Arizona Form AZ 140V

What is the Arizona Form AZ 140V

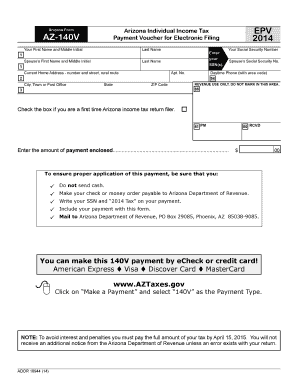

The Arizona Form AZ 140V is a payment voucher used by taxpayers in Arizona when submitting their individual income tax returns. This form is primarily utilized to ensure that any tax payments are correctly processed and associated with the taxpayer's account. It is an essential component in the tax filing process, particularly for those who owe taxes and wish to make a payment electronically or by mail.

How to use the Arizona Form AZ 140V

To effectively use the Arizona Form AZ 140V, taxpayers must first complete their individual income tax return. Once the return is prepared, the form serves as a means to submit any payments due. It is important to accurately fill out the form, including details such as the taxpayer's name, address, and the amount being paid. This ensures that the payment is correctly credited to the taxpayer's account.

Steps to complete the Arizona Form AZ 140V

Completing the Arizona Form AZ 140V involves several straightforward steps:

- Gather necessary information, including your tax return details and payment amount.

- Enter your name, address, and Social Security number on the form.

- Specify the payment amount you are submitting.

- Review the information for accuracy to prevent processing delays.

- Sign and date the form before submission.

Legal use of the Arizona Form AZ 140V

The Arizona Form AZ 140V is legally binding when properly completed and submitted. It complies with state tax regulations, ensuring that payments made using this form are valid and recognized by the Arizona Department of Revenue. Adhering to the guidelines set forth by the state is crucial for maintaining compliance and avoiding potential penalties.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Arizona Form AZ 140V. Typically, individual income tax returns are due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to check the Arizona Department of Revenue's official calendar for any updates or changes to these deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form AZ 140V can be submitted through various methods to accommodate taxpayer preferences:

- Online: Payments can be made electronically through the Arizona Department of Revenue's website.

- By Mail: Taxpayers can print the completed form and mail it to the appropriate address specified by the state.

- In-Person: Payments may also be made in person at designated Arizona Department of Revenue offices.

Quick guide on how to complete arizona form az 140v

Prepare Arizona Form AZ 140V seamlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal sustainable alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Manage Arizona Form AZ 140V across any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Arizona Form AZ 140V effortlessly

- Obtain Arizona Form AZ 140V and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive content with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether it's via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choosing. Edit and eSign Arizona Form AZ 140V while ensuring exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form az 140v

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Arizona Form AZ 140V?

Arizona Form AZ 140V is a payment voucher used to remit individual income tax payments in the state of Arizona. This form is essential for ensuring that taxpayers can efficiently manage their tax obligations and avoid penalties. By utilizing airSlate SignNow, users can easily eSign and submit the Arizona Form AZ 140V.

-

How can airSlate SignNow help with Arizona Form AZ 140V?

airSlate SignNow streamlines the process of completing and eSigning Arizona Form AZ 140V. Our platform offers features that enable users to fill out the form digitally, electronically sign it, and securely share it with tax authorities. This simplifies the overall process and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for Arizona Form AZ 140V?

Yes, there is a subscription fee for using airSlate SignNow, which provides access to several features including the ability to manage documents like Arizona Form AZ 140V. We offer various pricing plans to suit the needs of individuals and businesses, ensuring a cost-effective solution for document management.

-

What features does airSlate SignNow offer for Arizona Form AZ 140V?

airSlate SignNow includes user-friendly features such as templates, document sharing, and real-time tracking for Arizona Form AZ 140V. These features enhance efficiency and ensure that all parties involved can easily access and manage the form. Additionally, our security measures protect sensitive information.

-

Can I integrate airSlate SignNow with other software to use Arizona Form AZ 140V?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, allowing users to streamline the workflow around Arizona Form AZ 140V. You can connect our service with CRM systems, project management tools, and more, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for tax documents like Arizona Form AZ 140V?

Using airSlate SignNow for tax documents such as Arizona Form AZ 140V allows for faster processing times and reduces the likelihood of errors. Our platform's electronic signing and secure document storage features ensure that your information is kept safe and accessible. This not only saves time but also enhances compliance with tax regulations.

-

How does airSlate SignNow ensure the security of Arizona Form AZ 140V?

airSlate SignNow prioritizes the security of all documents, including Arizona Form AZ 140V, with advanced encryption and compliance with industry standards. We implement stringent security measures to protect user data and ensure that your signed documents are safe. User privacy and document confidentiality are paramount.

Get more for Arizona Form AZ 140V

Find out other Arizona Form AZ 140V

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself