IL 4644 Gains from Sales of Employers Securities Received from a Qualified Employee Benefit Plan Gains from Sales of Employers S Form

What is the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

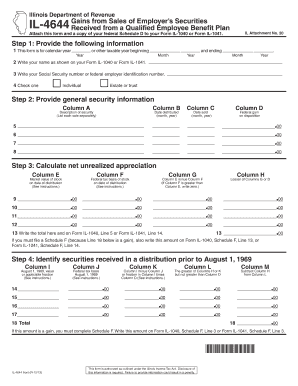

The IL 4644 form is a tax document used to report gains from the sale of employer securities received from a qualified employee benefit plan. This form is significant for employees who have sold securities acquired through their employer's benefit plans, as it helps determine the tax implications of those transactions. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Using the IL 4644 form involves a few straightforward steps. First, gather all necessary documentation related to the sale of employer securities. This includes details about the securities, the sale transaction, and any related costs. Next, accurately fill out the form, ensuring that all information is complete and correct. Finally, submit the form as part of your tax return to the IRS, either electronically or via mail, depending on your filing method.

Steps to complete the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Completing the IL 4644 form requires careful attention to detail. Follow these steps:

- Collect all relevant information about the employer securities sold, including purchase dates, sale dates, and sale prices.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report the details of the securities sold, including the number of shares and the total gain or loss from the sale.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form with your tax return by the applicable deadline.

Legal use of the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

The IL 4644 form is legally binding when filled out correctly and submitted to the IRS. It is crucial for taxpayers to understand that inaccuracies or omissions can lead to penalties or audits. Compliance with tax laws ensures that the gains from the sale of employer securities are reported accurately, which is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing the IL 4644 form must align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended. It is important for taxpayers to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the IL 4644 form, several documents are required. These include:

- Transaction records for the sale of employer securities.

- Statements from the employer benefit plan detailing the securities received.

- Previous tax documents that may affect the reporting of gains.

Quick guide on how to complete il 4644 gains from sales of employers securities received from a qualified employee benefit plan gains from sales of employers

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Effortlessly Edit and eSign [SKS]

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential parts of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending the form—via email, SMS, or an invitation link—or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 4644 gains from sales of employers securities received from a qualified employee benefit plan gains from sales of employers

The way to generate an e-signature for your PDF file online

The way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What are IL 4644 Gains From Sales Of Employers Securities?

IL 4644 Gains From Sales Of Employers Securities refers to the profits realized from the sale of securities received through a qualified employee benefit plan. This pertains to the tax implications and reporting requirements for employees who have sold these assets. Understanding this can help employees manage their tax burdens effectively.

-

How does airSlate SignNow simplify the eSigning process for IL 4644 Gains?

airSlate SignNow streamlines the eSigning process, making it easy for businesses to manage documents related to IL 4644 Gains From Sales Of Employers Securities. With its user-friendly interface, you can quickly create, send, and sign documents from anywhere. This helps ensure that all necessary documents are processed efficiently and securely.

-

What features does airSlate SignNow offer for handling financial documents?

airSlate SignNow offers features like customizable templates, automated workflows, and secure storage for financial documents related to IL 4644 Gains From Sales Of Employers Securities. These features help businesses manage important documents while maintaining compliance with regulatory standards. The platform also includes real-time tracking to monitor document status.

-

Is airSlate SignNow cost-effective for small businesses managing IL 4644 Gains?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage IL 4644 Gains From Sales Of Employers Securities efficiently. With a variety of pricing plans, small businesses can choose an option that fits their budget while accessing essential eSigning features and tools. This helps in reducing overhead costs associated with document management.

-

Can airSlate SignNow integrate with other tools for managing IL 4644 Gains?

Absolutely! airSlate SignNow can integrate seamlessly with various tools such as CRM systems, accounting software, and cloud storage services. This allows you to manage the documentation related to IL 4644 Gains From Sales Of Employers Securities alongside your existing workflows. Integration can enhance productivity and streamline your document processes further.

-

What benefits does airSlate SignNow provide for eSigning legal documents related to IL 4644 Gains?

Using airSlate SignNow for eSigning legal documents connected to IL 4644 Gains From Sales Of Employers Securities enhances security and compliance. The platform uses encryption and authentication measures to ensure that your documents are safe. Moreover, it reduces the time taken for signatures, facilitating quicker transactions and decisions.

-

How does airSlate SignNow ensure compliance with regulations regarding IL 4644 Gains?

airSlate SignNow is designed to comply with various regulatory standards related to IL 4644 Gains From Sales Of Employers Securities, including eSignature laws. The platform provides an audit trail and evidence of consent, which are essential for legal compliance. This ensures that your transactions remain valid and recognized by authorities.

Get more for IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan Gains From Sales Of Employers S

Find out other IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan Gains From Sales Of Employers S

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF