Arizona Schedule a Itemized Deduction Adjustments for Full Year Residents Azdor Form

What is the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

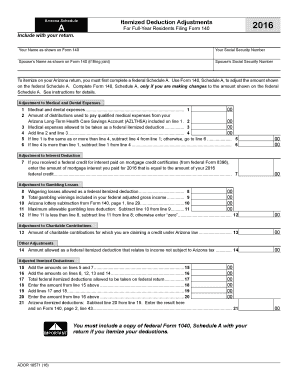

The Arizona Schedule A Itemized Deduction Adjustments for Full Year Residents is a tax form used by residents of Arizona to report itemized deductions on their state income tax returns. This form allows taxpayers to detail specific deductions that may reduce their taxable income, such as medical expenses, mortgage interest, and charitable contributions. Understanding this form is essential for residents who choose to itemize rather than take the standard deduction, as it can lead to significant tax savings.

Steps to complete the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

Completing the Arizona Schedule A involves several key steps:

- Gather all relevant financial documents, including receipts for deductible expenses.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Detail each itemized deduction in the appropriate sections, ensuring you include all eligible expenses.

- Calculate the total deductions and ensure they align with the requirements set by the Arizona Department of Revenue.

- Review the form for completeness and accuracy before submission.

How to use the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

The Arizona Schedule A is utilized during the tax filing process to itemize deductions. Taxpayers should use this form when they believe their total itemized deductions exceed the standard deduction amount. After completing the form, it should be attached to the Arizona state tax return. Proper usage of this form can help taxpayers maximize their deductions and minimize their tax liabilities.

State-specific rules for the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

Arizona has specific rules governing itemized deductions that differ from federal guidelines. Taxpayers must be aware of state-specific adjustments, such as limitations on certain deductions and the requirement to add back some federal deductions that are not allowed at the state level. Familiarity with these rules is crucial for accurate tax reporting and compliance.

Legal use of the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

The legal use of the Arizona Schedule A requires adherence to state tax laws and regulations. Taxpayers must ensure that all reported deductions are legitimate and supported by documentation. Filing this form accurately is essential to avoid penalties or audits from the Arizona Department of Revenue. Additionally, e-signatures can be used to submit the form electronically, provided they meet legal standards for electronic documentation.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Arizona Schedule A. Typically, the state tax return, including the Schedule A, is due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to filing deadlines annually.

Quick guide on how to complete arizona schedule a itemized deduction adjustments for full year residents azdor

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to access the necessary template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without stress

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a classic wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule a itemized deduction adjustments for full year residents azdor

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What are Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor?

Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor allows taxpayers to itemize deductions on their state tax returns, tailoring deductions to fit their financial situation. Understanding these adjustments can maximize your tax return and ensure compliance with state regulations.

-

How does airSlate SignNow assist with preparing Arizona Schedule A Itemized Deduction Adjustments?

airSlate SignNow simplifies the process of preparing Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor by providing templates and features for easy document upload and signature. This streamlines your tax preparation, ensuring you have all necessary adjustments documented efficiently.

-

What is the pricing structure for using airSlate SignNow to manage Arizona Schedule A adjustments?

airSlate SignNow offers various pricing plans that cater to different business needs, starting at a competitive rate. This cost-effective solution ensures that you can efficiently manage Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor without breaking your budget.

-

Can airSlate SignNow integrate with accounting software for smoother tax preparation?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, allowing you to easily manage your Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor. This integration enhances your tax preparation process by combining document management with financial data management.

-

What features does airSlate SignNow offer for document security and compliance?

airSlate SignNow prioritizes document security, offering features such as encryption and secure storage. These features ensure that your Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor are protected, compliant, and only accessible to authorized individuals.

-

How can airSlate SignNow help optimize my deductions under Arizona Schedule A?

By using airSlate SignNow, you can organize your documents and track your expenses more effectively, facilitating a more thorough review of your Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor. This helps in identifying all potential deductions you may qualify for, optimizing your tax return.

-

Is there customer support available for questions regarding Arizona Schedule A adjustments?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with inquiries about your Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor. Our team is available to ensure you have all the necessary guidance and assistance during your tax preparation.

Get more for Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

Find out other Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents Azdor

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT