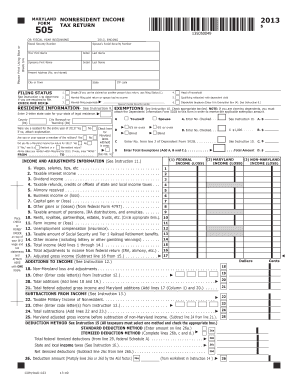

MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN $ or FISCAL YEAR BEGINNING , ENDING Please Print Using Blue or Black Ink Social

What is the Maryland Form 505 Nonresident Income Tax Return?

The Maryland Form 505 Nonresident Income Tax Return is a tax document specifically designed for nonresidents who earn income in Maryland. This form is essential for individuals who do not reside in Maryland but have taxable income sourced from the state. It allows the Maryland Comptroller’s Office to assess the correct amount of tax owed based on the income earned within the state during the specified fiscal year. Completing this form accurately is crucial for compliance with state tax laws.

Steps to Complete the Maryland Form 505 Nonresident Income Tax Return

Completing the Maryland Form 505 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your Social Security number and income statements. Next, carefully fill in your personal information, including your name and the fiscal year for which you are filing. Report your income earned in Maryland and any applicable deductions. Finally, review the form for accuracy before submitting it to the Maryland Comptroller’s Office.

How to Obtain the Maryland Form 505 Nonresident Income Tax Return

The Maryland Form 505 can be obtained from the official Maryland Comptroller’s website or through various tax preparation services. It is available in both digital and printable formats, allowing taxpayers to choose the method that best suits their needs. Ensure that you are using the most current version of the form to avoid any issues during the filing process.

Key Elements of the Maryland Form 505 Nonresident Income Tax Return

Several key elements must be included in the Maryland Form 505 to ensure its validity. These include your Social Security number, details about your income earned in Maryland, and any deductions you are claiming. Additionally, the form requires your signature and the date of submission. Each section must be filled out accurately to comply with state tax regulations.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Maryland Form 505 to avoid penalties. Typically, the form must be filed by the due date for the income tax return, which is usually April 15 for most taxpayers. If you are unable to meet this deadline, consider filing for an extension to avoid late fees.

Penalties for Non-Compliance

Failing to file the Maryland Form 505 or submitting it inaccurately can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the state. It is crucial to ensure that the form is completed correctly and submitted on time to avoid these consequences.

Quick guide on how to complete maryland form 505 2013 nonresident income tax return or fiscal year beginning 2013 ending please print using blue or black ink

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to find the suitable form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications, and enhance any document-centric procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN $ OR FISCAL YEAR BEGINNING , ENDING Please Print Using Blue Or Black Ink Social

Create this form in 5 minutes!

How to create an eSignature for the maryland form 505 2013 nonresident income tax return or fiscal year beginning 2013 ending please print using blue or black ink

How to create an e-signature for a PDF document in the online mode

How to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN?

The MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN is a tax form used by nonresident individuals who earn income in Maryland. This form allows nonresidents to report their income effectively and comply with Maryland tax regulations. When completing this form, make sure to use blue or black ink as specified.

-

How do I complete the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN?

To complete the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN, gather your necessary information such as your Social Security number and your spouse's information if applicable. It’s important to follow the instructions carefully, including printing in blue or black ink. You can use tools like airSlate SignNow to streamline the process of filling out and signing your documents.

-

What are the deadlines for filing the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN?

The deadline for filing the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN is typically April 15th following the end of the tax year, unless that date falls on a weekend or holiday. It’s essential to file on time to avoid penalties or interest charges. If you need more flexibility, consider using airSlate SignNow to manage your documents efficiently.

-

Are there any penalties for late filing of the MARYLAND FORM 505?

Yes, there are penalties for late filing of the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN. If you fail to file on time, the Maryland Comptroller's office may impose penalties and interest on any unpaid taxes. To avoid such issues, consider eSigning your forms promptly with airSlate SignNow for a hassle-free experience.

-

What features does airSlate SignNow offer for filling out tax forms?

airSlate SignNow offers several features to help streamline the completion of tax forms, including templates for MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN. Users can easily fill out fields, sign, and send documents from any device. These features ensure a smooth filing process while maintaining compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals. Pricing varies depending on the features and level of service you require. The investment can save you time and provide peace of mind while completing your MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN.

-

Can I integrate airSlate SignNow with other applications for filing taxes?

Absolutely! airSlate SignNow offers integrations with various applications to help streamline your tax filing process. This means you can easily pull data from tax software or other platforms when completing the MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN, enhancing efficiency in your workflows.

Get more for MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN $ OR FISCAL YEAR BEGINNING , ENDING Please Print Using Blue Or Black Ink Social

- Florida dairy grade id applicationdoc form

- Intern application form sustainable uf sustainable ufl

- Abstract isef form

- Cusersefs5documentsefs nfp prosaprv formsuga process caes uga

- Sample letter of completion of marriage counseling form

- Delaware child protection request form

- Provider interest form umbh university of miami umbh med miami

- U miami transcript request form

Find out other MARYLAND FORM 505 NONRESIDENT INCOME TAX RETURN $ OR FISCAL YEAR BEGINNING , ENDING Please Print Using Blue Or Black Ink Social

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later