Can I File New York's Nonobligated Spouse Allocations Form it 280 2017

What is the Can I File New York's Nonobligated Spouse Allocations Form IT 280

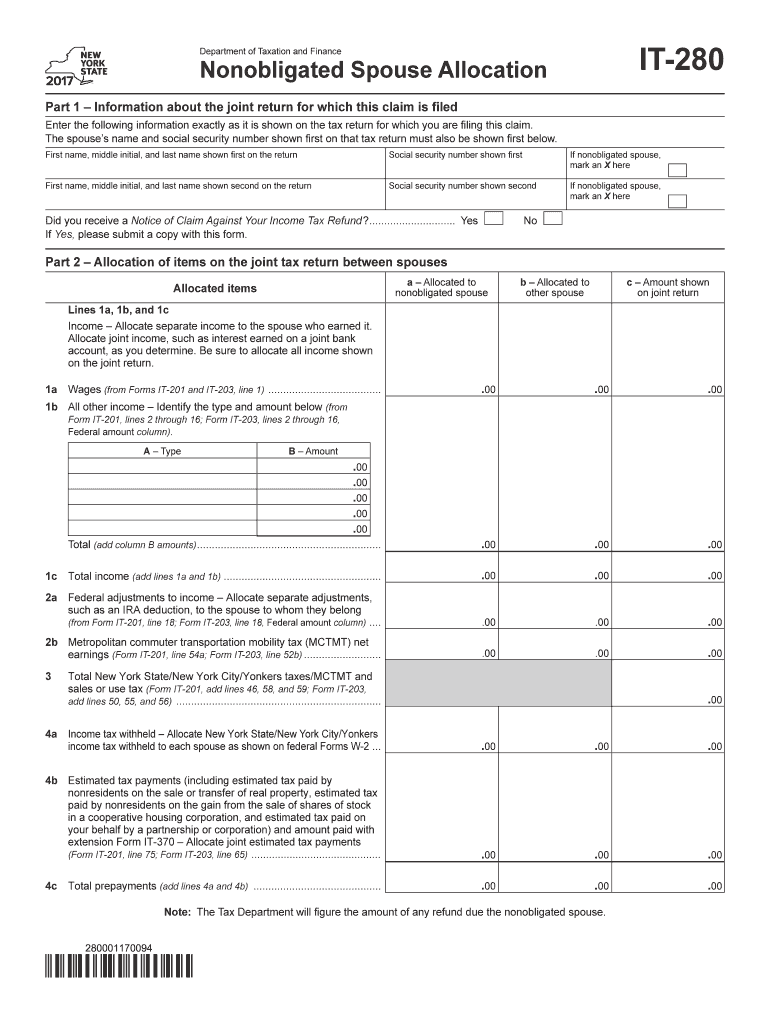

The Can I File New York's Nonobligated Spouse Allocations Form IT 280 is a tax form designed for individuals who are filing their taxes in New York State. This form allows taxpayers to allocate certain tax credits or deductions between spouses when one spouse is not obligated to pay taxes due to various reasons, such as being a non-resident or having no taxable income. Understanding this form is crucial for ensuring accurate tax reporting and compliance with state tax laws.

Steps to Complete the Can I File New York's Nonobligated Spouse Allocations Form IT 280

Completing the IT 280 form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the personal information sections, including names, addresses, and Social Security numbers. Then, accurately report income and deductions for both spouses. Finally, review the completed form for any errors before submitting it. Ensuring that all information is correct will help avoid delays or issues with your tax filing.

How to Obtain the Can I File New York's Nonobligated Spouse Allocations Form IT 280

The IT 280 form can be obtained through various channels. It is available for download from the New York State Department of Taxation and Finance website. Additionally, taxpayers can request a physical copy by contacting the department directly. Many tax preparation offices also have copies of this form available for their clients. Ensure that you have the most recent version to comply with current tax regulations.

Key Elements of the Can I File New York's Nonobligated Spouse Allocations Form IT 280

Key elements of the IT 280 form include sections for personal information, income reporting, and allocation of deductions or credits. It is essential to accurately complete each section to reflect the financial situation of both spouses. The form also includes instructions on how to allocate specific tax benefits, which can significantly affect the overall tax liability. Understanding these elements will help ensure that the form is filled out correctly and completely.

Legal Use of the Can I File New York's Nonobligated Spouse Allocations Form IT 280

The legal use of the IT 280 form is governed by New York State tax laws. This form is intended for use by couples where one spouse is not obligated to pay taxes. Filing this form correctly can help ensure compliance with state tax regulations and may prevent potential penalties. It is important to consult with a tax professional if there are any uncertainties regarding eligibility or the proper use of this form.

Form Submission Methods (Online / Mail / In-Person)

Submitting the IT 280 form can be done through multiple methods. Taxpayers have the option to file online through the New York State Department of Taxation and Finance e-filing system, which is a convenient and secure method. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible at designated tax offices, but it is advisable to check in advance for availability and any required appointments.

Quick guide on how to complete can i file new yorks nonobligated spouse allocations form it 280

Your assistance manual on preparing your Can I File New York's Nonobligated Spouse Allocations Form IT 280

If you're looking to understand how to generate and present your Can I File New York's Nonobligated Spouse Allocations Form IT 280, here are a few succinct instructions to simplify tax reporting.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an intuitive and powerful document solution that enables you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing capabilities.

Follow the instructions below to finalize your Can I File New York's Nonobligated Spouse Allocations Form IT 280 in minutes:

- Create your account and start editing PDFs within minutes.

- Browse our library to access any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Can I File New York's Nonobligated Spouse Allocations Form IT 280 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Be aware that submitting on paper can lead to increased return errors and delayed reimbursements. Moreover, before e-filing your taxes, check the IRS website for submission guidelines applicable to your state.

Create this form in 5 minutes or less

Find and fill out the correct can i file new yorks nonobligated spouse allocations form it 280

FAQs

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the can i file new yorks nonobligated spouse allocations form it 280

How to make an electronic signature for your Can I File New Yorks Nonobligated Spouse Allocations Form It 280 in the online mode

How to create an eSignature for your Can I File New Yorks Nonobligated Spouse Allocations Form It 280 in Google Chrome

How to make an electronic signature for putting it on the Can I File New Yorks Nonobligated Spouse Allocations Form It 280 in Gmail

How to generate an electronic signature for the Can I File New Yorks Nonobligated Spouse Allocations Form It 280 straight from your smart phone

How to create an eSignature for the Can I File New Yorks Nonobligated Spouse Allocations Form It 280 on iOS

How to make an eSignature for the Can I File New Yorks Nonobligated Spouse Allocations Form It 280 on Android

People also ask

-

What is New York's Nonobligated Spouse Allocations Form IT 280?

New York's Nonobligated Spouse Allocations Form IT 280 is used to allocate income and expenses between spouses for tax purposes. It helps in situations where one spouse is not responsible for tax liabilities. If you're asking, 'Can I File New York's Nonobligated Spouse Allocations Form IT 280,' it's crucial to understand its utility in ensuring accurate tax assessments.

-

How can airSlate SignNow help me with Form IT 280?

airSlate SignNow simplifies the process of filling out and submitting Form IT 280. With our user-friendly interface, you can easily eSign and send the form securely. So, if you're wondering, 'Can I File New York's Nonobligated Spouse Allocations Form IT 280,' the answer is yes; our platform streamlines this process.

-

Is there a cost associated with using airSlate SignNow for filing Form IT 280?

Yes, there is a subscription fee to use airSlate SignNow, which provides access to advanced features for document management and eSigning. Investing in our service ensures a smooth filing experience for forms like New York's Nonobligated Spouse Allocations Form IT 280. Consider it as a valuable tool to simplify tax filing.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow offers a range of features, including template creation, secure eSigning, and cloud storage. These features make it easier to manage forms like New York's Nonobligated Spouse Allocations Form IT 280. With these tools, you can track your document status in real-time, enhancing your tax filing efficiency.

-

Can airSlate SignNow help with other tax forms besides Form IT 280?

Absolutely! airSlate SignNow supports various tax forms beyond New York's Nonobligated Spouse Allocations Form IT 280. Our platform is designed to cater to a broad spectrum of document needs, ensuring you can manage and eSign different forms effectively and securely.

-

How secure is airSlate SignNow when filing sensitive tax documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols to protect all documents, including New York's Nonobligated Spouse Allocations Form IT 280. You can trust that your sensitive data remains confidential and secure throughout the filing process.

-

What integrations does airSlate SignNow offer that might help with tax filing?

airSlate SignNow integrates with various applications to streamline your workflows. With tools like Google Drive and CRM systems, you can easily manage and file documents, including New York's Nonobligated Spouse Allocations Form IT 280. Our integrations help you stay organized and efficient during tax season.

Get more for Can I File New York's Nonobligated Spouse Allocations Form IT 280

- 4 stage balance test pdf form

- Domestic wire transfer form

- How to fill out firearms transaction record part 1 over the counter form

- Direc o geral dsri direc o dos impostos d g c i de servi os das rela es internacionais rep blica portuguesa av form

- Application disclaimer fair housing farah real estate form

- Hbap application city of irving texas cityofirving form

- Guide to standard rental application formsrentspree blogguide to standard rental application formsrentspree blogthe application

- Security clearance request form ramblerpark com

Find out other Can I File New York's Nonobligated Spouse Allocations Form IT 280

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast