NONRESIDENT INCOME FORM TAX RETURN 505 1040 Com

What is the NONRESIDENT INCOME FORM TAX RETURN com

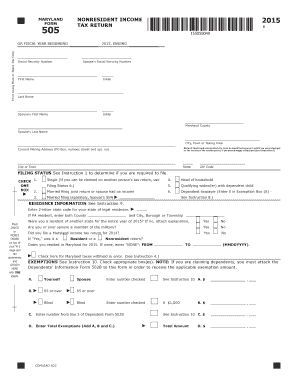

The NONRESIDENT INCOME FORM TAX RETURN com is a specific tax form designed for nonresident individuals who earn income in the United States. This form allows these individuals to report their U.S.-sourced income and calculate their tax obligations. It is essential for nonresidents to comply with U.S. tax laws, ensuring they accurately report their earnings and pay any taxes owed. The form is crucial for maintaining legal compliance and avoiding potential penalties associated with incorrect or incomplete filings.

Steps to complete the NONRESIDENT INCOME FORM TAX RETURN com

Completing the NONRESIDENT INCOME FORM TAX RETURN com involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and taxpayer identification number accurately on the form.

- Report income: Include all U.S.-sourced income, detailing each source and amount in the appropriate sections.

- Calculate deductions: Identify any eligible deductions that apply to your situation, which can help reduce your taxable income.

- Determine tax liability: Use the IRS tax tables to calculate the amount of tax owed based on your reported income.

- Sign and date the form: Ensure you sign the form, as an unsigned form may be considered invalid.

Legal use of the NONRESIDENT INCOME FORM TAX RETURN com

The legal use of the NONRESIDENT INCOME FORM TAX RETURN com is governed by U.S. tax law. It is important for nonresidents to understand that submitting this form is not only a requirement but also a legal obligation. Failing to file or inaccurately reporting income can lead to penalties, interest on unpaid taxes, and potential legal issues. The form must be completed in accordance with IRS guidelines to ensure it is considered valid and enforceable.

Required Documents

To complete the NONRESIDENT INCOME FORM TAX RETURN com, several documents are necessary:

- W-2 forms: These are issued by employers and report annual wages and taxes withheld.

- 1099 forms: These forms report various types of income received, such as freelance earnings or interest income.

- Tax identification number: This may be a Social Security number or an Individual Taxpayer Identification Number (ITIN).

- Records of deductions: Documentation supporting any deductions claimed, such as receipts or statements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NONRESIDENT INCOME FORM TAX RETURN com is crucial for compliance. Typically, the deadline for filing this form is April 15 of the year following the tax year. However, if you are a nonresident and cannot meet this deadline, you may file for an extension, which generally allows for an additional six months. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

How to obtain the NONRESIDENT INCOME FORM TAX RETURN com

The NONRESIDENT INCOME FORM TAX RETURN com can be obtained through various means. It is available for download directly from the IRS website, where you can find the most current version of the form. Additionally, tax preparation software often includes this form as part of their offerings, making it easier for users to complete their tax returns electronically. If you prefer a physical copy, you can request one from the IRS or visit a local IRS office to obtain the form in person.

Quick guide on how to complete nonresident income form tax return 505 1040com

Handle NONRESIDENT INCOME FORM TAX RETURN 505 1040 com seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage NONRESIDENT INCOME FORM TAX RETURN 505 1040 com on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The simplest way to edit and eSign NONRESIDENT INCOME FORM TAX RETURN 505 1040 com effortlessly

- Locate NONRESIDENT INCOME FORM TAX RETURN 505 1040 com and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign NONRESIDENT INCOME FORM TAX RETURN 505 1040 com and ensure excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonresident income form tax return 505 1040com

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com?

The NONRESIDENT INCOME FORM TAX RETURN 505 1040 com is a tax return specifically designed for nonresidents who need to report their income to the IRS. This form allows individuals to accurately file their taxes while complying with federal regulations. It's crucial for anyone earning income in the U.S. without being a resident.

-

How can airSlate SignNow help with the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com?

airSlate SignNow facilitates the completion and e-signing of the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com by providing a user-friendly platform to manage your documents. You can easily upload, fill out, and sign your tax forms digitally, streamlining the filing process. This saves time and reduces the likelihood of errors.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage for managing your NONRESIDENT INCOME FORM TAX RETURN 505 1040 com. These tools help ensure that your tax documents are organized, easily accessible, and legally binding. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow a cost-effective solution for filing the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com?

Yes, airSlate SignNow is a cost-effective solution for filing your NONRESIDENT INCOME FORM TAX RETURN 505 1040 com. With various pricing plans available, businesses can choose an option that fits their budget. The efficiency gained through digital signing can also lead to signNow cost savings in time and resources.

-

Can I integrate airSlate SignNow with other software for my tax needs?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your tax filing process, including accounting and document management systems. This makes it easier for users to sync their data and manage their NONRESIDENT INCOME FORM TAX RETURN 505 1040 com alongside other business operations.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for filing your NONRESIDENT INCOME FORM TAX RETURN 505 1040 com offers numerous benefits including improved accuracy, reduced paperwork, and faster processing times. The eSignature feature ensures that your documents are signed securely and legally. Ultimately, it simplifies the entire tax preparation process.

-

Is there support available if I have questions about the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com?

Yes, airSlate SignNow provides customer support to assist users with any questions regarding the NONRESIDENT INCOME FORM TAX RETURN 505 1040 com. You can signNow out via chat or email for personalized assistance. This support can help clarify any uncertainties and ensure that your tax filing goes smoothly.

Get more for NONRESIDENT INCOME FORM TAX RETURN 505 1040 com

- Massachusetts revocation form

- Newly divorced individuals package massachusetts form

- Contractors forms package massachusetts

- Power of attorney for sale of motor vehicle massachusetts form

- Wedding planning or consultant package massachusetts form

- Hunting forms package massachusetts

- Identity theft recovery package massachusetts form

- Aging parent package massachusetts form

Find out other NONRESIDENT INCOME FORM TAX RETURN 505 1040 com

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer