Form Mt 41 2009

What is the Form Mt 41

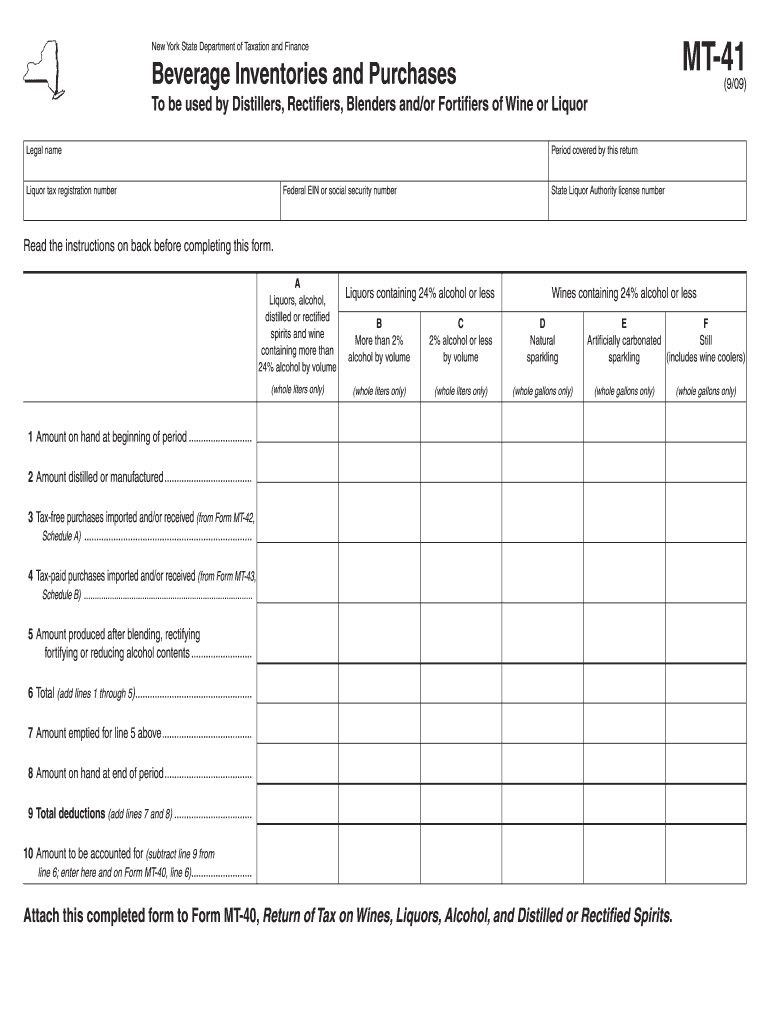

The Form Mt 41 is a document issued by the New York State Department of Taxation and Finance, primarily used for tax purposes. This form allows individuals and businesses to report specific tax information accurately. It is essential for ensuring compliance with state tax regulations. By utilizing the Form Mt 41, taxpayers can provide the necessary details required for their tax filings, which helps streamline the review process by tax authorities.

How to use the Form Mt 41

Using the Form Mt 41 involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents, including income statements and previous tax returns. Next, access the form through the New York State Department of Taxation and Finance website or other authorized platforms. Fill out the required fields with accurate information, ensuring that all entries are clear and legible. Once completed, review the form for any errors before submitting it electronically or via mail, depending on your preference and the submission guidelines.

Steps to complete the Form Mt 41

Completing the Form Mt 41 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as income records and deductions.

- Access the Form Mt 41 from the New York State Department of Taxation and Finance website.

- Fill in personal information, including your name, address, and tax identification number.

- Provide detailed financial information as required by the form.

- Review all entries for accuracy and completeness.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

- Submit the completed form according to the specified methods.

Legal use of the Form Mt 41

The Form Mt 41 is legally recognized for tax reporting in New York State. It must be completed accurately to comply with state tax laws. The use of this form is governed by regulations set forth by the New York State Department of Taxation and Finance, ensuring that all submitted information is valid and verifiable. Failure to use the form correctly can result in penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Form Mt 41 are critical to avoid penalties. Typically, the due date aligns with the annual tax filing deadline set by the state. For most individuals, this date is April fifteenth. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines and any updates that may affect your filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Form Mt 41 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online Submission: Utilize the New York State Department of Taxation and Finance’s online portal for electronic filing.

- Mail: Print the completed form and send it to the designated address provided in the instructions.

- In-Person: Visit local tax offices to submit the form directly, if preferred.

Quick guide on how to complete form mt 41 the new york state department of taxation and tax ny

Your assistance manual on how to prepare your Form Mt 41

If you’re curious about how to complete and submit your Form Mt 41, here are some concise instructions on how to simplify tax declaration.

To begin, you just need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, generate, and finalize your income tax forms without hassle. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust answers as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form Mt 41 in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our library to obtain any IRS tax form; explore versions and schedules.

- Click Get form to access your Form Mt 41 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that filing on paper can lead to increased errors and delayed refunds. Of course, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form mt 41 the new york state department of taxation and tax ny

FAQs

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

How will the just released New York Times story of Donald Trump participating in tax fraud and schemes to funnel millions from his father Fred's estate play out?

I have just read ALL of it… there was a LOT to read…it is quite a treatise on the subject.The details are RIVETING meaning that I could not stop reading and what I read gave me chills up and down my spine. The veracity, the depth of the investigation, the thoroughness the comparatives, the scale and scope… taken at any individual level is one thing taking in the totality of it… well below I will state my conclusion…My major in University was accounting my minor was economics, My first job out of university was for a public accounting firm, I did audit work, I prepared financial statements, tax returns, and I KNOW this stuff cold…This is a tale of lies, fraud, deceit, theft, criminal wrong doing of monumental proportions and the man masquerading as PRESIDENT of the United States was thick as a thief in the middle of it. I would not want to be one of the accountants who prepared those fraudulent tax returns - their licenses to practice could be in jeopardy. The ones who actually signed those returns… are however criminals. New York State has already said they are investigating these allegations.. The interest and penalties if assessed… well there is a line in Trading places that Eddie Murphy speaks to the effect “that the best way to hurt rich people is to turn them into poor people”.He lied to EVERYONE, the public, he stole from the American Taxpayer on a scale and with specific intentions to do so that organized crime never contemplated… This family’s theft from the American treasury is so VULGAR and obscene as to defy credulity. There is no innocent explanation what so ever possible for the actions taken. This is a damning conclusion.I do not shock easily.. I have seen many things in my life, this work from the Times is beyond question the most compelling case I have ever read.This one would have been a case for the RICO statutes…Opinion | Suzanne Garment: Trump and his family could owe millions for their decades-long con jobAppalling and disgusting …. and this criminal is the President? Really? So if America knew about how he inherited all his wealth, how he committed fraud on his Taxes and how he was an adulterous asshole with a porn star and a Playboy Playmate, how he dodged the draft…and then goes and attacks John McCain - would they have elected him President? Him hiding these facts - was a fraud upon the American People…. So please do not call him legitimate in my presence.As vile as his sexual peccadilloes are, his financial background and that of his Father and siblings is every bit as vile…reprehensible - the audacity of this man to stand as President is so wrong on so many levels… and he has the chutzpah to express his opinions on other peoples behaviour? How DARE he… He is not a judge of other people- he is to be judged, he is subject to America’s judgement.Just in case you wanted to know what I really thought…

-

How much does it cost and what is involved to file for the charter of a corporation in the New York state and get a tax ID number?

The registration fee is $125 (Division of Corporations, State Records and Uniform Commercial Code, NYS Dept. of State) but the advertising requirement (Page on ny.gov) was about $2,500 when I did it in 2006.You have to place an ad in a set form in one of a set list of publications. I believe that they now allow fewer or cheaper publications than when I did it but the list varies by county and you will have to check with the county clerk or use a law firm to place the ads. You also need to pay your lawyer something if they advise you or apply on your behalf, and you will probably use a specialist law firm to place the ads. The tax ID however is free.

-

What are the implications if the NY State passes the TRUST Act, authorizing the Department of taxation and Finance to turn over his state tax return if Congress request them for a specific and legislative purpose? Will it restore Congress' checks?

It’s clear that some people here don’t understand what this law is and/or don’t know how government works.The law affects (in this case) Trump’s state tax return. SCOTUS has no jurisdiction over state tax law. I’m not even sure how SCOTUS could weigh in on this insofar as there is no constitutional right of tax return privacy. Tax return privacy is an IRS law and only applies to federal tax returns. NY is free to write its own tax and privacy laws.Furthermore, it only pertains to releasing tax information to a congressional investigation on request, not plastering it on billboards or sending it to the media.And, let’s be clear, congress already has the unambiguous right to see Trump’s federal tax return now under Section 6103 of IRS law. Just because Trump has his minions trying to drag this out into a court fight that they will ultimately lose doesn’t mean that right doesn’t exist.

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

I reside and work in New York City only but the company is in New Jersey, and the company deducts New Jersey taxes only, how does affect me at the end of the year when I declare taxes, or if lost my job where do I have to apply for unemployment NJ or NY?

Title 54A New Jersey Gross Income Tax Act - 54A:5-8 states that income received by a nonresident "in connection with a trade, profession, occupation carried on in this State or for the rendition of personal services performed in this State" is subject to New Jersey state tax. You state that you performed no personal services in the state of New Jersey, but it's not entirely clear based on the facts whether the first part of the section is true in your case. Normally if you provide no personal services in the state your income is sourced to the state in which you perform the services, but some states are taking an expansive view of what it means to have income "connected to a trade or business" in the state.You should have a conversation with your company's HR or financial department, asking them to state in writing why they are withholding NJ state income taxes from your wages when you are performing no personal services in the state of New Jersey. If the company has determined that you are subject to New Jersey state tax because your income is being received "in connection with a trade, profession occupation carried on" in NJ, even though you are performing no services in NJ, get them to state the reasons for that determination in writing. You need it in writing for your own protection - the company should understand that you're trying to make sure that you do have a NJ tax obligation. (And it does happen that the company itself doesn't understand its own withholding requirements.)Before you file I strongly suggest that you discuss this with a competent tax professional in New York. Most have experience dealing with precisely this situation.In either case you are going to have to file as a New Jersey non-resident and as a New York resident. If it turns out that you do owe the state of New Jersey, you will be able to take a credit on the New York return for the net taxes you owe New Jersey. If it turns out that you do not owe New Jersey, you still have to file the return to get a refund on the taxes withheld.

-

How will AOC and the other business extractive NY politicians make up the net 25 billion in economic activity lost due to Amazon pulling HQ2 out of New York?

They can’t, of course.This was one of the single most boneheaded political actions I have ever seen, and I say that as a liberal Democrat.It’s the Venezuelan philosophy of economics — kill the farmers and divide the crops.And then, well, oops.The greediest, most sink and swim Republican couldn’t have done more harm to the people of New York City.And that’s without even considering the importance of starting the kernel of a local IT industry, something that has otherwise mostly benefited other regions like Silicon Valley and Seattle, and that it sends a message — New York City is not open to business.By the way, I see people getting hung up on the tax incentive. While I agree thoroughly that the whole tax incentive thing should end, it has to be remembered that New York would not otherwise have received those taxes, that those incentives are normally offered to any business that moves to the City, and that if other locales are offering incentives, New York has to compete. It also has to be remembered that the net tax revenues would have been a huge plus to the City and State, and that the City’s taxes are already uncompetitive so that the tax breaks merely bring them to the level of other locales.And, really, if you care about housing the homeless or fixing the subways, the revenue has to come from somewhere.I take comfort from the fact that those jobs will still be created elsewhere in the country. But it scares me that we are sending representatives to Congress who are so stupid or ideological that they would make the Venezuelan mistake.

Create this form in 5 minutes!

How to create an eSignature for the form mt 41 the new york state department of taxation and tax ny

How to make an electronic signature for your Form Mt 41 The New York State Department Of Taxation And Tax Ny in the online mode

How to create an eSignature for your Form Mt 41 The New York State Department Of Taxation And Tax Ny in Google Chrome

How to create an electronic signature for putting it on the Form Mt 41 The New York State Department Of Taxation And Tax Ny in Gmail

How to make an electronic signature for the Form Mt 41 The New York State Department Of Taxation And Tax Ny from your mobile device

How to create an electronic signature for the Form Mt 41 The New York State Department Of Taxation And Tax Ny on iOS devices

How to create an electronic signature for the Form Mt 41 The New York State Department Of Taxation And Tax Ny on Android devices

People also ask

-

What is Form Mt 41 and how can airSlate SignNow help?

Form Mt 41 is a specific document used for various business processes. With airSlate SignNow, you can easily create, send, and eSign Form Mt 41, streamlining your workflows and enhancing productivity. Our platform ensures that your documents are legally binding and securely handled.

-

Is airSlate SignNow a cost-effective solution for managing Form Mt 41?

Yes, airSlate SignNow offers competitive pricing plans that are designed to fit the needs of businesses of all sizes. By utilizing our platform to manage Form Mt 41, you can save on printing and mailing costs while increasing efficiency in your operations.

-

What features does airSlate SignNow provide for Form Mt 41?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for Form Mt 41. These features help you manage your documents more efficiently, ensuring that you never miss a deadline and that all signatures are collected promptly.

-

Can I integrate airSlate SignNow with other applications to manage Form Mt 41?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Microsoft Office. This allows you to manage Form Mt 41 alongside your other business tools, enhancing collaboration and streamlining your processes.

-

How does airSlate SignNow ensure the security of Form Mt 41?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods and adhere to strict compliance standards to protect your Form Mt 41 and all sensitive information. You can trust that your documents are safe and secure with us.

-

What are the benefits of using airSlate SignNow for Form Mt 41?

Using airSlate SignNow for Form Mt 41 offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. Our user-friendly platform allows you to eSign and manage documents with ease, freeing up time for more critical business tasks.

-

Can I customize Form Mt 41 templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form Mt 41 templates to suit your specific needs. You can add your branding, adjust fields, and create a workflow that fits your business processes perfectly, ensuring a professional appearance and functionality.

Get more for Form Mt 41

- Sc 133 judgment debtors statement of assets small claims judicial council forms

- Notice of appeal small claims sc 140pdf fpdf doc docx form

- Fill in the court name and street address form

- Sc 200 notice of entry of judgment small claims form

- Sc 100 plaintiff s claim and order to go to small claims court form

- Sc 221 response to request to make payments small claims form

- Sc 290 acknowledgment of satisfaction of judgment free form

- 978 0077733711 chapter 24 lecture note coursepapercom form

Find out other Form Mt 41

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form