Form 3519 Payment for Automatic Extension for Individuals Ftb Ca

What is the Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

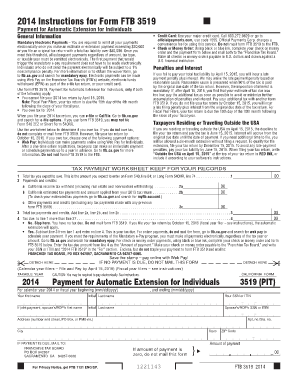

The Form 3519 is a document used by individuals in California to request an automatic extension for filing their state income tax returns. This form allows taxpayers to defer their filing deadline by six months, providing additional time to prepare their tax returns without incurring penalties for late submission. It is important to note that while the form extends the filing deadline, it does not extend the payment deadline for any taxes owed. Taxpayers must still estimate and pay any owed taxes by the original due date to avoid interest and penalties.

How to use the Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

Using the Form 3519 involves several straightforward steps. First, taxpayers must accurately complete the form with their personal information, including name, address, and Social Security number. Next, they need to estimate their tax liability for the year and indicate this amount on the form. After completing the form, it should be submitted along with the appropriate payment to the California Franchise Tax Board (FTB) by the original tax deadline. This submission can be done electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

Completing the Form 3519 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of Form 3519 from the California Franchise Tax Board website or other official sources.

- Fill in your personal details, including your name, address, and Social Security number.

- Estimate your total tax liability for the year and enter this amount on the form.

- Calculate the payment amount, if applicable, and ensure it is submitted with the form.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail to the FTB by the original filing deadline.

Key elements of the Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

The Form 3519 includes several key elements that are crucial for proper completion. These elements consist of:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Estimated Tax Liability: Taxpayers must provide an estimate of their total tax liability for the year.

- Payment Information: If taxes are owed, the form must include the payment amount to avoid penalties.

- Signature: The form must be signed to validate the request for an extension.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 3519 is essential for compliance. The original deadline for submitting the form typically aligns with the state income tax return deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers must ensure that their Form 3519 is submitted by this date to receive the automatic extension.

Penalties for Non-Compliance

Failure to properly file the Form 3519 or to pay any owed taxes by the original deadline can result in penalties. If a taxpayer does not submit the form, they may face a late filing penalty, which can accumulate over time. Additionally, any unpaid taxes will incur interest and penalties until fully paid. It is crucial for taxpayers to adhere to the filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete 2014 form 3519 payment for automatic extension for individuals ftb ca

Manage Form 3519 Payment For Automatic Extension For Individuals Ftb Ca seamlessly on any device

The digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed forms, as you can easily access the right document and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Form 3519 Payment For Automatic Extension For Individuals Ftb Ca on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign Form 3519 Payment For Automatic Extension For Individuals Ftb Ca effortlessly

- Find Form 3519 Payment For Automatic Extension For Individuals Ftb Ca and click on Get Form to commence.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form 3519 Payment For Automatic Extension For Individuals Ftb Ca and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 3519 payment for automatic extension for individuals ftb ca

The way to create an e-signature for a PDF in the online mode

The way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

Form 3519 is a California tax form used by individuals to request an automatic extension for their personal income tax returns. This form allows taxpayers to extend their filing deadline without incurring penalties, provided that the extension fee is paid. Understanding Form 3519 is essential for staying compliant with California tax regulations.

-

How can airSlate SignNow assist with Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

airSlate SignNow simplifies the process of completing and submitting Form 3519 by allowing users to eSign documents quickly and securely. With our platform, individuals can effortlessly handle their tax extension forms from anywhere, eliminating the need for paper submissions. This efficiency helps ensure timely compliance with California's tax deadlines.

-

What are the benefits of using airSlate SignNow for Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

Using airSlate SignNow for Form 3519 offers several benefits, including ease of use, time savings, and document security. The platform provides a user-friendly interface that allows users to fill out and sign documents online, reducing the hassle associated with traditional methods. Additionally, all documents are stored securely within our system.

-

Is there a cost associated with using airSlate SignNow for Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

Yes, there is a subscription cost for using airSlate SignNow, but it is competitively priced and designed to offer value for individuals and businesses. The service provides unlimited document signing and sharing, making it a cost-effective solution for managing Form 3519 and other important documents. Various pricing plans are available to suit different needs.

-

Can I integrate airSlate SignNow with other applications while working on Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

Absolutely! airSlate SignNow offers multiple integrations with popular applications and services, making it easy to streamline your workflow. Whether you use CRM systems, email platforms, or cloud storage services, you can seamlessly connect these tools to enhance your experience while managing Form 3519.

-

How does airSlate SignNow ensure the security of my Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

airSlate SignNow prioritizes your security with advanced encryption methods and compliance with industry standards. We implement stringent security measures to protect your sensitive information while you complete and send Form 3519. Your data is safe, ensuring peace of mind as you handle your tax documents online.

-

Is there customer support available for using airSlate SignNow with Form 3519 Payment For Automatic Extension For Individuals Ftb Ca?

Yes, airSlate SignNow provides robust customer support to assist users with any questions or challenges while completing Form 3519. Our support team is available via multiple channels, including chat and email, ensuring you get the help you need promptly. We aim to facilitate a smooth experience for all users.

Get more for Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

- Bill of sale without warranty by corporate seller louisiana form

- Motion valuation form

- Louisiana notice form 497309238

- Reaffirmation agreement louisiana form

- Reaffirmation agreement louisiana 497309240 form

- Verification of creditors matrix louisiana form

- Verification of creditors matrix louisiana 497309242 form

- Verification of creditors matrix louisiana 497309243 form

Find out other Form 3519 Payment For Automatic Extension For Individuals Ftb Ca

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself