IL 4852 Revenue State Il Form

What is the IL 4852 Revenue State IL

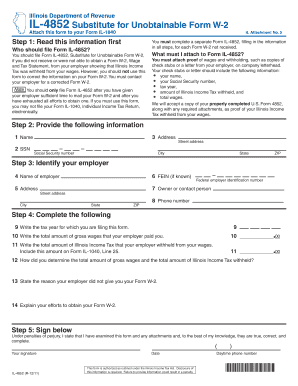

The IL 4852 Revenue State IL form is a tax document used in the state of Illinois. It serves as a means for taxpayers to report specific financial information to the Illinois Department of Revenue. This form is particularly relevant for individuals who need to claim a refund or report income that has not been previously documented. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for facilitating accurate tax reporting.

How to use the IL 4852 Revenue State IL

Using the IL 4852 Revenue State IL form involves several key steps. First, gather all necessary financial documents, including W-2s and other income statements. Next, accurately fill out the form by providing detailed information about your income, deductions, and any applicable credits. It is essential to double-check your entries for accuracy to avoid potential issues with the Illinois Department of Revenue. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the requirements set by the state.

Steps to complete the IL 4852 Revenue State IL

Completing the IL 4852 Revenue State IL form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including previous tax returns and income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that all sources are included.

- Claim any deductions or credits you are eligible for, providing necessary documentation.

- Review the completed form for accuracy and completeness.

- Submit the form according to the preferred method, either electronically or via mail.

Legal use of the IL 4852 Revenue State IL

The IL 4852 Revenue State IL form has legal significance as it is a formal declaration of your financial status to the state. Properly completing and submitting this form is essential to avoid legal repercussions, including penalties or audits. The form must be filled out in compliance with Illinois tax laws, ensuring that all reported information is truthful and accurate. Misrepresentation or failure to file can lead to serious consequences, including fines or legal action.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical when dealing with the IL 4852 Revenue State IL form. Typically, the form must be submitted by the state’s tax deadline, which aligns with the federal tax deadline. It is advisable to check the Illinois Department of Revenue’s official calendar for any specific dates that may vary from year to year. Missing the deadline can result in penalties, so timely submission is essential for compliance.

Required Documents

To complete the IL 4852 Revenue State IL form, certain documents are required. These typically include:

- W-2 forms from all employers.

- 1099 forms for any additional income.

- Records of deductions and credits you intend to claim.

- Previous tax returns for reference.

Having these documents ready will streamline the process and help ensure accurate reporting.

Quick guide on how to complete il 4852 revenue state il

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task right now.

The simplest way to modify and eSign [SKS] without any hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and select the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 4852 Revenue State Il

Create this form in 5 minutes!

How to create an eSignature for the il 4852 revenue state il

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the IL 4852 Revenue State Il form and why is it important?

The IL 4852 Revenue State Il form is a critical document for taxpayers in Illinois as it provides essential information regarding income tax deductions and credits. Understanding this form is vital for accurate tax filing and minimizing potential liabilities.

-

How can airSlate SignNow assist with the IL 4852 Revenue State Il form?

airSlate SignNow streamlines the process of filling and submitting the IL 4852 Revenue State Il form by allowing users to easily eSign and send documents securely. Our platform ensures that all necessary information is captured accurately and efficiently.

-

What are the pricing options available for airSlate SignNow users?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs, which can be beneficial when dealing with the IL 4852 Revenue State Il form. Our plans provide comprehensive features at competitive rates to ensure value for your investment.

-

What features does airSlate SignNow provide for eSigning the IL 4852 Revenue State Il?

With airSlate SignNow, users can eSign the IL 4852 Revenue State Il form from any device, track document status, and manage templates easily. These features enhance efficiency and ensure compliance with legal standards for electronic signatures.

-

Are there any integrations available that enhance the use of IL 4852 Revenue State Il forms?

Yes, airSlate SignNow integrates seamlessly with various business applications that can simplify the management of IL 4852 Revenue State Il forms. This ensures a smooth workflow and better data management for tax-related processes.

-

What benefits does airSlate SignNow offer for businesses managing IL 4852 Revenue State Il forms?

Using airSlate SignNow provides numerous benefits like reduced paperwork, quicker turnaround times, and enhanced security for your IL 4852 Revenue State Il forms. This allows businesses to focus on core activities while ensuring compliance and accuracy.

-

Is it easy to set up airSlate SignNow for using the IL 4852 Revenue State Il form?

Yes, airSlate SignNow offers an intuitive setup process that makes it easy to begin using your IL 4852 Revenue State Il form quickly. Even those with minimal technical skills can navigate the platform and start eSigning documents efficiently.

Get more for IL 4852 Revenue State Il

- Georgia form 602 es for 2013

- Georgia department of revenue etax dor ga form

- Ccdr amp fd electronic filing access code georgia government media ethics ga form

- Ga psc experience verification form

- Osah form 1 natural resources all cases except bui osah ga

- 401k opt out form

- Texas trs disability retirement form

- Hi guardianship form

Find out other IL 4852 Revenue State Il

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later