CT 1040NRPY Booklet, Connecticut Nonresident and CT Gov Form

What is the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

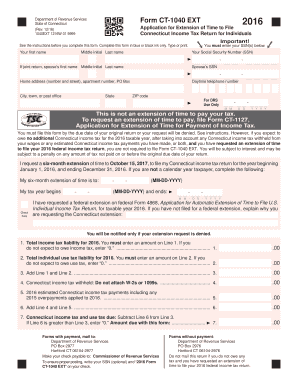

The CT 1040NRPY Booklet is a tax form specifically designed for nonresident individuals who earn income in Connecticut. This booklet provides essential information and instructions for completing the Connecticut Nonresident Income Tax Return. It is issued by the Connecticut Department of Revenue Services (CT gov) and is crucial for ensuring compliance with state tax laws. Nonresidents must accurately report their income earned in Connecticut to determine their tax liability.

How to use the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

Using the CT 1040NRPY Booklet involves several steps to ensure proper completion and submission. First, gather all necessary documents, including W-2 forms and any other income statements. Next, follow the instructions outlined in the booklet to fill out the form accurately. Pay close attention to the sections that pertain to your specific income sources and deductions. Once completed, you can submit the form either electronically or by mail, depending on your preference.

Steps to complete the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

Completing the CT 1040NRPY Booklet requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income earned in Connecticut, ensuring that you include all relevant sources. After calculating your total income, apply any deductions or credits that you qualify for. Finally, review your form for accuracy before signing and submitting it to the Connecticut Department of Revenue Services.

Legal use of the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

The CT 1040NRPY Booklet is legally binding when completed and submitted according to Connecticut tax laws. It is essential to provide accurate information, as any discrepancies can lead to penalties or audits. The form must be signed and dated, affirming that the information provided is true and complete. Compliance with state tax regulations is crucial for avoiding legal issues and ensuring that you fulfill your tax obligations as a nonresident.

Filing Deadlines / Important Dates

Filing deadlines for the CT 1040NRPY Booklet are typically aligned with federal tax deadlines. Nonresidents must file their Connecticut income tax return by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines or additional requirements that may arise.

Required Documents

To complete the CT 1040NRPY Booklet, you will need several key documents. These include your W-2 forms, 1099 forms, and any other income statements that reflect earnings from Connecticut sources. Additionally, documentation for any deductions or credits you plan to claim should be gathered in advance. Having all necessary documents on hand will streamline the completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The CT 1040NRPY Booklet can be submitted in various ways to accommodate different preferences. Nonresidents have the option to file electronically through the Connecticut Department of Revenue Services website, which is often the fastest method. Alternatively, you can print the completed form and mail it to the appropriate address provided in the booklet. In-person submissions are generally not available, so electronic and mail options are the primary methods for filing.

Quick guide on how to complete ct 1040nrpy booklet 2016 connecticut nonresident and ctgov

Manage CT 1040NRPY Booklet, Connecticut Nonresident And CT gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle CT 1040NRPY Booklet, Connecticut Nonresident And CT gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign CT 1040NRPY Booklet, Connecticut Nonresident And CT gov seamlessly

- Locate CT 1040NRPY Booklet, Connecticut Nonresident And CT gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs with just a few clicks from your chosen device. Edit and eSign CT 1040NRPY Booklet, Connecticut Nonresident And CT gov and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1040nrpy booklet 2016 connecticut nonresident and ctgov

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

The CT 1040NRPY Booklet, Connecticut Nonresident And CT gov., is an essential document for nonresident taxpayers who need to file their tax returns in Connecticut. It provides detailed instructions and forms necessary for reporting income earned in the state. Utilizing this booklet ensures that you comply with Connecticut tax regulations.

-

How can airSlate SignNow help with the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

airSlate SignNow offers a streamlined process for eSigning and managing the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov. You can easily upload the booklet, add your digital signature, and send it to relevant parties, saving time and reducing paperwork hassle.

-

What are the pricing options for using airSlate SignNow with the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

airSlate SignNow offers flexible pricing plans that cater to businesses of various sizes. You can choose from monthly or annual subscriptions, depending on your needs, making it a cost-effective solution to manage the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov. efficiently.

-

Are there any additional features when using airSlate SignNow for the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

Yes, airSlate SignNow provides features like real-time tracking, customizable templates, and integration with popular cloud storage solutions. These features enhance the experience of handling the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov., by making document management simpler and more efficient.

-

Can I integrate airSlate SignNow with other tools for managing the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

Absolutely! airSlate SignNow integrates seamlessly with various productivity and cloud applications. This means you can efficiently manage your CT 1040NRPY Booklet, Connecticut Nonresident And CT gov. alongside your other business tools without any interruptions.

-

What are the benefits of opting for airSlate SignNow for the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

By using airSlate SignNow, you benefit from increased security, reduced turnaround time, and improved accuracy with your documents. This solution not only simplifies eSigning the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov., but also enhances your overall workflow efficiency.

-

Is airSlate SignNow suitable for individuals filing the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov.?

Yes, airSlate SignNow is user-friendly and designed for both businesses and individuals. Whether you need to manage the CT 1040NRPY Booklet, Connecticut Nonresident And CT gov. for personal or professional purposes, our platform makes it easy to eSign and send documents securely from anywhere.

Get more for CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

Find out other CT 1040NRPY Booklet, Connecticut Nonresident And CT gov

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent