Az Optional Tax Tables Form

What is the Arizona Optional Tax Tables?

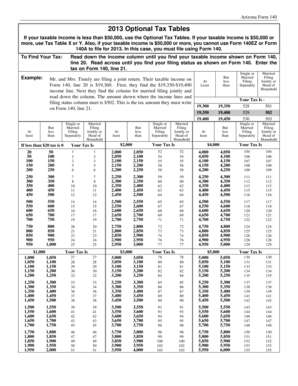

The Arizona Optional Tax Tables are a set of guidelines that help taxpayers determine their tax liability based on their income levels. These tables provide a simplified method for calculating state income tax, allowing individuals and businesses to compute their taxes without complex calculations. The optional tax tables are particularly useful for those who may not have extensive tax knowledge or prefer a straightforward approach to filing their taxes.

How to Use the Arizona Optional Tax Tables

Using the Arizona Optional Tax Tables involves several straightforward steps. First, identify your filing status, such as single, married filing jointly, or head of household. Next, locate your taxable income within the appropriate range on the tax table. The table will provide the corresponding tax amount owed. It is essential to ensure that all income is accurately reported to select the correct range. This method simplifies the tax calculation process, making it accessible for all taxpayers.

Steps to Complete the Arizona Optional Tax Tables

To complete the Arizona Optional Tax Tables, follow these steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Determine your total taxable income by adding all sources of income.

- Refer to the Arizona Optional Tax Tables to find your income bracket.

- Calculate your tax liability based on the table's guidance.

- Complete your tax return by including the calculated tax amount.

Legal Use of the Arizona Optional Tax Tables

The Arizona Optional Tax Tables are legally recognized by the Arizona Department of Revenue. Taxpayers can confidently use these tables to ensure compliance with state tax laws. It is crucial to follow the guidelines provided in the tables accurately, as incorrect calculations can lead to penalties or audits. The tables are designed to facilitate a clear understanding of tax obligations, promoting transparency and compliance.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the Arizona Optional Tax Tables. The primary filing deadline for individual tax returns is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check for any updates or changes to these deadlines annually to avoid late filing penalties.

Examples of Using the Arizona Optional Tax Tables

To illustrate the use of the Arizona Optional Tax Tables, consider a taxpayer with a taxable income of fifty thousand dollars who is married filing jointly. By referencing the tax table, they may find that their tax liability is a specific amount based on their income bracket. Another example could involve a single filer with a taxable income of thirty thousand dollars, who would also refer to the table for their corresponding tax amount. These examples demonstrate the practical application of the tables in real-life scenarios.

IRS Guidelines

While the Arizona Optional Tax Tables are specific to state tax calculations, they must align with IRS guidelines for federal tax compliance. Taxpayers should ensure that their state tax calculations do not conflict with federal requirements. Familiarity with both sets of guidelines helps maintain compliance and reduces the risk of discrepancies during tax filing.

Quick guide on how to complete az optional tax tables 2019

Complete Az Optional Tax Tables effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage Az Optional Tax Tables on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Az Optional Tax Tables seamlessly

- Obtain Az Optional Tax Tables and click Get Form to begin.

- Utilize the various tools we provide to complete your document.

- Highlight important sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors requiring new document copies to be printed. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Edit and eSign Az Optional Tax Tables to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az optional tax tables 2019

The best way to generate an e-signature for a PDF file in the online mode

The best way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is the tax table 2021 and how does it affect my business?

The tax table 2021 outlines the various tax rates applicable for individuals and businesses for the fiscal year. Understanding this table is crucial for accurate tax calculations and compliance. By integrating our solutions with the tax table 2021, you can streamline your document signing processes related to tax compliance.

-

How can airSlate SignNow help with tax document management?

airSlate SignNow allows you to efficiently manage tax-related documents by enabling easy eSigning and sharing. With access to the tax table 2021, you can ensure your forms are filled out correctly and submitted on time. This automation saves time and reduces the risk of errors in tax documentation.

-

Is airSlate SignNow cost-effective for small businesses handling tax documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With affordable pricing plans, you can utilize features that enhance your workflow, especially when working with the tax table 2021. This allows for an efficient way to handle tax documents without breaking the bank.

-

What features does airSlate SignNow offer for tax-related processes?

airSlate SignNow provides various features for efficient tax-related processes, including customizable templates and document tracking. These features ensure you’re always in sync with the latest updates in the tax table 2021. Additionally, you can securely eSign documents, which is vital for tax compliance and submission.

-

Can I integrate airSlate SignNow with my existing accounting software for tax processes?

Absolutely! airSlate SignNow offers integrations with popular accounting software that can help you manage your taxes more effectively. By combining these tools with the tax table 2021, you can automate data entry and improve accuracy in your tax filings. This integration streamlines your entire tax process.

-

Does airSlate SignNow provide support for understanding the tax table 2021?

While airSlate SignNow does not provide tax advice, our platform can simplify the document processes related to tax submissions. Familiarizing yourself with the tax table 2021 is essential, as it informs your document preparation. Our customer support team can help you navigate document-related queries.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority at airSlate SignNow. Our platform is equipped with robust security features that protect your sensitive tax information, including documents linked to the tax table 2021. You can trust that your data is safeguarded during the eSigning and document management processes.

Get more for Az Optional Tax Tables

- Claimed form

- Subpoena subpoena duces tecum dekalbcountyorg form

- Managing cases with pro se litigants ingov form

- No 17 1351 us case law justia in form

- No contact order supplement to confidential form for multiple protected parties in

- Caption for petition for writ in form

- State of new jersey domestic violence procedures nj judiciary in form

- Local court rules ingov in form

Find out other Az Optional Tax Tables

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template