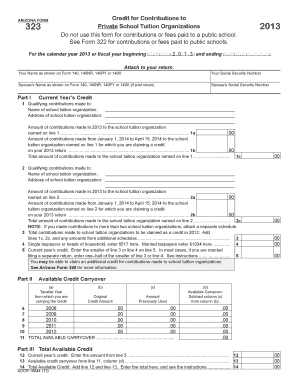

See Form 322 for Contributions or Fees Paid to Public Schools

What is the See Form 322 For Contributions Or Fees Paid To Public Schools

The See Form 322 for contributions or fees paid to public schools is a document used to report financial contributions made to public educational institutions. This form typically serves as a record for taxpayers who wish to document their donations for potential tax deductions or credits. It is essential for individuals and organizations making contributions to ensure that they comply with relevant tax regulations and guidelines.

How to use the See Form 322 For Contributions Or Fees Paid To Public Schools

Using the See Form 322 involves a straightforward process. First, gather all necessary information regarding the contributions made, including the amount, date, and recipient school. Next, fill out the form accurately, ensuring that all details are correct. Once completed, the form can be submitted electronically or printed for mailing, depending on the submission method chosen. It is important to keep a copy of the form for your records.

Steps to complete the See Form 322 For Contributions Or Fees Paid To Public Schools

Completing the See Form 322 involves several key steps:

- Collect all relevant information about your contributions, including amounts and dates.

- Access the form through an authorized source or download it from a reliable website.

- Fill in the required fields, ensuring accuracy in the details provided.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission method, either online or by mail.

Legal use of the See Form 322 For Contributions Or Fees Paid To Public Schools

The legal use of the See Form 322 is critical for ensuring that contributions are recognized for tax purposes. The form must be completed in accordance with IRS guidelines to be considered valid. This includes providing accurate information and ensuring that the contributions meet the necessary criteria for tax deductions. Failure to comply with these regulations may result in penalties or disallowance of deductions.

Key elements of the See Form 322 For Contributions Or Fees Paid To Public Schools

Key elements of the See Form 322 include:

- Donor information, including name and contact details.

- Details of the contributions, such as amounts and dates.

- Recipient information, specifying the public school or district.

- Signature of the donor, confirming the accuracy of the information.

Form Submission Methods (Online / Mail / In-Person)

The See Form 322 can be submitted through various methods, providing flexibility for donors. Options typically include:

- Online submission through designated platforms or portals.

- Mailing the completed form to the appropriate school district office.

- In-person submission at designated administrative offices, if available.

Quick guide on how to complete see form 322 for contributions or fees paid to public schools

Finish [SKS] effortlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign [SKS] without difficulty

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to See Form 322 For Contributions Or Fees Paid To Public Schools

Create this form in 5 minutes!

How to create an eSignature for the see form 322 for contributions or fees paid to public schools

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 322, and why is it important for contributions or fees paid to public schools?

Form 322 is a crucial document that details the contributions or fees paid to public schools. This form ensures transparency in funding and is essential for both donors and schools to track financial support. Understanding how to effectively fill out and submit Form 322 can help streamline the donation process.

-

How does airSlate SignNow simplify the process of submitting Form 322?

airSlate SignNow streamlines the submission process for Form 322 by allowing users to easily eSign and send documents securely. Our user-friendly platform ensures that contributions or fees paid to public schools are documented accurately and can be submitted directly from your device. This convenience saves time and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for Form 322 submissions?

Using airSlate SignNow for submitting Form 322 involves a cost-effective pricing model, allowing businesses to choose a plan that fits their needs. The platform provides flexible options based on the volume of documents and features required. This affordable solution makes it easy to manage contributions or fees paid to public schools without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 322 submissions?

airSlate SignNow provides a robust set of features for managing Form 322 submissions, including customizable templates, automated workflows, and real-time tracking. These tools help users stay organized and ensure that all necessary documentation for contributions or fees paid to public schools is completed accurately. Additionally, our platform integrates with various applications for seamless data transfer.

-

Can I integrate airSlate SignNow with other tools for managing public school contributions?

Yes, airSlate SignNow offers integration with various popular tools that can enhance the management of public school contributions. Users can connect with CRM systems, cloud storage solutions, and accounting software to streamline processes related to Form 322. This integration allows for a more efficient flow of information regarding contributions or fees paid to public schools.

-

What are the security measures in place for using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols and secure cloud storage to protect sensitive information related to Form 322. Users can confidently manage contributions or fees paid to public schools, knowing their data is safeguarded against unauthorized access.

-

Is there customer support available for help with Form 322 through airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support for users who need assistance with Form 322. Our dedicated team is available to help with any inquiries regarding submitting contributions or fees paid to public schools and can provide guidance on using our platform effectively.

Get more for See Form 322 For Contributions Or Fees Paid To Public Schools

- Form gc 5

- Gc 7q form

- Community services contract application form 3681 dads state tx

- Dads or hhsc form the texas department of aging and dads state tx

- Form h1830 r pdf

- Form h1200 ez

- Texas department of aging and disability services form 2382 august 2012 assisted living facilities checklist facility name

- Taiwanese tablet pc application ic market 1q form

Find out other See Form 322 For Contributions Or Fees Paid To Public Schools

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile