IL 4644 Gains from Sales of Employers Securities Received from a Qualified Employee Benefit Plan Form

What is the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

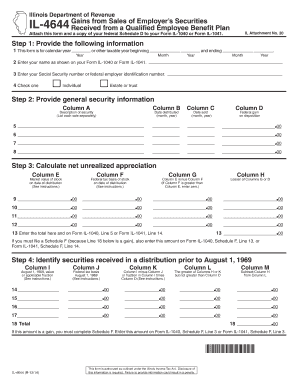

The IL 4644 form is specifically designed to report gains from the sale of employer securities that are received from a qualified employee benefit plan. This form is essential for employees who have sold securities acquired through their employer's benefit plan, allowing them to accurately report these transactions for tax purposes. Understanding the details of this form is crucial for compliance with IRS regulations and for ensuring that all gains are reported correctly on tax returns.

Steps to complete the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Completing the IL 4644 form involves several steps to ensure accuracy and compliance. First, gather all necessary information regarding the securities sold, including the acquisition date, sale date, and the amount received from the sale. Next, accurately calculate the gain or loss from the transaction by subtracting the original purchase price from the sale price. After calculating the gain, fill out the form by entering the relevant details in the designated fields. Finally, review the completed form for any errors before submitting it to the appropriate tax authority.

Legal use of the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

The IL 4644 form serves a legal purpose in documenting the sale of employer securities received from a qualified employee benefit plan. It is important to ensure that the form is filled out correctly and submitted on time to avoid potential legal issues with tax compliance. The form must adhere to IRS guidelines, and any inaccuracies may lead to penalties or audits. Therefore, understanding the legal implications of this form is essential for employees and employers alike.

Key elements of the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Key elements of the IL 4644 form include the identification of the taxpayer, details of the securities sold, and the calculation of gains or losses. The form requires information such as the date of acquisition, date of sale, and the amount realized from the sale. Additionally, it is important to include any adjustments that may affect the gain calculation, such as commissions or fees associated with the sale. Each of these elements plays a crucial role in ensuring the accuracy of the reported information.

Filing Deadlines / Important Dates

Filing deadlines for the IL 4644 form are critical for compliance with tax regulations. Typically, the form must be submitted along with the annual tax return by the tax filing deadline, which is usually April 15 for most taxpayers. However, if additional time is needed, taxpayers may file for an extension, allowing for a later submission date. It is essential to stay informed about any changes to these deadlines to avoid penalties.

Examples of using the IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Examples of using the IL 4644 form include scenarios where an employee has sold stocks received as part of their retirement plan or stock option program. For instance, if an employee sells shares of stock they acquired through their employer's benefit plan, they would use the IL 4644 to report the gain from that sale. Another example could involve an employee who sells securities after leaving the company, requiring them to report any gains on their tax return using this form.

Quick guide on how to complete il 4644 gains from sales of employers securities received from a qualified employee benefit plan 2015

Complete [SKS] effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without hold-ups. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 4644 gains from sales of employers securities received from a qualified employee benefit plan 2015

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What are IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan?

IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan refers to the capital gains realized when employees sell securities they received as part of their benefits package. Understanding this can help individuals manage their investments wisely and minimize tax liabilities. Our solution simplifies the documentation process linked to these gains through electronic signatures.

-

How can airSlate SignNow help with IL 4644 reporting?

airSlate SignNow allows businesses to easily create, send, and track documents related to IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan. By streamlining documentation, you can ensure compliance with tax regulations and maintain accurate records. This enhances financial transparency for both employers and employees.

-

What features does airSlate SignNow offer that are relevant to handling IL 4644 documentation?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which are crucial for generating IL 4644 documentation efficiently. These features help businesses reduce paperwork, save time, and minimize errors in documentation. This is particularly beneficial for handling gains from employer securities.

-

Is airSlate SignNow cost-effective for businesses managing IL 4644 transactions?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan. Our pricing plans are flexible and designed to fit the needs of businesses of all sizes, ensuring that you get maximum value out of your investment in document management.

-

Can airSlate SignNow integrate with other financial software for IL 4644 documentation?

Absolutely! airSlate SignNow offers seamless integrations with various financial and accounting software to help manage IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan. This integration ensures that your documentation processes can sync with existing systems, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for IL 4644 related documentation?

Using airSlate SignNow for IL 4644 related documentation offers benefits like improved efficiency, reduced processing time, and enhanced security for sensitive financial information. It empowers businesses to handle necessary forms electronically, which can signNowly cut down on paper waste and streamline workflows, making compliance much easier.

-

How do I get started with airSlate SignNow for IL 4644 documentation?

Getting started with airSlate SignNow is easy! Simply sign up for an account, select a suitable pricing plan, and begin creating templates for your IL 4644 documentation. Our user-friendly interface guides you through the process of sending and signing documents, ensuring a smooth transition into digital document management.

Get more for IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

Find out other IL 4644 Gains From Sales Of Employers Securities Received From A Qualified Employee Benefit Plan

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template