Boe 65 California Form 2015

What is the Boe 65 California Form

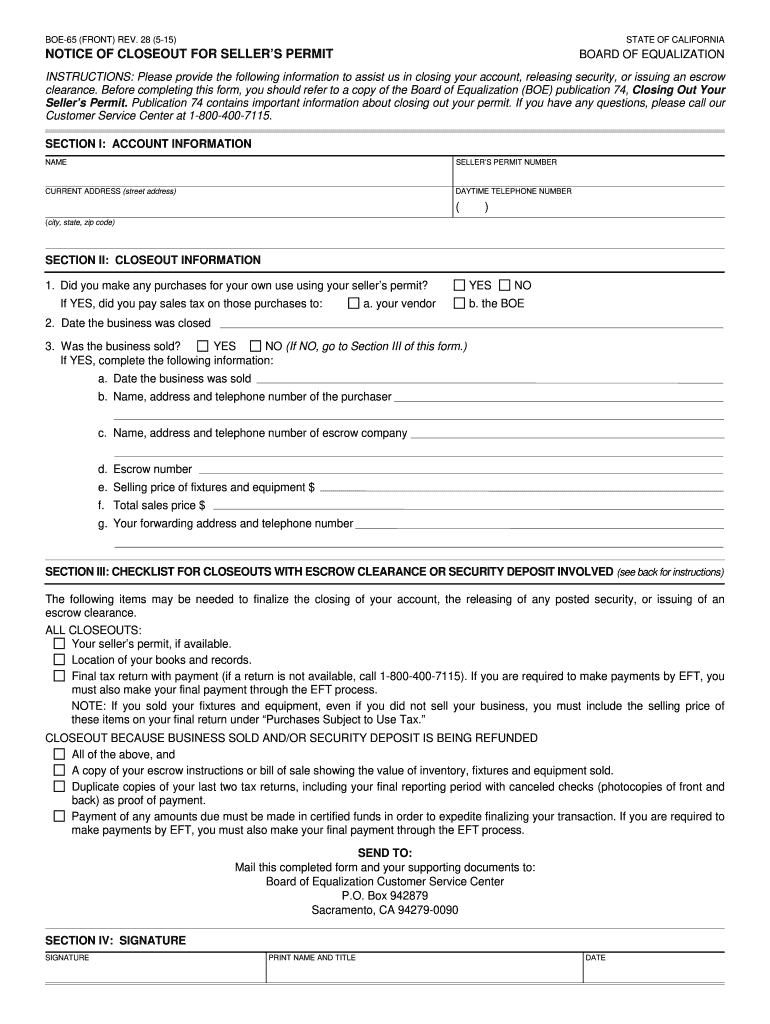

The Boe 65 California Form is a document used primarily for reporting and claiming a property tax exemption for certain types of property in California. This form is essential for property owners who wish to apply for exemptions that can reduce their tax liability. The form is designed to ensure that property owners meet specific criteria set forth by the California Board of Equalization, which oversees property tax assessments and exemptions.

How to use the Boe 65 California Form

To use the Boe 65 California Form effectively, property owners should first review the eligibility requirements for the exemption they are seeking. Once confirmed, they can obtain the form from the California Board of Equalization's website or local tax assessor's office. After filling out the necessary information, including property details and owner information, the completed form should be submitted to the appropriate local tax authority for processing.

Steps to complete the Boe 65 California Form

Completing the Boe 65 California Form involves several key steps:

- Gather necessary documentation, including property deeds and identification.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check the form for any errors or omissions.

- Submit the form to your local tax assessor's office by the specified deadline.

Key elements of the Boe 65 California Form

The Boe 65 California Form includes several key elements that must be accurately completed:

- Property Information: Details about the property for which the exemption is being claimed.

- Owner Information: The name and contact information of the property owner.

- Exemption Type: The specific exemption being applied for, such as a homeowner's exemption.

- Signature: The property owner's signature certifying the accuracy of the information provided.

Legal use of the Boe 65 California Form

The legal use of the Boe 65 California Form is governed by California state law. It is crucial that property owners complete the form in compliance with all applicable regulations to ensure the validity of their exemption claims. Any inaccuracies or misrepresentations can lead to penalties or denial of the exemption. Therefore, understanding the legal implications and requirements is essential for successful submission.

Form Submission Methods

The Boe 65 California Form can be submitted through various methods, depending on local regulations. Common submission options include:

- Online Submission: Many counties allow for electronic submission through their official websites.

- Mail: Completed forms can be sent via postal mail to the local tax assessor's office.

- In-Person: Property owners may also deliver the form in person to ensure it is received on time.

Quick guide on how to complete boe 65 california 2015 form

Manage Boe 65 California Form anytime, anywhere

Your daily organizational tasks might require extra focus when addressing state-specific business documents. Reclaim your work hours and reduce the costs associated with paper-intensive processes using airSlate SignNow. airSlate SignNow provides a variety of pre-created business documents, including Boe 65 California Form, that you can utilize and share with your business partners. Manage your Boe 65 California Form effortlessly with robust editing and eSignature functionalities, and send it directly to your intended recipients.

How to obtain Boe 65 California Form in just a few clicks:

- Select a form pertinent to your state.

- Tap Learn More to view the document and ensure its accuracy.

- Click Get Form to start working on it.

- Boe 65 California Form will automatically launch in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or adjust the form.

- Choose the Sign feature to create your signature and eSign the document.

- When you’re ready, click Done, save changes, and access your document.

- Share the form via email or SMS, or use a link-to-fill option with partners or enable them to download the document.

airSlate SignNow signNowly enhances your efficiency in managing Boe 65 California Form and allows you to locate necessary documents in one place. An extensive library of forms is organized and designed to address vital business operations necessary for your organization. The advanced editor minimizes the risk of errors, as you can easily amend mistakes and review your documents on any device before sending them out. Start your free trial today to uncover all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

Find and fill out the correct boe 65 california 2015 form

FAQs

-

Can I appear in the JEE Advanced with an overall 67% being from the scheduled caste?

Important information regarding marks in CLASS XII (OR EQUIVALENT) BOARD EXAMINATION FOR ADMISSIONThe candidates should satisfy at least one of the following two criteria for admission to IITs:Must have secured at least 75% aggregate marks in the Class XII (or equivalent) Board examination. The aggregate marks for SC, ST and PwD candidates should be at least 65%. orMust be within the category-wise top 20 percentile of successful candidates in their respective Class XII (or equivalent) board examination.The percentile calculation will be done for the required subjects in a single academic year only. Therefore, candidates appearing for improvement in Board examinations can EITHER appear in one or more subjects and secure 75% aggregate marks (65% for SC, ST and PwD) after improvement, OR, appear for improvement in ALL subjects to be in top 20 percentile (see section titled “Regarding the cut-off marks for the top 20 percentile”) of the corresponding academic year.The marks scored in the following five subjects will be considered for calculating the aggregate marks and the cut-off marks for fulfilling the top 20 percentile criterion.PhysicsChemistryMathematicsA language (if the candidate has taken more than one language, then the language with the higher marks will be considered)Any subject other than the above four (the subject with the highest marks will be considered).For calculation of the total marks for five subjects, if the marks awarded in a subject is NOT out of 100, then the marks will be scaled (up or down) to 100 so that the total aggregate marks is out of 500.If a Board awards only letter grades without providing an equivalent percentage of marks on the grade sheet, the candidate should obtain a certificate from the Board specifying the equivalent marks and submit it at the time of acceptance of the allocated seat. In case such a certificate is not provided, the decision taken by the Joint Implementation Committee of JEE (Advanced) 2018 will be final.In case any of the subjects Physics, Chemistry, Mathematics and Language are not evaluated in the final year (e.g., in a 3-year diploma course), then the marks for the same subject from the previous year/s will be used for calculating percentage of aggregate marks.For candidates who appeared in the Class XII (or equivalent) Board examination for the first time in 2017 and reappeared in ALL subjects (for whatsoever reason) in 2018, the best of the two performances will be considered.If a Board gives aggregate marks considering both Class XI and Class XII examinations (in the 10+2 system), then only Class XII marks will be considered. If a Board gives aggregate marks considering the results of all three years of a 3-year diploma or courses of equivalent duration, then only the marks scored in the final year will be considered. Similarly, for Boards which follow a semester system, the marks scored in the final two semesters will be considered.If a Board does not give marks scored in individual subjects but gives only the aggregate marks, then the aggregate marks given by the Board will be considered as such.For more refer to Will I be eligible for the JEE Advanced? I got 72% in boards. If taking the Improvement exam in two subjects crosses the barrier of 75%, will I be eligible for it, or the top 20 percentile will be considered?

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

Create this form in 5 minutes!

How to create an eSignature for the boe 65 california 2015 form

How to create an eSignature for your Boe 65 California 2015 Form online

How to generate an eSignature for your Boe 65 California 2015 Form in Chrome

How to create an electronic signature for putting it on the Boe 65 California 2015 Form in Gmail

How to make an electronic signature for the Boe 65 California 2015 Form from your smartphone

How to create an eSignature for the Boe 65 California 2015 Form on iOS devices

How to create an electronic signature for the Boe 65 California 2015 Form on Android devices

People also ask

-

What is the Boe 65 California Form?

The Boe 65 California Form is a document used for verifying the physical presence of items during property tax assessments. It helps ensure that property owners accurately report their assets to comply with state regulations. Using airSlate SignNow simplifies the process of filling out and eSigning this form.

-

How can airSlate SignNow help with the Boe 65 California Form?

AirSlate SignNow allows users to easily create, send, and eSign the Boe 65 California Form online. With a user-friendly interface and secure digital signatures, businesses can streamline their property tax documentation process. This makes compliance easier and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the Boe 65 California Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to features that enhance the eSigning process, including for the Boe 65 California Form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Boe 65 California Form?

AirSlate SignNow includes features such as customizable templates, mobile access, and advanced security options for the Boe 65 California Form. Users can easily edit and share forms, ensuring all necessary parties can eSign quickly. These features enhance both efficiency and compliance.

-

Are there any benefits to using airSlate SignNow for the Boe 65 California Form?

Using airSlate SignNow for the Boe 65 California Form increases efficiency, reduces errors, and accelerates the signature process. Businesses benefit from faster turnaround times and greater accuracy, which are vital during tax seasons. This digital solution also improves record-keeping and compliance.

-

Can I integrate airSlate SignNow with other platforms for managing the Boe 65 California Form?

Yes, airSlate SignNow can be integrated with a variety of third-party applications to enhance your workflow for the Boe 65 California Form. This integration allows you to sync data seamlessly and enhance productivity. Popular integrations include CRMs and document management systems.

-

Is it possible to track the status of my Boe 65 California Form using airSlate SignNow?

Absolutely! AirSlate SignNow provides tracking features that let you monitor the status of the Boe 65 California Form. You will receive real-time updates on when the document is viewed, signed, or completed, ensuring transparency in the signing process.

Get more for Boe 65 California Form

- X3 multiplication crossword puzzle practice multiplying by 3 and use the products in the puzzle form

- Pdf handball score sheet pdf ebook and user guide download form

- Visa application form enter japan

- Td bank letter head form

- Directions for filing form fi 17report of dmv ny

- Church anniversary program order of service form

- Pilot survey results form the canadian survey of household amstat

- Renewal of lease agreement template 787746722 form

Find out other Boe 65 California Form

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement