Arizona Schedule APYN Itemized Deductions for Part Year Residents Form

What is the Arizona Schedule APYN Itemized Deductions For Part Year Residents

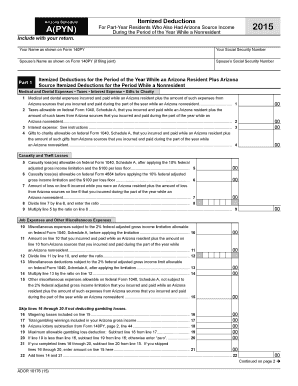

The Arizona Schedule APYN Itemized Deductions for Part Year Residents is a tax form specifically designed for individuals who have lived in Arizona for only part of the tax year. This form allows taxpayers to report their itemized deductions accurately, ensuring they only claim deductions applicable to the time they resided in the state. It is essential for part-year residents to differentiate their deductions to comply with Arizona tax laws while maximizing their potential tax benefits.

How to use the Arizona Schedule APYN Itemized Deductions For Part Year Residents

Using the Arizona Schedule APYN Itemized Deductions involves several steps. First, gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, complete the form by entering your itemized deductions, such as mortgage interest, property taxes, and medical expenses, prorated for the time you lived in Arizona. Ensure that you follow the instructions carefully to avoid errors that could delay your tax return processing.

Steps to complete the Arizona Schedule APYN Itemized Deductions For Part Year Residents

Completing the Arizona Schedule APYN Itemized Deductions involves a systematic approach:

- Collect all necessary documents, including income statements and receipts for deductible expenses.

- Determine the period you were a resident of Arizona during the tax year.

- Calculate your total itemized deductions and prorate them based on your residency period.

- Fill out the Schedule APYN form with the calculated amounts.

- Review the form for accuracy before submission.

Legal use of the Arizona Schedule APYN Itemized Deductions For Part Year Residents

The legal use of the Arizona Schedule APYN Itemized Deductions requires adherence to state tax laws. Part-year residents must ensure that their deductions reflect only the time spent in Arizona. This form must be filed accurately to avoid potential audits or penalties from the Arizona Department of Revenue. Utilizing a reliable eSignature solution can help ensure that your submission is legally binding and compliant with electronic signature laws.

Eligibility Criteria

To be eligible to use the Arizona Schedule APYN Itemized Deductions, you must have been a resident of Arizona for part of the tax year. Additionally, you should have incurred itemized deductions that exceed the standard deduction amount for your filing status. It is important to verify that you meet these criteria before completing the form to ensure compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Schedule APYN Itemized Deductions align with the general state tax filing deadlines. Typically, individual income tax returns are due on April fifteenth of each year. However, if you are filing for an extension, be sure to check the specific dates that apply to part-year residents. Timely filing is crucial to avoid penalties and interest on any taxes owed.

Quick guide on how to complete arizona schedule apyn itemized deductions for part year residents 397759531

Complete Arizona Schedule APYN Itemized Deductions For Part Year Residents effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Manage Arizona Schedule APYN Itemized Deductions For Part Year Residents on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Arizona Schedule APYN Itemized Deductions For Part Year Residents with ease

- Locate Arizona Schedule APYN Itemized Deductions For Part Year Residents and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Arizona Schedule APYN Itemized Deductions For Part Year Residents to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apyn itemized deductions for part year residents 397759531

How to make an e-signature for your PDF document online

How to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What are Arizona Schedule APYN Itemized Deductions For Part Year Residents?

Arizona Schedule APYN Itemized Deductions For Part Year Residents allows part-year residents to report their itemized deductions accurately when filing state taxes. This form helps taxpayers ensure they maximize their deductions and comply with Arizona tax regulations.

-

How can airSlate SignNow help with Arizona Schedule APYN Itemized Deductions For Part Year Residents?

airSlate SignNow provides a straightforward platform for you to prepare and eSign your Arizona Schedule APYN Itemized Deductions For Part Year Residents documents. Our solution simplifies the process, ensuring all necessary signatures are gathered quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for Arizona Schedule APYN Itemized Deductions For Part Year Residents?

Yes, using airSlate SignNow does involve a subscription fee, but it's designed to be cost-effective compared to traditional document signing methods. This investment provides you with convenient access to features that streamline the preparation of your Arizona Schedule APYN Itemized Deductions For Part Year Residents.

-

What features does airSlate SignNow offer for preparing Arizona Schedule APYN Itemized Deductions For Part Year Residents?

Our features include customizable templates, automated reminders, and a user-friendly interface to facilitate the preparation of Arizona Schedule APYN Itemized Deductions For Part Year Residents. Additionally, the platform ensures compliance with relevant legal standards, enhancing security.

-

How does airSlate SignNow ensure the security of my Arizona Schedule APYN Itemized Deductions For Part Year Residents?

airSlate SignNow prioritizes security with end-to-end encryption and advanced authentication methods. Your Arizona Schedule APYN Itemized Deductions For Part Year Residents documents are secure, ensuring that sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other tax software for my Arizona Schedule APYN Itemized Deductions For Part Year Residents?

Yes, airSlate SignNow supports integrations with various tax software and tools, allowing for a seamless experience when handling your Arizona Schedule APYN Itemized Deductions For Part Year Residents. This compatibility helps streamline your workflow and improves overall efficiency.

-

What benefits can I expect from using airSlate SignNow for my Arizona Schedule APYN Itemized Deductions For Part Year Residents?

By using airSlate SignNow, you gain access to a fast, efficient, and user-friendly solution for managing your Arizona Schedule APYN Itemized Deductions For Part Year Residents. This simplifies your document workflow and helps ensure compliance, ultimately saving you time and reducing stress.

Get more for Arizona Schedule APYN Itemized Deductions For Part Year Residents

- Ms revocation 497315687 form

- Employment or job termination package mississippi form

- Newly widowed individuals package mississippi form

- Employment interview package mississippi form

- Employment employee personnel file package mississippi form

- Assignment of mortgage package mississippi form

- Assignment of lease package mississippi form

- Mississippi lease purchase agreement form

Find out other Arizona Schedule APYN Itemized Deductions For Part Year Residents

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template