For the Calendar Year or Fiscal Year Beginning M M D D 2 0 1 6 and Ending M M D D Y Y Y Y Form

What is the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

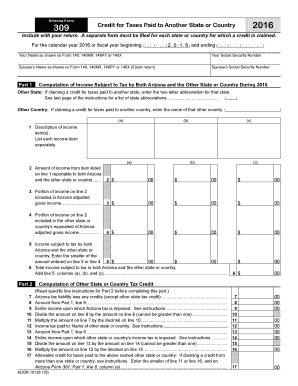

The form referred to as "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" is typically utilized for reporting income, expenses, and other financial information for a specific period. This form is crucial for businesses and individuals who need to comply with tax regulations. It helps ensure that all relevant financial data is accurately reported to the Internal Revenue Service (IRS) or other governing bodies. Understanding the purpose of this form is essential for proper financial reporting and compliance.

How to use the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

Using the "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" form involves several steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant receipts. Next, fill out the form with accurate data corresponding to the specified dates. Ensure that all calculations are correct and that you have included all required information. Finally, submit the completed form by the designated deadline to avoid any penalties.

Steps to complete the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

Completing the "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Review the form instructions carefully.

- Input your financial data accurately.

- Double-check all calculations for accuracy.

- Sign and date the form as required.

- Submit the form by the deadline, ensuring you keep a copy for your records.

Legal use of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

The legal use of the "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" form is governed by IRS regulations and compliance standards. To ensure the form is legally binding, it must be filled out accurately and submitted on time. Failure to comply with these regulations can result in penalties or legal issues. It is important to understand the legal implications of the information reported on this form, as it may affect your tax obligations and financial standing.

Filing Deadlines / Important Dates

Filing deadlines for the "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" form are critical to avoid penalties. Generally, forms must be submitted by April 15 for calendar year filers. For fiscal year filers, the deadline is typically the 15th day of the fourth month following the end of the fiscal year. It is essential to keep track of these dates and any changes announced by the IRS to ensure timely submission.

IRS Guidelines

The IRS provides specific guidelines for completing the "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y" form. These guidelines include instructions on what information must be reported, how to calculate income and expenses, and the necessary documentation to support your claims. Following these guidelines closely will help ensure that your submission is accurate and compliant with federal regulations.

Quick guide on how to complete for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y

Prepare [SKS] easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, as you can access the correct document and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-related operation today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your desktop.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a powerful platform that allows businesses to send and eSign documents efficiently. It streamlines the signing process, making it easy for users to manage documents 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' With its intuitive interface, you can quickly prepare, send, and store your signed documents.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you require basic features or advanced functionalities for 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y,' you will find a plan that fits your budget and requirements. You can choose monthly or annual billing options, which provide savings for long-term commitments.

-

What features does airSlate SignNow provide?

airSlate SignNow comes equipped with a range of features designed to enhance document management. Key features include customizable templates, in-person signing, and extensive audit trails to ensure compliance 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' These functionalities are designed to simplify the way businesses handle documents.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with popular software applications to enhance your workflow. This allows businesses to manage documents and data more efficiently 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' Popular integrations include Salesforce, Google Drive, and Dropbox, making it easier to incorporate into your existing systems.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides several benefits, including an efficient signing process, improved workflow, and cost savings. Businesses can reduce turnaround times and enhance client satisfaction 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' It ultimately helps to streamline operations and increase productivity.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance for all transactions. The platform employs encryption and follows legal standards to ensure that your documents are secure 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' You can trust that your data is handled with the highest level of confidentiality.

-

How can I get started with airSlate SignNow?

Starting with airSlate SignNow is easy! Simply visit our website to sign up for an account, where you can explore features and settings 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y.' You also have access to guided tutorials and customer support to assist you in optimizing your document management processes.

Get more for For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

Find out other For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile