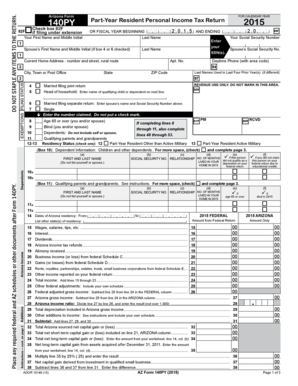

140PY Check Box 82F If Filing under Extension 82F or FISCAL YEAR BEGINNING MM D D 2 0 1 5 Spouses First Name and Middle Initial Form

Understanding the 140PY Check Box 82F

The 140PY Check Box 82F is a specific designation used in tax filings, particularly for individuals filing under an extension or those with a fiscal year beginning in 2015. This form captures essential information, such as the spouse's first name and middle initial if specific boxes are checked. It is crucial for ensuring accurate tax reporting and compliance with IRS regulations. Understanding its components helps taxpayers navigate the complexities of tax forms effectively.

Steps to Complete the 140PY Check Box 82F

Completing the 140PY Check Box 82F involves several steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your spouse's name and home address. Next, check the relevant boxes that apply to your filing situation, such as Box 4 or Box 6, which may affect how you fill out the form. Carefully input the fiscal year dates and ensure all information is correct before submission. Double-checking your entries helps prevent errors that could lead to complications with your tax filing.

Legal Use of the 140PY Check Box 82F

The 140PY Check Box 82F holds legal significance in the context of tax filings. When completed correctly, it serves as a formal declaration of your tax situation for the year indicated. Compliance with IRS guidelines is essential to ensure that the information provided is accurate and legally binding. Utilizing electronic signature solutions can enhance the legal standing of your submission, as these platforms often provide a secure method for signing and storing documents.

IRS Guidelines for the 140PY Check Box 82F

The IRS provides specific guidelines regarding the use of the 140PY Check Box 82F. Familiarizing yourself with these guidelines is essential for accurate completion and submission. The IRS outlines what information is required, the importance of checking the appropriate boxes, and the implications of filing under extension. Adhering to these guidelines helps ensure that your tax return is processed smoothly and without unnecessary delays.

Examples of Using the 140PY Check Box 82F

Practical examples can help clarify how to use the 140PY Check Box 82F effectively. For instance, if a taxpayer is filing jointly and has checked Box 4, they must include their spouse's first name and middle initial on the form. Another example includes a taxpayer who is filing under an extension; they must ensure that the fiscal year dates are accurately reflected. Such examples illustrate the importance of understanding the form's requirements to avoid common pitfalls.

Filing Deadlines for the 140PY Check Box 82F

Timely submission of the 140PY Check Box 82F is crucial to avoid penalties. The IRS sets specific deadlines for tax filings, including those under extensions. Taxpayers should be aware of these deadlines to ensure their forms are submitted on time. Missing a deadline can lead to complications, including fines or interest on unpaid taxes, making it essential to stay informed about important dates throughout the tax year.

Quick guide on how to complete 140py check box 82f if filing under extension 82f or fiscal year beginning mm d d 2 0 1 5 spouses first name and middle initial

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign [SKS] seamlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 140py check box 82f if filing under extension 82f or fiscal year beginning mm d d 2 0 1 5 spouses first name and middle initial

The best way to generate an e-signature for your PDF file online

The best way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF document on Android devices

People also ask

-

What is the significance of the 140PY Check Box 82F If Filing Under Extension 82F OR FISCAL YEAR BEGINNING MM D D 2 0 1 5 Spouses First Name And Middle Initial?

The 140PY Check Box 82F is relevant for taxpayers who are filing for an extension or fiscal year beginning in 2015. It helps to indicate specific information needed for accurate processing of tax returns. Filling this box correctly ensures compliance and avoids potential delays in processing.

-

How does airSlate SignNow facilitate the completion of 140PY forms?

airSlate SignNow provides templates and tools that simplify the process of completing 140PY forms, including the 140PY Check Box 82F If Filing Under Extension 82F OR FISCAL YEAR BEGINNING MM D D 2 0 1 5 Spouses First Name And Middle Initial. You can easily fill out these forms digitally, ensuring all required fields are addressed.

-

Are there any costs associated with using airSlate SignNow for 140PY forms?

Yes, airSlate SignNow offers a variety of pricing plans to choose from, catering to different business needs. The costs depend on the features included and the number of users. Overall, it's a cost-effective solution for businesses needing to manage documents like the 140PY Check Box 82F.

-

Can airSlate SignNow integrate with other platforms for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various platforms commonly used for tax management. This enables users to handle their 140PY Check Box 82F submissions alongside other financial tools, streamlining the overall workflow and enhancing productivity.

-

What features does airSlate SignNow provide to ease the signing process?

airSlate SignNow offers features such as electronic signatures, templates for frequently used forms, and the ability to request signatures from multiple parties. These tools are particularly useful when dealing with important tax documents, including those requiring the 140PY Check Box 82F.

-

Is it safe to use airSlate SignNow for submitting sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance to protect sensitive information. All transactions and documents, including those related to the 140PY Check Box 82F, are encrypted to ensure high levels of data security and confidentiality.

-

What benefits does airSlate SignNow offer for businesses working with tax documents?

airSlate SignNow offers benefits such as improved efficiency, reduced turnaround time for signing documents, and error reduction in form completion. For businesses managing tax-related tasks, including items like the 140PY Check Box 82F, these benefits can signNowly enhance productivity.

Get more for 140PY Check Box 82F If Filing Under Extension 82F OR FISCAL YEAR BEGINNING MM D D 2 0 1 5 Spouses First Name And Middle Initial

- Form affidavit fact

- Affidavit for repossessed vessel texas parks amp wildlife department tpwd state tx form

- Texas certificate insurance form

- Certificate of insurance form texas state board of plumbing

- Texas school gas pipe testing form

- Railroad commission of texas form p 5lc 2010

- Tdrf damage reporting form

- Mce form 9 8 alternative instructional methods reporting form trec state tx

Find out other 140PY Check Box 82F If Filing Under Extension 82F OR FISCAL YEAR BEGINNING MM D D 2 0 1 5 Spouses First Name And Middle Initial

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template