104AMT Colorado Gov Form

What is the 104AMT Colorado gov?

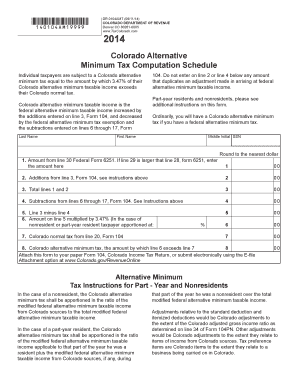

The 104AMT form is a specific tax document used by residents of Colorado to calculate their Alternative Minimum Tax (AMT). This form is essential for taxpayers who may be subject to AMT, which is designed to ensure that individuals with higher incomes pay a minimum amount of tax, regardless of deductions or credits. The 104AMT form helps determine if you owe additional taxes beyond your regular income tax obligations.

How to use the 104AMT Colorado gov

Using the 104AMT form involves several steps that ensure accurate reporting and compliance with state tax laws. First, gather all necessary financial documents, including your income statements and any deductions you plan to claim. Next, complete the form by carefully following the instructions provided. It is crucial to calculate your AMT based on your taxable income and any applicable adjustments. Once completed, review the form for accuracy before submitting it to the Colorado Department of Revenue.

Steps to complete the 104AMT Colorado gov

Completing the 104AMT form requires attention to detail. Begin by filling out your personal information at the top of the form. Then, proceed to calculate your Alternative Minimum Taxable Income (AMTI) by adjusting your regular taxable income for specific tax preferences. After calculating your AMTI, apply the appropriate AMT rates to determine your tax liability. Finally, ensure all calculations are correct and submit the form by the designated deadline.

Legal use of the 104AMT Colorado gov

The 104AMT form is legally binding when completed accurately and submitted on time. It is essential to comply with Colorado tax regulations to avoid penalties. The form must be filed in accordance with the state’s tax laws, which include maintaining accurate records and providing truthful information. Failure to comply with these requirements can result in fines or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the 104AMT form align with Colorado's tax filing schedule. Typically, the form must be submitted by April 15 each year, unless an extension is filed. It is important to keep track of any changes in deadlines, as they may vary based on specific circumstances, such as natural disasters or state legislation. Staying informed about these dates ensures timely compliance and avoids potential penalties.

Required Documents

To complete the 104AMT form, you will need several documents, including:

- Your W-2 forms, which report your annual wages and tax withholdings.

- Any 1099 forms if you have income from freelance work or investments.

- Documentation of deductions you intend to claim, such as mortgage interest statements.

- Records of any tax credits you may be eligible for.

Having these documents ready will streamline the process of completing the 104AMT form and ensure accuracy in your tax reporting.

Quick guide on how to complete 104amt

Effortlessly Prepare 104amt on Any Device

Managing documents online has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the essential tools required to create, modify, and electronically sign your documents quickly and without interruptions. Handle 104amt on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign what is form 104 colorado Effortlessly

- Obtain 104amt and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign what is form 104 colorado to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 104amt

Create this form in 5 minutes!

How to create an eSignature for the what is form 104 colorado

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF document on Android OS

People also ask what is form 104 colorado

-

What is Form 104 Colorado and who should use it?

Form 104 Colorado is the state income tax form that residents and certain non-residents of Colorado use to report their income and calculate their state taxes. Individuals who earn income in Colorado must use this form to ensure compliance with state tax regulations.

-

How do I file Form 104 Colorado using airSlate SignNow?

To file Form 104 Colorado using airSlate SignNow, users simply need to upload their completed Form 104 document to the platform. They can then use the eSigning feature to sign and send the form securely, making the filing process straightforward and efficient.

-

What are the benefits of using airSlate SignNow for Form 104 Colorado?

Using airSlate SignNow for Form 104 Colorado offers several benefits, including enhanced security for sensitive information and real-time tracking of submissions. Additionally, the platform simplifies the eSigning process, ensuring that users can file their returns swiftly and without hassle.

-

Can I integrate airSlate SignNow with other tax software for Form 104 Colorado?

Yes, airSlate SignNow can be integrated with various tax software programs, allowing users to manage their Form 104 Colorado filings more effectively. This integration streamlines the workflow, making it easier to prepare, sign, and submit forms electronically.

-

What features of airSlate SignNow make it ideal for electronic filing of Form 104 Colorado?

Key features of airSlate SignNow that make it ideal for electronic filing of Form 104 Colorado include user-friendly document management, secure eSigning capabilities, and flexible cloud storage. These features cater to both individuals and businesses, simplifying the entire filing process.

-

Is airSlate SignNow cost-effective for filing Form 104 Colorado?

Absolutely, airSlate SignNow offers a cost-effective solution for filing Form 104 Colorado with competitive pricing plans that cater to various user needs. This affordability, combined with ease of use, makes it a popular choice among those needing to file their state tax forms.

-

How long does it take to complete Form 104 Colorado with airSlate SignNow?

Completing Form 104 Colorado with airSlate SignNow can take as little as 15 minutes, depending on the complexity of your financial situation. The intuitive interface helps users efficiently input their information and prepare the document for eSigning.

Get more for 104amt

- Move out disposition form

- Arizona trade renewal 2011 form

- Controlled substance dispensingadministration log vetboard az form

- Controlled drug log templatepdffillercom form

- Sf 424 version 703 2003 2019 form

- Appl for reg of llp arkansas secretary of state sos arkansas form

- Ar elderchoices respite form

- Bulk fuel log form

Find out other what is form 104 colorado

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself