Full Year Resident Filers Complete Columns a and B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas Form

What is the Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

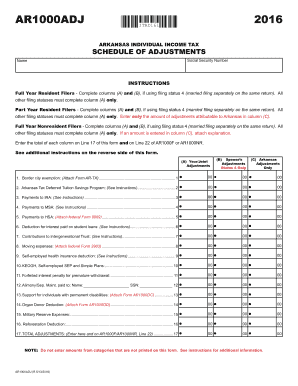

The Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas is a specific tax form used by residents of Arkansas who are filing their state income taxes. This form is essential for individuals who have lived in Arkansas for the entire tax year and need to report their income accurately. It includes sections that require detailed information about income, deductions, and credits applicable to Arkansas residents.

Steps to complete the Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

Completing the Full Year Resident Filers form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out Columns A and B with accurate income figures and any applicable deductions.

- Ensure that all entries are consistent with your federal tax return to avoid discrepancies.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, depending on your preference and compliance with state guidelines.

Legal use of the Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

The legal validity of the Full Year Resident Filers form hinges on compliance with state tax laws and regulations. When filled out correctly, this form serves as an official document that can be used to assess tax obligations. It is important to ensure that signatures and dates are included as required, as these elements confirm the authenticity of the submission. Utilizing a reliable eSignature platform can enhance the legal standing of your electronically submitted form.

State-specific rules for the Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

Arkansas has specific rules governing the completion and submission of the Full Year Resident Filers form. These rules include deadlines for submission, eligibility criteria for filers, and guidelines on what constitutes taxable income. Familiarizing yourself with these state-specific regulations is crucial to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Full Year Resident Filers form typically align with federal tax deadlines. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, it is advisable to check for any state-specific extensions or changes to these dates, especially in light of recent developments in tax legislation.

Required Documents

To complete the Full Year Resident Filers form accurately, you will need several key documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failing to comply with the requirements for the Full Year Resident Filers form can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete full year resident filers complete columns a and b li xvlqj olqj vwdwxv pduulhg olqj vhsdudwho rq wkh vdph uhwxuq dfa arkansas

Effortlessly Prepare Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any delays. Manage Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas on any device with the airSlate SignNow apps available for Android and iOS, enhancing any document-centric process today.

The Simplest Way to Modify and Electronically Sign Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas Effortlessly

- Obtain Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the full year resident filers complete columns a and b li xvlqj olqj vwdwxv pduulhg olqj vhsdudwho rq wkh vdph uhwxuq dfa arkansas

The best way to make an e-signature for your PDF file in the online mode

The best way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What are the key features of airSlate SignNow for Full Year Resident Filers?

airSlate SignNow offers a variety of features designed specifically for Full Year Resident Filers. Users can easily eSign documents, streamline workflows, and ensure compliance with Arkansas DFA regulations. The platform also allows for efficient management of document storage and access from any device.

-

How does airSlate SignNow improve the filing process for Full Year Resident Filers?

With airSlate SignNow, Full Year Resident Filers can complete Columns A and B effortlessly. The platform simplifies the filing process by providing templates that ensure all required information is accurately filled out. This reduces the chances of errors and facilitates a smoother experience when submitting documents to the Arkansas DFA.

-

What pricing plans are available for Full Year Resident Filers using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet the needs of Full Year Resident Filers. Whether you are an individual or part of a larger organization, there are affordable options available that provide full access to essential features. This enables you to choose a plan that fits your budget while efficiently managing your document signing needs.

-

Can airSlate SignNow integrate with other tools for Full Year Resident Filers?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that are commonly used by Full Year Resident Filers. This compatibility allows users to streamline their processes by linking their existing tools, reducing the time spent switching between applications. Integrations with platforms like Google Drive and Salesforce enhances productivity.

-

What benefits does airSlate SignNow offer for signed documents related to Full Year Resident Filers?

One of the key benefits of using airSlate SignNow for Full Year Resident Filers is the enhanced security and legality of signed documents. Each eSigned document is protected with robust encryption and comes with a digital certificate, ensuring authenticity. This provides peace of mind that submissions to the Arkansas DFA meet required standards.

-

Is airSlate SignNow user-friendly for Full Year Resident Filers?

Absolutely! airSlate SignNow is designed to be user-friendly for all levels of tech-savviness, making it ideal for Full Year Resident Filers. The intuitive interface ensures that you can navigate through the signing and documentation process without any confusion, allowing you to focus on your filing needs with ease.

-

How does airSlate SignNow ensure compliance for Full Year Resident Filers?

airSlate SignNow provides various compliance features that assist Full Year Resident Filers in adhering to Arkansas DFA regulations. The platform regularly updates its functionalities to align with local laws and requirements. This ensures that you are always filing correctly and efficiently with updated compliance standards in mind.

Get more for Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

Find out other Full Year Resident Filers Complete Columns A And B, LI XVLQJ OLQJ VWDWXV PDUULHG OLQJ VHSDUDWHO RQ WKH VDPH UHWXUQ Dfa Arkansas

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement