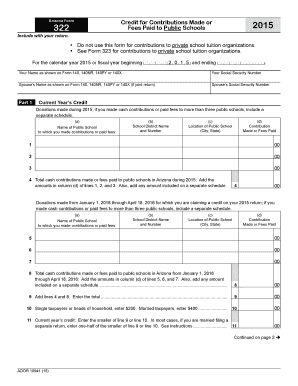

Arizona Form 322 Credit for Contributions Made or Fees Paid to Public Schools Include with Your Return

What is the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

The Arizona Form 322 is a tax credit form that allows taxpayers to claim a credit for contributions made or fees paid to public schools in Arizona. This credit is designed to encourage support for public education by providing a financial incentive to taxpayers who contribute to schools. The contributions can be used for various educational purposes, including extracurricular activities, character education programs, and other school-related expenses. By filling out this form, taxpayers can reduce their state tax liability while supporting local schools.

How to use the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

To use the Arizona Form 322, taxpayers must first determine their eligibility based on the contributions made to public schools. Once eligibility is confirmed, the taxpayer should complete the form by providing details about the contributions, including the amount and the school receiving the funds. After filling out the form, it should be included with the taxpayer's state income tax return. This ensures that the credit is applied correctly against the taxpayer's overall tax liability.

Steps to complete the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

Completing the Arizona Form 322 involves several key steps:

- Gather documentation of contributions made to public schools.

- Fill in personal information, including name, address, and Social Security number.

- Detail the contributions made, specifying the amount and the school.

- Calculate the total credit amount based on the contributions.

- Attach the completed form to your state tax return before submission.

Eligibility Criteria

To qualify for the Arizona Form 322 credit, taxpayers must meet specific eligibility criteria. Contributions must be made to a public school located in Arizona. The contributions can be monetary or in the form of fees paid for extracurricular activities. There are limits on the amount of credit that can be claimed, which varies based on filing status. Taxpayers should ensure they meet these criteria to take advantage of the tax credit.

Required Documents

When completing the Arizona Form 322, taxpayers need to provide certain documents to substantiate their claims. These include:

- Receipts or proof of payment for contributions made to public schools.

- Any documentation that outlines the purpose of the contributions, such as school activity flyers.

- Personal identification information, including Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 322 can be submitted in several ways. Taxpayers can file it online through the Arizona Department of Revenue's e-filing system, which is a convenient option. Alternatively, the completed form can be mailed to the appropriate tax authority address listed on the form. In-person submissions may also be possible at designated tax offices. Each method has its own processing time, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete arizona form 322 credit for contributions made or fees paid to public schools 2015 include with your return

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

Create this form in 5 minutes!

How to create an eSignature for the arizona form 322 credit for contributions made or fees paid to public schools 2015 include with your return

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return?

The Arizona Form 322 Credit allows taxpayers to receive a tax credit for contributions made to public schools. This can include fees paid for extracurricular activities or donations towards school improvement projects. To benefit from this credit, ensure to include the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return when filing your taxes.

-

How can airSlate SignNow help me with the Arizona Form 322 submission process?

airSlate SignNow streamlines the document signing process, making it easier for you to prepare and submit the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return. Our platform allows you to securely eSign documents and share them with necessary parties instantly, ensuring a smooth submission experience.

-

Are there any costs associated with using airSlate SignNow for the Arizona Form 322?

While the initial use of airSlate SignNow may involve subscription fees, our service provides a cost-effective solution for managing documentation. By using airSlate SignNow for the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return, you may save time and resources in document management and signing processes.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers an array of features tailored for efficient document management, including electronic signatures, document templates, and real-time collaboration. These features facilitate the completion and submission of essential forms such as the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return, ensuring a user-friendly experience.

-

Can I integrate airSlate SignNow with other applications for managing tax documents?

Yes, airSlate SignNow provides seamless integrations with many applications, allowing for comprehensive management of your documents. This flexibility is beneficial when dealing with tax forms like the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return, ensuring all your data and documents are synced efficiently.

-

What benefits can I expect from using airSlate SignNow for my tax documentation?

Using airSlate SignNow can enhance your productivity and ensure compliance by simplifying the document signing process. You will be able to handle the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return more efficiently, reducing your turnaround time and minimizing errors in submission.

-

Is airSlate SignNow secure for managing sensitive tax information?

Absolutely! airSlate SignNow utilizes advanced security protocols to protect your sensitive information, including that associated with the Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return. Your data is encrypted and securely stored, ensuring compliance with industry standards.

Get more for Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

Find out other Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools Include With Your Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document