Arizona Schedule APYN Include with Your Return Form

What is the Arizona Schedule APYN Include With Your Return

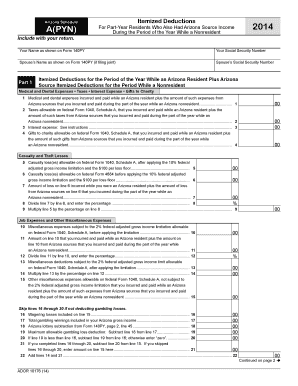

The Arizona Schedule APYN Include With Your Return is a tax form specifically designed for Arizona taxpayers. It is used to report specific income types and deductions that are not captured on the standard state tax return. This form allows individuals to provide detailed information about their income, ensuring compliance with state tax regulations. By including this schedule, taxpayers can accurately reflect their financial situation and potentially reduce their overall tax liability.

How to use the Arizona Schedule APYN Include With Your Return

Using the Arizona Schedule APYN Include With Your Return involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts. Next, fill out the form by entering your income details and applicable deductions. Be sure to follow the instructions carefully, as errors can lead to delays or penalties. Once completed, attach the schedule to your main tax return before submission, whether filing electronically or via mail.

Steps to complete the Arizona Schedule APYN Include With Your Return

Completing the Arizona Schedule APYN Include With Your Return requires careful attention to detail. Here are the steps to follow:

- Review the form instructions to understand the required information.

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information at the top of the form.

- Report your income sources in the designated sections.

- Include any deductions you qualify for, such as business expenses or educational credits.

- Double-check your entries for accuracy before finalizing the form.

- Attach the completed schedule to your main Arizona tax return.

Legal use of the Arizona Schedule APYN Include With Your Return

The Arizona Schedule APYN Include With Your Return is legally recognized as part of the state tax filing process. To ensure its legal validity, taxpayers must comply with Arizona tax laws and regulations. This includes accurately reporting income and deductions, as well as maintaining proper documentation to support the entries made on the form. Failure to adhere to these guidelines may result in penalties or audits by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Schedule APYN Include With Your Return align with the overall state tax return deadlines. Typically, individual income tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file while ensuring that any taxes owed are paid by the original deadline to avoid penalties.

Required Documents

To complete the Arizona Schedule APYN Include With Your Return, several documents are essential. These include:

- W-2 forms from employers to report wages and tax withholdings.

- 1099 forms for reporting various types of income, such as freelance work or interest.

- Receipts for deductible expenses, including business-related costs or educational expenses.

- Previous tax returns for reference and consistency in reporting.

Quick guide on how to complete arizona schedule apyn include with your return

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hassle. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign [SKS] while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule APYN Include With Your Return

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apyn include with your return

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Arizona Schedule APYN Include With Your Return?

The Arizona Schedule APYN is a tax form for reporting items such as income, deductions, and credits. When you include this form with your return, you ensure that the Arizona Department of Revenue has all the necessary information for accurate processing of your tax filing. Properly completing and including the Arizona Schedule APYN with your return can help avoid delays or issues with your tax return.

-

How can airSlate SignNow help in preparing the Arizona Schedule APYN Include With Your Return?

airSlate SignNow simplifies the process of preparing and signing the Arizona Schedule APYN by providing an easy-to-use, digital platform for document management. You can efficiently fill out the form and eSign it before including it with your return. This not only saves time but also helps ensure accuracy and compliance with state regulations.

-

What are the pricing options for using airSlate SignNow for the Arizona Schedule APYN Include With Your Return?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for including the Arizona Schedule APYN with your return. Pricing is based on features and the number of users, so you can choose the plan that best fits your organization. You can start with a free trial to explore features and see how it can streamline your tax filing process.

-

What benefits does airSlate SignNow provide for eSigning the Arizona Schedule APYN Include With Your Return?

By eSigning the Arizona Schedule APYN with airSlate SignNow, you gain the advantage of a secure, legally binding signature process. This feature ensures that your tax documents are processed quickly and securely, helping to eliminate the risks associated with paper-based signatures. Additionally, airSlate SignNow offers convenient access to signed documents anytime, anywhere.

-

Are there any integrations available for airSlate SignNow that assist with the Arizona Schedule APYN Include With Your Return?

Yes, airSlate SignNow integrates with various accounting and tax software that can help streamline the process of preparing the Arizona Schedule APYN Include With Your Return. These integrations allow you to transfer data easily, reducing manual entry errors and increasing efficiency in your tax filings. Check our website for a full list of supported integrations.

-

Can multiple users collaborate on the Arizona Schedule APYN Include With Your Return using airSlate SignNow?

Absolutely! airSlate SignNow supports collaboration among multiple users, making it easier for teams to work together on the Arizona Schedule APYN Include With Your Return. You can invite team members to review, edit, and sign documents, ensuring everyone stays informed and contributing to the process. This collaborative feature leads to more accurate and efficient completion of tax documents.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with digital forms for the Arizona Schedule APYN Include With Your Return?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be tech-savvy. The interface is intuitive, allowing users to navigate easily through the process of completing and eSigning the Arizona Schedule APYN to include with their return. Our customer support team is also available to assist with any questions or concerns.

Get more for Arizona Schedule APYN Include With Your Return

- Martin county permit applaction form

- Woodinville tree permit form

- Master application tdlr pdf form

- Building permit application bf03 lake county lakecountyfl form

- Form to add father to birth certificate

- Vaccination certificate format

- Mother s worksheet for child s birth certificate louisiana new dhh louisiana form

- Marriage license in san benito county 2009 form

Find out other Arizona Schedule APYN Include With Your Return

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter