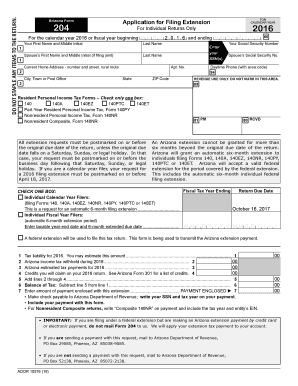

Application for Filing Extension Form

What is the Application For Filing Extension

The Application For Filing Extension is a formal request submitted to the Internal Revenue Service (IRS) that allows taxpayers to extend the deadline for filing their federal income tax returns. This application is particularly useful for individuals and businesses who may require additional time to gather necessary documentation or complete their tax filings accurately. By submitting this application, taxpayers can avoid penalties associated with late filings, provided they meet the requirements set forth by the IRS.

Steps to complete the Application For Filing Extension

Completing the Application For Filing Extension involves several straightforward steps. First, taxpayers need to obtain the appropriate form, typically Form 4868 for individuals. Next, they should fill out the required information, including their name, address, and Social Security number. It is essential to estimate the tax liability accurately to ensure compliance. Once the form is completed, it can be submitted electronically through the IRS e-file system or mailed to the designated address. Timely submission is crucial to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for submitting the Application For Filing Extension. Taxpayers must ensure that they file the application by the original due date of their tax return, which is usually April 15 for individuals. The application grants an automatic six-month extension, but it is important to note that this extension only applies to the filing of the return, not the payment of any taxes owed. Taxpayers are still required to pay any estimated taxes by the original due date to avoid interest and penalties.

Legal use of the Application For Filing Extension

The legal use of the Application For Filing Extension is governed by IRS regulations. To be considered valid, the application must be submitted on time and must include accurate information. The IRS recognizes electronic signatures as legally binding, provided that the submission complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that taxpayers can confidently file their applications digitally while maintaining legal integrity.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers. The Application For Filing Extension must be submitted by the original due date of the tax return, typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. After the extension is granted, the new deadline for filing the tax return is usually October 15. Awareness of these dates helps taxpayers avoid penalties and ensures compliance with IRS regulations.

Required Documents

When completing the Application For Filing Extension, certain documents may be required to provide accurate information. Taxpayers should have their previous year's tax return on hand, as it contains valuable information such as income, deductions, and tax credits. Additionally, any relevant financial documents that reflect current income and expenses should be gathered. Having these documents ready can facilitate a smoother application process and help in estimating any taxes owed.

Eligibility Criteria

Eligibility for the Application For Filing Extension is generally broad, encompassing most individual taxpayers and businesses. However, specific criteria must be met. Taxpayers must ensure they are filing for a valid tax year and that they have not previously filed for an extension for the same tax return. Additionally, those who owe taxes must estimate their liability accurately and pay any owed amounts by the original due date to avoid penalties. Understanding these criteria helps ensure a successful application process.

Quick guide on how to complete application for filing extension

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure excellent communication at any step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Filing Extension

Create this form in 5 minutes!

How to create an eSignature for the application for filing extension

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Application For Filing Extension and how does it work?

The Application For Filing Extension is a streamlined process that allows individuals and businesses to request additional time to file their tax returns. Using airSlate SignNow, you can easily complete and eSign your application online, ensuring that it's submitted on time and without hassle.

-

What are the key features of the Application For Filing Extension?

The Application For Filing Extension includes features such as customizable templates, secure eSigning, and automatic reminders for important deadlines. With airSlate SignNow, you can manage your tax documents efficiently while maintaining compliance with IRS regulations.

-

How can I benefit from using airSlate SignNow for my Application For Filing Extension?

By using airSlate SignNow for your Application For Filing Extension, you gain access to a user-friendly interface that simplifies document management. This cost-effective solution enhances collaboration and ensures that your application is submitted swiftly and accurately.

-

Is there a cost associated with using the Application For Filing Extension on airSlate SignNow?

The pricing for using the Application For Filing Extension on airSlate SignNow varies depending on the plan you choose. Our tiers are designed to fit different business needs, ensuring that you get the most value out of your investment in document management solutions.

-

Can I integrate airSlate SignNow with other applications for my Application For Filing Extension?

Yes, airSlate SignNow seamlessly integrates with various applications, including CRMs and productivity tools, making it easier to streamline your Application For Filing Extension process. This integration capability enhances your workflow and saves time during busy tax seasons.

-

What security measures are in place for the Application For Filing Extension?

Security is a top priority at airSlate SignNow. The Application For Filing Extension is protected with bank-grade encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my Application For Filing Extension?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Application For Filing Extension. This transparency helps you stay informed about your submission and ensures that you meet any upcoming deadlines efficiently.

Get more for Application For Filing Extension

Find out other Application For Filing Extension

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document