting software, CRMs, and other document management platforms, enhancing your overall productivity and minimizing data entry errors.

-

What are the benefits of using airSlate SignNow for Schedule D Amp E Revenue Alabama documentation?

Using airSlate SignNow for Schedule D Amp E Revenue Alabama documentation provides numerous benefits, including enhanced document security, quick turnaround times, and improved compliance. Our platform is user-friendly, ensuring a smooth experience for both senders and recipients, which ultimately leads to increased efficiency in handling critical paperwork.

-

How secure is airSlate SignNow for handling Schedule D Amp E Revenue Alabama documents?

airSlate SignNow employs top-notch security measures to protect your Schedule D Amp E Revenue Alabama documents. We utilize encryption, multi-factor authentication, and regular audits to ensure that all data remains secure. Our commitment to security allows businesses to manage their documentation without worrying about unauthorized access.

Get more for Schedule D Amp E Revenue Alabama

- Indiana app title form

- Cost of demo permit cobb form

- Declaration assets liabilities form

- Printable safety patrol certificates form

- Coverage selection form if you can see this page check your url

- Two year registration hazardous consumer products texas dshs state tx form

- Dh 726 2010 form

- Gaylaw fellowship application wordpress com form

Find out other Schedule D Amp E Revenue Alabama

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy