Corporation Bonds, Savings and Loan Deposits, and Credit Union There is No Dividend Exclusion Applicable to Arkansas Form

Understanding the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

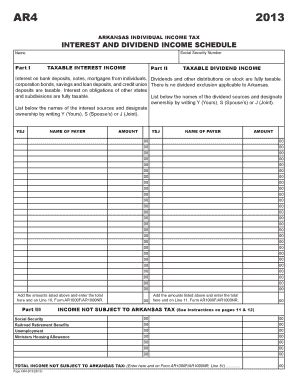

The Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas form is essential for individuals and businesses in Arkansas to report specific financial activities. This form addresses the treatment of income from corporation bonds, savings and loan deposits, and credit union accounts, specifically clarifying that no dividend exclusion applies in these cases. Understanding the nuances of this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

Completing the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather all relevant financial documents, including statements from your corporation bonds, savings accounts, and credit union deposits.

- Review the specific instructions provided with the form to understand the required information.

- Fill in your personal or business information accurately, ensuring that names and identification numbers match official documents.

- Report income from corporation bonds, savings and loan deposits, and credit union accounts as specified.

- Double-check all entries for accuracy before submission.

Legal Use of the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

This form is legally binding when completed and submitted according to Arkansas state regulations. It serves as an official record of income derived from specific financial sources. Compliance with the form's requirements is essential to avoid potential legal issues, including penalties for misreporting income. Understanding the legal implications of this form can help individuals and businesses maintain proper tax compliance.

State-Specific Rules for the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

Arkansas has specific regulations regarding the taxation of income from corporation bonds, savings and loan deposits, and credit union accounts. It is important to be aware of these state-specific rules to ensure compliance. For instance, the lack of a dividend exclusion means that all income generated from these sources is subject to state taxation. Familiarizing yourself with these regulations can help in effective financial planning and tax preparation.

Required Documents for the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

When preparing to complete the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas form, certain documents are essential. These typically include:

- Financial statements from corporations and credit unions.

- Account statements from savings and loan deposits.

- Any previous tax returns that may provide context for current filings.

Having these documents on hand will streamline the completion process and ensure accuracy in reporting.

Examples of Using the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

Understanding how to apply the Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas form can be enhanced through practical examples. For instance:

- A business that earns interest from a credit union account must report that income on this form, as it is not eligible for a dividend exclusion.

- An individual receiving interest from corporate bonds must also include this income, ensuring compliance with state tax laws.

These examples illustrate the importance of accurately reporting income to avoid penalties and ensure compliance with Arkansas tax regulations.

Quick guide on how to complete corporation bonds savings and loan deposits and credit union there is no dividend exclusion applicable to arkansas

Complete [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS apps and enhance any document-focused process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporation bonds savings and loan deposits and credit union there is no dividend exclusion applicable to arkansas

The best way to make an e-signature for your PDF document online

The best way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What are Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas?

Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas refers to specific financial instruments and deposit accounts in Arkansas that do not benefit from a dividend exclusion. This means that the interest earned from these investments may be subject to state taxes. Understanding this can help investors make informed decisions regarding their financial strategies in the state.

-

How does airSlate SignNow facilitate transactions involving Corporation Bonds and Savings And Loan Deposits?

airSlate SignNow allows users to easily sign and send documents related to Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas. Our platform ensures that all necessary legal documents are executed efficiently, reducing turnaround time and enhancing compliance. It's an ideal solution for financial institutions looking to streamline their operations.

-

What pricing options are available for using airSlate SignNow for these financial documents?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes that deal with Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas. Our plans include various features, ensuring that you only pay for what you need. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow provide for managing financial documents?

With airSlate SignNow, you get robust features like customizable templates, real-time tracking, and secure electronic signatures specifically for documents related to Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas. These features help streamline your workflow and enhance document management efficiency. Additionally, our user-friendly interface simplifies the entire process.

-

Are there any benefits to using airSlate SignNow for financial sectors?

Yes, using airSlate SignNow for managing documents related to Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas has several benefits. It offers increased efficiency, reduced costs, and improved security for sensitive financial documents. Our platform ensures compliance with legal standards, making it a trustworthy choice for the financial sector.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various financial software and systems that handle Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas. This integration allows for a more streamlined workflow and ensures that your documents are easily accessible across platforms, enhancing overall productivity.

-

Is airSlate SignNow secure for handling sensitive financial documents?

Yes, security is a top priority at airSlate SignNow. Our platform is equipped with advanced encryption and compliance with industry standards, ensuring that documents related to Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas are safe from unauthorized access. You can confidently manage sensitive information knowing it's protected.

Get more for Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

- Printable ps form 6401

- Request form to change a birth or death alabama department of adph

- Art institute transcript request form

- School forms printable

- For guyana what a p3a form for penction

- Application for certificate cooma monaro shire council form

- Municipal form no 103

- Form 3 certificate of legal practitioner and waiver by purchaser

Find out other Corporation Bonds, Savings And Loan Deposits, And Credit Union There Is No Dividend Exclusion Applicable To Arkansas

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy