MARYLAND SUBTRACTIONS FORM from INCOME Attachment 502SU

What is the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

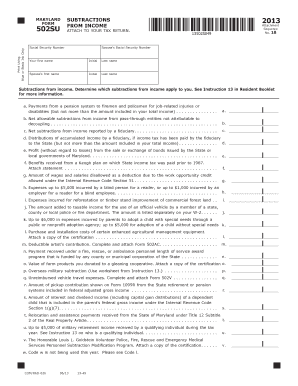

The MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU is a tax form used by Maryland residents to report specific subtractions from their income when filing state taxes. This form allows taxpayers to claim various deductions that reduce their taxable income, ultimately affecting the amount of tax owed. Understanding this form is essential for accurate tax reporting and compliance with Maryland state tax laws.

How to use the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

To effectively use the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU, taxpayers should first gather all necessary financial documents, including W-2s and 1099s. The form requires detailed information regarding income sources and specific subtractions that apply to the taxpayer's situation. After completing the form, it should be attached to the Maryland state tax return, ensuring all relevant information is accurately reported to avoid delays or issues with processing.

Steps to complete the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

Completing the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU involves several key steps:

- Gather all income documentation, including W-2s and 1099s.

- Identify eligible subtractions based on your financial situation.

- Fill out the form accurately, ensuring all figures are correct.

- Attach the completed form to your Maryland state tax return.

- Review the entire submission for accuracy before filing.

Legal use of the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

The legal use of the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU is governed by Maryland tax laws. To ensure compliance, taxpayers must accurately report their income and applicable subtractions. The form must be submitted alongside the state tax return by the designated filing deadline. Failure to comply with these regulations can result in penalties or additional tax liabilities.

Key elements of the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

Key elements of the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU include:

- Identification of the taxpayer, including name and Social Security number.

- Details of income sources that are subject to subtraction.

- Specific subtractions being claimed, such as retirement contributions or certain expenses.

- Signature of the taxpayer to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU typically align with the Maryland state tax return deadlines. Taxpayers should be aware of the annual filing date, which is usually April 15. It is crucial to submit the form on time to avoid late fees or penalties.

Quick guide on how to complete maryland subtractions 2013 form from income attachment 502su

Prepare MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without complications. Handle MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU without any hassle

- Locate MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost files, monotonous form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Revise and eSign MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU and assure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland subtractions 2013 form from income attachment 502su

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

The MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU is a crucial document used to report subtractions that reduce your taxable income in Maryland. It allows taxpayers to claim various deductions, thereby potentially lowering their tax liability. Understanding how to properly fill out this form is essential for optimizing your tax return.

-

How can airSlate SignNow help me with the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

airSlate SignNow provides a seamless platform to create, send, and eSign your MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU. With user-friendly features, you can easily fill out the form, ensuring all relevant subtractions are accounted for, and sign it electronically. This simplifies the submission process, saving you time and effort.

-

Are there any costs associated with using airSlate SignNow for the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

Using airSlate SignNow for the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU is cost-effective, with various pricing plans designed to fit your needs. You can choose from monthly or annual subscriptions, which come with numerous features to enhance your document management. Check our pricing page for specific details on plans.

-

What features does airSlate SignNow offer for managing the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

airSlate SignNow offers a range of features to facilitate the management of the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU. These include customizable templates, automated workflows, in-app messaging, and secure document storage. These features make it easy to organize and send important tax documents with confidence.

-

Can I integrate airSlate SignNow with other software for my MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow, especially when dealing with the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU. You can connect with CRM systems, cloud storage services, and productivity tools for enhanced efficiency in your document handling. This ensures a smooth transition between platforms.

-

What are the benefits of using airSlate SignNow for my MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

Using airSlate SignNow for your MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU brings numerous benefits, including reduced processing times and increased accuracy in filling out tax forms. The eSigning feature provides a legally binding signature, ensuring your submissions are valid. Additionally, the platform enhances collaboration by allowing multiple users to review and sign documents easily.

-

Is airSlate SignNow secure for handling the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU?

AirSlate SignNow prioritizes security, employing industry-standard encryption to protect your data while handling the MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU. Your documents are safeguarded against unauthorized access, ensuring your sensitive tax information remains confidential. You can use the platform with peace of mind knowing your data is protected.

Get more for MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

- Nc will form

- Legal last will and testament form for married person with adult and minor children from prior marriage north carolina

- Legal last will and testament form for married person with adult and minor children north carolina

- Mutual wills package with last wills and testaments for married couple with adult and minor children north carolina form

- North carolina widow form

- Legal last will and testament form for widow or widower with minor children north carolina

- Legal last will form for a widow or widower with no children north carolina

- North carolina will form

Find out other MARYLAND SUBTRACTIONS FORM FROM INCOME Attachment 502SU

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation