Maryland Individual Income Tax Form 2018

What is the Maryland Individual Income Tax Form

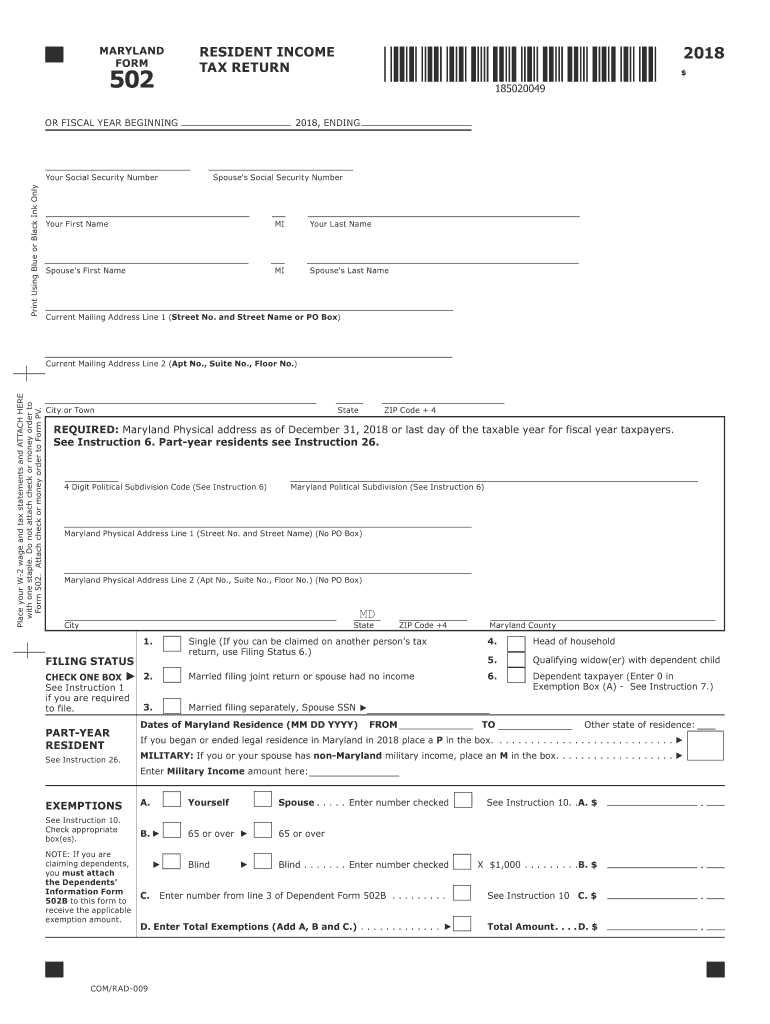

The Maryland Individual Income Tax Form, commonly referred to as Form 502, is a crucial document used by residents to report their income and calculate their state tax obligations. This form is specifically designed for individuals who earn income within the state of Maryland and must comply with state tax laws. It captures various sources of income, deductions, and credits that may apply to the taxpayer's situation, ensuring accurate reporting and compliance with Maryland tax regulations.

Steps to complete the Maryland Individual Income Tax Form

Completing the Maryland Individual Income Tax Form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Begin with personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, dividends, and interest.

- Claim any allowable deductions, such as those for student loan interest or retirement contributions.

- Calculate your taxable income by subtracting deductions from your total income.

- Determine your tax liability using the Maryland tax rates applicable for the year.

- Complete any additional schedules or forms if required, such as for credits or special circumstances.

- Review the form for accuracy before signing and dating it.

How to obtain the Maryland Individual Income Tax Form

The Maryland Individual Income Tax Form can be obtained through several methods. Taxpayers can access the form online via the Maryland State Comptroller's website, where it is available for download in PDF format. Additionally, physical copies of the form can be requested by contacting the Comptroller's office or visiting local tax offices. It is advisable to ensure that you are using the correct tax year version of the form, such as the 2014 edition, to avoid any filing issues.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Individual Income Tax Form are critical to avoid penalties and interest. For most taxpayers, the deadline to file is typically April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Maryland Individual Income Tax Form. The most efficient method is electronic filing, which allows for quick processing and confirmation of receipt. Alternatively, taxpayers can mail their completed forms to the appropriate address provided in the form instructions. For those who prefer in-person submission, local tax offices may accept forms directly. Regardless of the method chosen, it is essential to keep a copy of the submitted form for personal records.

Key elements of the Maryland Individual Income Tax Form

The Maryland Individual Income Tax Form includes several key elements that taxpayers must complete accurately. These elements typically consist of:

- Personal information: Name, address, and Social Security number.

- Income details: Total income from various sources.

- Deductions: Allowable deductions that reduce taxable income.

- Tax calculation: Determining tax liability based on taxable income.

- Signature and date: Verification of the information provided.

Quick guide on how to complete maryland state tax form 502 2018 2019

Your assistance manual on how to prepare your Maryland Individual Income Tax Form

If you’re pondering how to develop and file your Maryland Individual Income Tax Form, below are a few brief directions on how to simplify tax submission.

To start, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that allows you to modify, generate, and finalize your income tax forms effortlessly. Utilizing its editor, you can switch between text, checkboxes, and eSignatures and revisit to change responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Maryland Individual Income Tax Form in just a few minutes:

- Create your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Maryland Individual Income Tax Form in our editor.

- Provide the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can increase return errors and postpone reimbursements. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct maryland state tax form 502 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the maryland state tax form 502 2018 2019

How to create an eSignature for your Maryland State Tax Form 502 2018 2019 online

How to make an electronic signature for your Maryland State Tax Form 502 2018 2019 in Chrome

How to make an eSignature for putting it on the Maryland State Tax Form 502 2018 2019 in Gmail

How to create an electronic signature for the Maryland State Tax Form 502 2018 2019 right from your mobile device

How to make an eSignature for the Maryland State Tax Form 502 2018 2019 on iOS

How to create an eSignature for the Maryland State Tax Form 502 2018 2019 on Android

People also ask

-

What are the Maryland state tax forms for 2014?

The Maryland state tax forms for 2014 include the 502, 503, and 505 forms, among others. These forms are essential for filing your income tax returns accurately in Maryland. It's important to download the correct forms to ensure compliance with state tax regulations.

-

Where can I find the Maryland state tax forms 2014?

You can find the Maryland state tax forms 2014 on the official Maryland state government website or through trusted tax preparation resources. Additionally, airSlate SignNow provides easy access to these forms for electronic signature and submission, streamlining your tax filing process.

-

How can airSlate SignNow help with filing Maryland state tax forms 2014?

airSlate SignNow allows users to easily fill out, sign, and send Maryland state tax forms 2014 electronically. With its user-friendly interface, you can manage your tax forms efficiently while ensuring they are securely signed and submitted on time. This service saves time and minimizes the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow offers features like eSignature, document management, and secure storage for all your Maryland state tax forms 2014. With its ability to integrate with other applications, users can streamline their workflow and enhance productivity. The platform's robust security measures also ensure your sensitive tax information is protected.

-

Is airSlate SignNow a cost-effective solution for handling tax forms?

Yes, airSlate SignNow provides a cost-effective solution for handling Maryland state tax forms 2014 without the need for expensive software or printing costs. Our subscription plans are competitively priced, catering to both individuals and businesses looking to save on time and resources during tax season.

-

Can I integrate airSlate SignNow with my current tax software?

Absolutely! airSlate SignNow seamlessly integrates with various tax software applications, allowing you to manage your Maryland state tax forms 2014 alongside your existing tools. This integration helps you streamline your filing process and ensures that all documents are synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for tax form submissions?

Using airSlate SignNow for your Maryland state tax forms 2014 offers numerous benefits, such as faster submission times, improved organization, and enhanced document security. Additionally, the ability to collect electronic signatures allows you to expedite the approval process, making tax filing less stressful and more efficient.

Get more for Maryland Individual Income Tax Form

- Mia standard migration agent form

- Hotel cost estimating guide pdf form

- Printable hot work permit form 415935278

- Canada employment form

- Form 2500 124 mobility device access application and permit for department lands form 2500 124 mobility device access

- Town of islip housing grants form

- Mississippi registration application form 70 001 rev 0811

- Fillable online enrollment form for group

Find out other Maryland Individual Income Tax Form

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure