CT 1040 Instructions, Connecticut Resident Income Tax CT Gov Taxhow Form

What is the CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

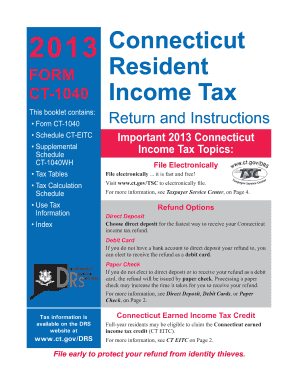

The CT 1040 Instructions provide essential guidelines for Connecticut residents filing their state income tax returns. This form outlines the necessary steps, requirements, and information needed to accurately report income and calculate tax obligations. It is crucial for taxpayers to understand the specific regulations that apply to Connecticut to ensure compliance and avoid penalties.

Steps to complete the CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

Completing the CT 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Review the CT 1040 Instructions carefully to understand the required information.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Double-check calculations to confirm accuracy.

- Sign and date the form before submission.

Required Documents

To complete the CT 1040, taxpayers must have several documents on hand:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

It is important to be aware of key deadlines for filing the CT 1040. Typically, the filing deadline is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any extensions that may apply and the associated deadlines for submitting payment to avoid penalties.

Legal use of the CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

The CT 1040 Instructions are legally binding documents that provide the framework for filing state income taxes in Connecticut. Utilizing these instructions ensures compliance with state tax laws, which helps to avoid legal issues or penalties. It is important for taxpayers to follow these guidelines closely to ensure their filings are valid and accepted by the state.

Examples of using the CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

Taxpayers can use the CT 1040 Instructions in various scenarios:

- A full-time employee filing their annual income tax return.

- A self-employed individual reporting business income and expenses.

- A retiree with pension income needing to understand tax implications.

Each of these examples illustrates the versatility of the CT 1040 Instructions in catering to different taxpayer situations.

Quick guide on how to complete ct 1040 instructions 2013 connecticut resident income tax ctgov free taxhow

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant parts of your documents or hide sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 instructions 2013 connecticut resident income tax ctgov free taxhow

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What are the CT 1040 Instructions for filing Connecticut Resident Income Tax?

The CT 1040 Instructions provide a comprehensive guide for filing your Connecticut Resident Income Tax. These instructions are essential in ensuring that you fill out your forms correctly and take advantage of any deductions you may qualify for. For details, visit the CT gov Taxhow website where you can find additional resources.

-

What features does airSlate SignNow offer to streamline document signing?

airSlate SignNow offers a user-friendly interface that simplifies the process of eSigning documents. With features like document templates, bulk sending, and mobile access, it enhances efficiency for users dealing with CT 1040 Instructions and other documents. This ensures a hassle-free experience for Connecticut Resident Income Tax filing.

-

How much does airSlate SignNow cost for businesses when handling tax documents?

The pricing for airSlate SignNow varies based on the subscription plan chosen, but it is generally cost-effective for small to medium-sized businesses. This affordability allows companies to invest in streamlined processes when dealing with essential documents like CT 1040 Instructions, Connecticut Resident Income Tax forms. You can check the pricing section on our website for specific details.

-

Can airSlate SignNow help with my CT 1040 filing process?

Yes, airSlate SignNow is designed to assist you with your CT 1040 filing process. It allows you to quickly sign and send documents electronically, making it easy to manage the submission of your Connecticut Resident Income Tax forms. By using our platform, you can ensure timely and secure filing.

-

Is airSlate SignNow compliant with state regulations for tax documents?

Absolutely, airSlate SignNow complies with all relevant state regulations regarding electronic signatures and tax documents. Our platform is regularly updated to adhere to the latest legal standards, including those for CT 1040 Instructions and Connecticut Resident Income Tax submissions. This reliability ensures that your documents are legally valid.

-

What integrations does airSlate SignNow offer for tax preparation software?

airSlate SignNow integrates seamlessly with several popular tax preparation and management software systems. This integration enhances your workflow by allowing you to directly access your CT 1040 Instructions and Connecticut Resident Income Tax forms from your preferred platforms, simplifying the eSigning process.

-

How secure is airSlate SignNow for signing tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive information such as tax documents. Our platform uses advanced encryption and multi-factor authentication to ensure that your CT 1040 Instructions and Connecticut Resident Income Tax documents remain secure. You can trust that your data is protected when using our services.

Get more for CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

- Motion for continuance grievance hearing form connecticut jud ct

- Please type or print clearly connecticut secretary of the state sots ct form

- Unemployment separation packet connecticut department of labor ctdol state ct form

- Form 43

- Employee medical amp work status form state of connecticut wcc state ct

- What is form loe delaware

- Asbestos disposal form waste shipment recorddoc

- Diaa physical form

Find out other CT 1040 Instructions, Connecticut Resident Income Tax CT gov Taxhow

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage