CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach to Form 540, Long Form 540NR, or Form 541

What is the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

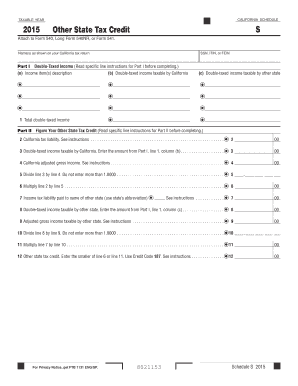

The CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit is a tax credit available to California residents who owe taxes to other states. This credit is designed to prevent double taxation on income earned in other states while being a resident of California. To claim this credit, taxpayers must attach the appropriate schedule to their California tax return, specifically Form 540, Long Form 540NR, or Form 541. Understanding this credit can help taxpayers reduce their overall tax liability when filing their state taxes.

Steps to complete the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

Completing the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit involves several key steps:

- Gather all relevant tax documents, including W-2s, 1099s, and any tax returns from the other states.

- Determine the amount of tax paid to the other state(s) for the taxable year.

- Fill out the CALIFORNIASCHEDULE TAXABLEYEAR S form, ensuring to provide accurate information regarding your income and taxes paid to other states.

- Attach the completed schedule to your Form 540, Long Form 540NR, or Form 541.

- Review your entire tax return for accuracy before submitting it to the California Franchise Tax Board.

Eligibility Criteria

To qualify for the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit, taxpayers must meet specific eligibility criteria:

- Be a resident of California for the taxable year in question.

- Have paid income tax to another state on income that is also subject to California tax.

- Complete the required forms accurately and submit them with your California tax return.

Legal use of the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

The legal use of the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit is governed by California tax law. To ensure compliance, taxpayers must accurately report their income and tax payments to other states. The credit is legally valid when claimed correctly and supported by appropriate documentation, such as tax returns from the other states. Additionally, electronic signatures on the forms are recognized as legally binding, provided they comply with relevant eSignature laws.

How to use the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

Using the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit effectively requires understanding its application within your tax return. After completing the schedule, attach it to your primary tax form. Ensure that all information is consistent with your other state tax returns. If using electronic filing, ensure your eSignature is compliant with legal standards to validate your submission. This process helps streamline your filing and ensures you receive the appropriate credit for taxes paid to other states.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit along with their California tax return:

- Online: Use the California Franchise Tax Board's e-file system to submit your forms electronically.

- Mail: Print and send your completed forms to the designated address provided by the California Franchise Tax Board.

- In-Person: Visit a local tax office to file your forms directly, though this option may vary by location.

Quick guide on how to complete californiaschedule taxableyear 2015 s other state tax credit attach to form 540 long form 540nr or form 541

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can retrieve the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without any holdups. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign [SKS] with minimal effort

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

Create this form in 5 minutes!

How to create an eSignature for the californiaschedule taxableyear 2015 s other state tax credit attach to form 540 long form 540nr or form 541

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit?

The CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit is a tax credit available to residents of California who have filed a tax return in another state. This credit can help reduce your California tax liability, so it's essential to know how it applies to your Form 540, Long Form 540NR, or Form 541.

-

How do I attach the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit to my tax forms?

To attach the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit, download the applicable form, such as Form 540, Long Form 540NR, or Form 541. Complete the necessary sections related to the other state tax credit and ensure that your documentation is properly included with your tax submission.

-

What features does airSlate SignNow offer for tax document signing?

airSlate SignNow provides a seamless platform for signing tax documents electronically, including the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit applications. With features like templates, reminders, and secure storage, it simplifies the process for both businesses and individual taxpayers.

-

Is there a cost associated with using airSlate SignNow for filing state tax credits?

Yes, airSlate SignNow operates on a subscription model with plans designed to cater to diverse needs. The cost is generally affordable, making it a cost-effective solution for efficiently managing and signing tax-related documents, including the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, ensuring a streamlined workflow for managing your documents related to the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit. This integration allows for efficient data management and improved productivity.

-

What benefits does airSlate SignNow provide for tax professionals?

airSlate SignNow is designed for tax professionals to enhance efficiency in document management. The ability to eSign forms and securely store documents enables you to focus more on client relationships while efficiently managing workflows for documents like the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit.

-

How secure is airSlate SignNow for signing sensitive tax documents?

Security is a top priority for airSlate SignNow, as it employs bank-grade encryption to protect sensitive information. When signing documents like the CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit, you can trust that your confidential data is safeguarded against unauthorized access.

Get more for CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

- 190 form

- H apps formflow forms chp809frp printing california chp ca

- Job description form

- Federal custody and control form electronic

- Dros form

- Ct tr1 annual treasurers report for the attorney general of california annual treasurers report for the attorney general of form

- Application form state lands commission state of california slc ca

- Involuntary patient advisement department of mental dmh ca form

Find out other CALIFORNIASCHEDULE TAXABLEYEAR S Other State Tax Credit Attach To Form 540, Long Form 540NR, Or Form 541

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now