For the Calendar Year or Fiscal Year Beginning M M D D 2 0 1 6 and Ending M M D D Y Y Y Y Azdor Form

What is the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

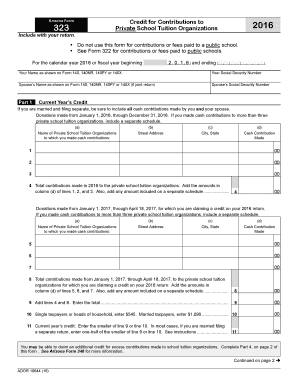

The form referred to as "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor" is a specific document used for tax reporting purposes. It is essential for individuals and businesses to accurately report their income and expenses for the designated fiscal year. This form is particularly relevant for those who need to submit financial information to the Arizona Department of Revenue (ADOR) for the year starting in 2016 and ending in the specified date range.

Steps to complete the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Completing this form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, expense receipts, and any other relevant documentation. Next, follow these steps:

- Enter your personal or business information at the top of the form.

- Report your total income for the year, ensuring all sources are included.

- Detail your allowable deductions, which can reduce your taxable income.

- Calculate your total tax liability based on the provided tax rates.

- Review the form for completeness and accuracy before submission.

Legal use of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

This form must be completed in accordance with state and federal regulations. Legal use of the form requires that all information provided is truthful and accurate. Misrepresentation or omission of information can lead to penalties or legal repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding the information required or the filing process.

Filing Deadlines / Important Dates

Timely submission of the form is crucial to avoid penalties. The filing deadline for the form typically aligns with the federal tax deadlines, which may vary based on whether you are an individual or a business entity. For the calendar year 2016, the standard deadline for filing would be April 15, 2017. However, extensions may be available under certain circumstances, so it is essential to check with the Arizona Department of Revenue for specific dates relevant to your situation.

Who Issues the Form

The "For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor" form is issued by the Arizona Department of Revenue (ADOR). This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. Individuals and businesses must submit this form to ADOR to report their financial activities for the specified period.

Required Documents

To successfully complete the form, several documents are required. These may include:

- Income statements (W-2s, 1099s, etc.)

- Receipts for deductible expenses

- Prior year tax returns for reference

- Any additional documentation required by the ADOR

Having these documents ready will streamline the process of filling out the form and help ensure accuracy.

Quick guide on how to complete for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y azdor 394182384

Finish [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Handle [SKS] on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form hunts, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and guarantee outstanding communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y azdor 394182384

The best way to generate an e-signature for a PDF file online

The best way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a versatile eSignature solution that enables businesses to send and eSign documents seamlessly. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, it simplifies the signing process, allowing users to manage their documents efficiently.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers diverse pricing plans tailored to fit different business needs. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, choose a plan that best suits your requirements and budget, ensuring that you have access to all the necessary features.

-

What features does airSlate SignNow provide?

airSlate SignNow comes with an array of features including document templates, team collaboration, and secure cloud storage. These features are essential for businesses looking to streamline their processes during the period For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce costs associated with manual document management. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, our solution enhances productivity and improves customer satisfaction through quick and easy document transactions.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integration with popular software applications like Salesforce, Google Workspace, and Microsoft Office. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, these integrations enhance functionality and streamline workflows across different platforms.

-

Is airSlate SignNow compliant with legal standards?

Absolutely, airSlate SignNow complies with various legal standards such as eIDAS and UETA, ensuring that all eSignatures are legally binding. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, you can trust that your documents are secure and meet regulatory requirements.

-

How easy is it to get started with airSlate SignNow?

Getting started with airSlate SignNow is straightforward and quick. For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor, simply sign up, and you can start sending documents for eSignature within minutes, with an intuitive interface guiding you through every step.

Get more for For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Find out other For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure