Optional Tax Tables Form

What is the Optional Tax Tables

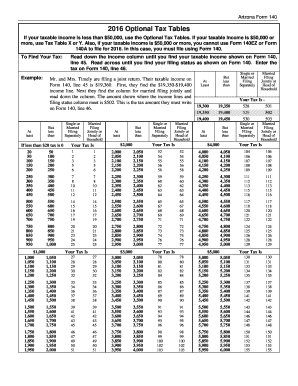

The Optional Tax Tables are a set of guidelines provided by the Internal Revenue Service (IRS) that allow taxpayers to determine the amount of federal income tax to withhold from their wages. These tables are designed to simplify the withholding process, making it easier for employers and employees to calculate the appropriate tax deductions. The tables take into account various factors such as filing status, income level, and the number of allowances claimed on Form W-4.

How to use the Optional Tax Tables

Using the Optional Tax Tables involves a straightforward process. First, an employee should complete Form W-4 to indicate their filing status and the number of allowances. Once this information is submitted to the employer, the employer can refer to the Optional Tax Tables to determine the correct withholding amount. The tables provide a clear breakdown based on the employee's income and filing status, ensuring accurate tax deductions from each paycheck.

Steps to complete the Optional Tax Tables

Completing the Optional Tax Tables requires several key steps:

- Fill out Form W-4 accurately, indicating your filing status and allowances.

- Refer to the Optional Tax Tables provided by the IRS.

- Locate the appropriate table based on your filing status and income level.

- Determine the withholding amount based on the table's guidance.

- Communicate the withholding amount to your employer for payroll processing.

Legal use of the Optional Tax Tables

The Optional Tax Tables are legally recognized by the IRS as a valid method for calculating income tax withholding. Employers are required to use these tables to ensure compliance with federal tax laws. Failure to adhere to the guidelines may result in incorrect withholding, which can lead to penalties or additional tax obligations for both the employer and employee. It is essential to keep updated with any changes to the tables or IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for using the Optional Tax Tables, including instructions on how to interpret the tables and apply them to various income scenarios. These guidelines are periodically updated to reflect changes in tax laws or rates. Taxpayers and employers should regularly consult the IRS website or official publications to ensure they are using the most current information when determining withholding amounts.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Optional Tax Tables is crucial for compliance. Typically, employers must submit withheld taxes to the IRS on a regular schedule, which may be monthly or semi-weekly, depending on the amount withheld. Additionally, individual taxpayers should be aware of annual tax filing deadlines, usually falling on April 15, to avoid penalties for late submissions. Keeping track of these important dates ensures that all tax obligations are met timely.

Quick guide on how to complete 2016 optional tax tables

Effortlessly Prepare Optional Tax Tables on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed materials, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage Optional Tax Tables on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Optional Tax Tables effortlessly

- Locate Optional Tax Tables and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, time-consuming searches for forms, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign Optional Tax Tables and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2016 optional tax tables

The best way to generate an e-signature for your PDF online

The best way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

What are Optional Tax Tables in airSlate SignNow?

Optional Tax Tables in airSlate SignNow allow users to apply specific tax rates to their documents, making it easier to manage tax calculations for various transactions. This feature is particularly beneficial for businesses that need to comply with regional tax regulations. By using Optional Tax Tables, users can streamline their documentation and ensure accurate tax reporting.

-

How can I access Optional Tax Tables in airSlate SignNow?

To access Optional Tax Tables in airSlate SignNow, you need to navigate to the settings section of your account. From there, you can customize the tax tables according to your business needs. This feature is user-friendly and designed to help you configure tax options seamlessly.

-

Are there any additional costs associated with using Optional Tax Tables?

Optional Tax Tables are included in the standard pricing plan of airSlate SignNow, meaning there are no hidden fees associated with this feature. This offers great value for businesses looking to manage their tax functions without incurring extra expenses. You can benefit from using Optional Tax Tables without any additional financial burden.

-

Can Optional Tax Tables be integrated with other software?

Yes, Optional Tax Tables can be integrated with a variety of accounting and ERP systems available through airSlate SignNow's API. This integration ensures smooth data flow between platforms, helping you maintain financial accuracy. You can maximize efficiency by leveraging the integrations offered.

-

What benefits do Optional Tax Tables provide for my business?

The benefits of Optional Tax Tables include improved accuracy in tax calculations and time-saving efficiencies when preparing documents. This feature enables your team to minimize manual data entry errors and ensures compliance with tax regulations. In turn, this leads to more reliable transactions and increased customer trust.

-

Is training available for using Optional Tax Tables in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training materials and customer support to help you utilize Optional Tax Tables effectively. These resources are designed to guide users through setup and usage, ensuring that you can maximize the benefit of this feature. Additionally, the user-friendly interface makes it easy to get started.

-

Can I customize the Optional Tax Tables for different states or countries?

Absolutely! Optional Tax Tables in airSlate SignNow allow for customization based on various states or countries to meet your specific tax requirements. This flexibility helps businesses operating in multiple regions to stay compliant with local tax laws. You can easily update the tables to reflect any changes in tax rates.

Get more for Optional Tax Tables

- Letter to bank advising of attorney representation and bankruptcy filing louisiana form

- Letter hearing appeal form

- Louisiana demand 497308891 form

- Opposing counsel form

- Sample letter to opposing counsel with settlement offer form

- Louisiana community property form

- Opposing counsel 497308895 form

- Letter to opposing counsel regarding intent to file motion to dismiss louisiana form

Find out other Optional Tax Tables

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT