AR1000S Full Year Resident Short from Income Tax Return Dfa Arkansas Form

What is the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

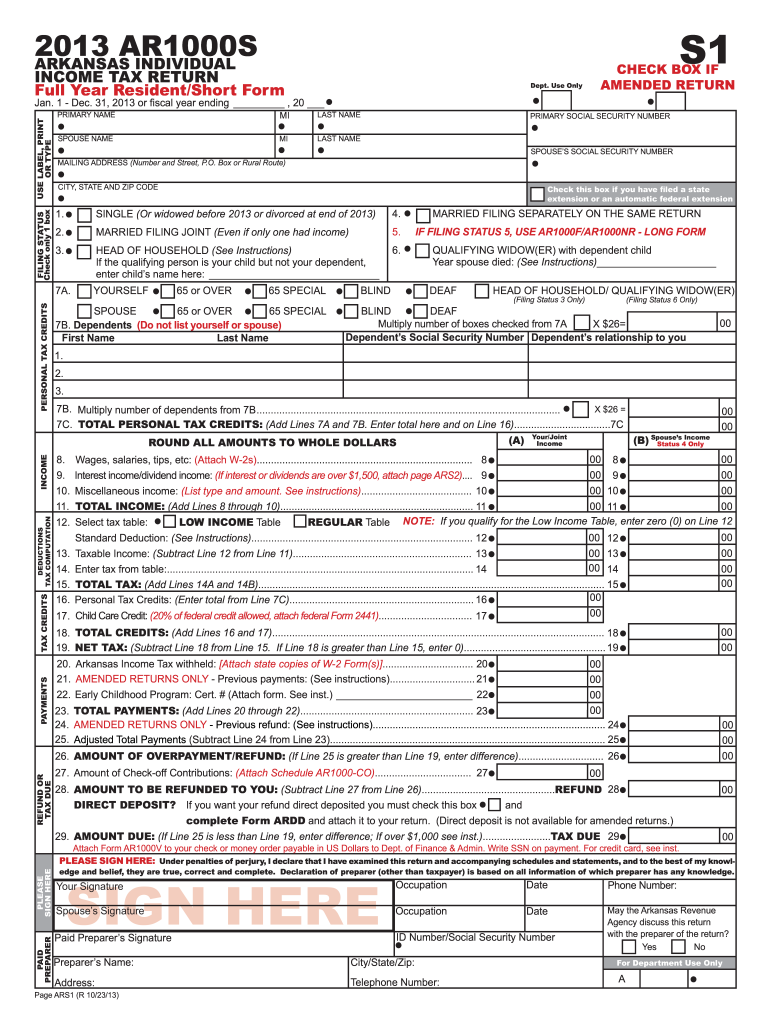

The AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas is a tax form specifically designed for full-year residents of Arkansas. This form allows individuals to report their income, calculate their tax liability, and claim any applicable deductions or credits. It is a simplified version of the standard income tax return, intended for those with straightforward financial situations. Filing this form is essential for compliance with state tax laws and ensures that residents fulfill their tax obligations while potentially minimizing their tax burden.

Steps to complete the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

Completing the AR1000S requires careful attention to detail. Here are the key steps:

- Gather your financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number at the top of the form.

- Report your total income in the designated section, ensuring accuracy to avoid discrepancies.

- Claim any deductions or credits you qualify for, such as those for dependents or educational expenses.

- Calculate your total tax liability based on the provided tax tables and instructions.

- Sign and date the form, confirming that all information is true and complete.

How to obtain the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

The AR1000S form can be obtained through several channels. Residents can download the form directly from the Arkansas Department of Finance and Administration (DFA) website. Additionally, physical copies are often available at local DFA offices and public libraries. Some tax preparation software also includes the AR1000S, allowing for easy access and completion as part of the e-filing process.

Legal use of the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

The AR1000S is legally recognized as a valid tax return form when filled out accurately and submitted on time. To ensure its legality, it must be signed by the taxpayer, confirming the authenticity of the information provided. The form must also comply with state tax regulations, which include adherence to deadlines and proper documentation of income and deductions. Failure to meet these requirements may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the AR1000S are crucial for compliance. Typically, the due date for submitting the form is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these dates to avoid late fees and ensure timely processing of their returns.

Required Documents

When completing the AR1000S, certain documents are necessary to provide accurate information. These typically include:

- W-2 forms from employers, detailing annual earnings and withheld taxes.

- 1099 forms for any freelance or contract work, reporting additional income.

- Documentation for any deductions or credits claimed, such as receipts or tax statements.

- Personal identification information, including Social Security numbers for the taxpayer and dependents.

Quick guide on how to complete ar1000s full year resident short from income tax return dfa arkansas

Complete AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas with ease

- Find AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1000s full year resident short from income tax return dfa arkansas

The best way to make an e-signature for a PDF file online

The best way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas?

The AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas is a simplified tax return form designed for Arkansas residents. This form helps streamline the filing process, making it easier to report your income and calculate your taxes owed. Utilizing this form can expedite the completion of your tax obligations.

-

How do I complete the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas?

Completing the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas involves gathering your financial documents and accurately filling out the form based on your income sources. The form typically requires personal information, income details, and deductions. For assistance, consider using tools from airSlate SignNow to eSign and manage your tax documents efficiently.

-

Is the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas easy to file?

Yes, the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas is designed for simplicity, allowing taxpayers to file quickly. Using user-friendly platforms like airSlate SignNow can further enhance the ease of eSigning and submitting your returns. This efficiency helps ensure accurate and timely filing.

-

What is the cost associated with filing the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas?

Filing the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas typically incurs minimal costs, especially when using online filing services. With airSlate SignNow, you can leverage cost-effective solutions for eSigning your documents. This approach saves time and money compared to traditional filing methods.

-

What benefits does the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas offer?

The AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas offers several benefits, such as simplified completion and a quicker turnaround for processing. Additionally, it can reduce the likelihood of errors, which is crucial for timely tax submissions. Pairing it with airSlate SignNow increases efficiency through easy document management.

-

Can I use airSlate SignNow to file the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas?

Absolutely! You can use airSlate SignNow to manage and eSign the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas. Our platform allows for secure document handling, ensuring that your tax submissions are completed accurately and on time. This integration provides convenience for both individuals and businesses.

-

Are there any common mistakes to avoid when filing the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas?

Common mistakes include miscalculating income or deductions, failing to sign the form, or missing submission deadlines. It's crucial to verify all information before submitting the AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas. Utilizing airSlate SignNow can help ensure that documents are properly reviewed and stored.

Get more for AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

Find out other AR1000S Full Year Resident Short From Income Tax Return Dfa Arkansas

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later