Bpi Fatca Form

What is the BPI FATCA Form?

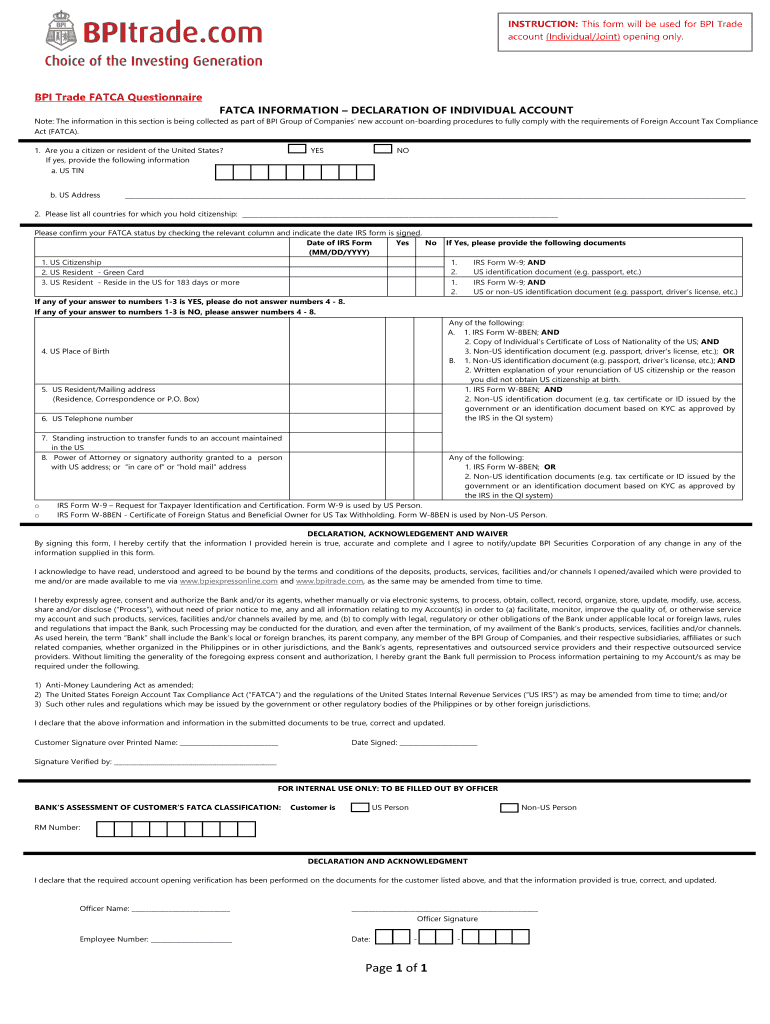

The BPI FATCA form is a crucial document used for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is specifically designed for individuals who hold accounts with the Bank of the Philippine Islands (BPI) and need to declare their foreign financial assets. It serves to provide the necessary information to the Internal Revenue Service (IRS) regarding foreign accounts, ensuring that U.S. taxpayers meet their reporting obligations. The BPI FATCA form helps in identifying U.S. persons and entities to ensure proper tax compliance.

How to Use the BPI FATCA Form

Using the BPI FATCA form involves several steps to ensure accurate completion and compliance. First, gather all necessary financial information, including account numbers and balances. Next, fill out the form with personal details, such as your name, address, and taxpayer identification number. It is essential to provide accurate information to avoid penalties. Once completed, the form can be submitted to BPI or the appropriate tax authority, depending on specific instructions provided. Utilizing digital tools can streamline this process, making it easier to manage and submit your form securely.

Steps to Complete the BPI FATCA Form

Completing the BPI FATCA form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all required financial documents, including account statements.

- Fill in your personal information accurately, ensuring it matches official records.

- Provide details about your foreign accounts, including balances and types of accounts.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail as per the guidelines provided by BPI.

Legal Use of the BPI FATCA Form

The legal use of the BPI FATCA form is governed by U.S. tax laws and international agreements. This form must be completed accurately to comply with FATCA regulations, which aim to prevent tax evasion by U.S. taxpayers holding assets overseas. Failure to submit the form can result in significant penalties, including fines and legal repercussions. It is essential to understand the legal implications of the information provided and to ensure that all data is truthful and complete.

Required Documents

To successfully complete the BPI FATCA form, certain documents are necessary. These typically include:

- Government-issued identification, such as a passport or driver's license.

- Taxpayer identification number (TIN) or Social Security number (SSN).

- Account statements for all foreign accounts being reported.

- Any previous correspondence with the IRS regarding foreign accounts.

Form Submission Methods

The BPI FATCA form can be submitted through various methods, depending on the preferences of the individual. Common submission methods include:

- Online submission through the BPI digital platform, ensuring a secure and efficient process.

- Mailing the completed form to the designated address provided by BPI.

- In-person submission at a local BPI branch, if preferred for direct assistance.

Quick guide on how to complete bpi fatca form

Effortlessly prepare Bpi Fatca Form on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and seamlessly. Manage Bpi Fatca Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign Bpi Fatca Form with ease

- Find Bpi Fatca Form and click on Get Form to initiate the process.

- Use the tools available to complete your form.

- Mark pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to apply your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or overlooked documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Bpi Fatca Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bpi fatca form

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the BPI FATCA form and why is it important?

The BPI FATCA form is a declaration required by the IRS for foreign financial institutions to report U.S. account holders. It is essential for ensuring compliance with tax regulations and avoiding penalties. Completing the BPI FATCA form accurately can save time and avoid complications in your banking processes.

-

How can airSlate SignNow help with filling out the BPI FATCA form?

airSlate SignNow offers a streamlined digital solution to easily complete and eSign your BPI FATCA form. With our user-friendly interface, you can fill out the document quickly and securely. Plus, our platform ensures that your form is compliant and ready for submission.

-

Is there a cost associated with using airSlate SignNow for the BPI FATCA form?

Yes, airSlate SignNow operates on a subscription-based pricing model, providing various plans to suit different needs. Our cost-effective solution ensures that you can manage all your document signing, including the BPI FATCA form, without breaking the bank. Check our pricing page for specific details on each plan.

-

What features does airSlate SignNow offer for managing the BPI FATCA form?

airSlate SignNow includes features such as customizable templates, cloud storage, and secure eSigning, all designed to enhance your experience with the BPI FATCA form. You can track the status of your documents in real-time and receive notifications upon completion. These features help streamline your workflow efficiently.

-

Can I integrate airSlate SignNow with other applications for the BPI FATCA form?

Yes, airSlate SignNow offers seamless integrations with numerous applications including CRM and storage solutions. This allows you to manage your documents, including the BPI FATCA form, directly from your existing workflow. Integrations help enhance efficiency and simplify document management.

-

How does airSlate SignNow ensure the security of my BPI FATCA form?

Security is a top priority for airSlate SignNow. We use advanced encryption technologies to protect all data, including your BPI FATCA form, both in transit and at rest. Our platform also complies with industry standards to ensure that your information remains safe and secure.

-

What are the benefits of using airSlate SignNow for the BPI FATCA form?

Using airSlate SignNow for your BPI FATCA form brings numerous benefits such as accelerated document turnaround times and reduced paper usage. Our easy-to-use platform allows for quick eSigning and document handling from anywhere, streamlining your compliance process. This efficiency can help improve business operations signNowly.

Get more for Bpi Fatca Form

Find out other Bpi Fatca Form

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe