PART a Qualifying Residing Artist Form

What is the PART A Qualifying Residing Artist

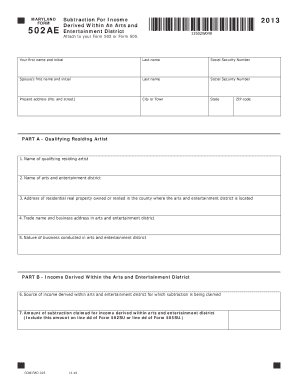

The PART A Qualifying Residing Artist form is a crucial document for artists seeking to establish their residency status for tax purposes. This form is particularly relevant for individuals who wish to benefit from specific tax advantages available to qualifying artists under U.S. tax law. By completing this form, artists can demonstrate their eligibility for deductions and credits that can significantly impact their financial situation. Understanding the nuances of this form is essential for anyone looking to navigate the complexities of tax obligations as a professional artist.

Steps to complete the PART A Qualifying Residing Artist

Completing the PART A Qualifying Residing Artist form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your legal name, address, and social security number. Next, provide details about your artistic work, including the types of art you create and your professional history. It is important to clearly indicate your residency status and any relevant supporting documentation, such as proof of income from artistic endeavors. After filling out the form, review it thoroughly for any errors or omissions before submitting it to the appropriate tax authority.

Legal use of the PART A Qualifying Residing Artist

The legal use of the PART A Qualifying Residing Artist form hinges on its compliance with U.S. tax regulations. This form must be filled out accurately to ensure that the claims made regarding residency and eligibility for tax benefits are valid. It is essential for artists to understand the legal implications of the information provided, as inaccuracies can lead to penalties or disqualification from benefits. By using a reliable eSignature platform, artists can ensure that their submissions are secure and legally binding, adhering to the requirements set forth by the IRS and other governing bodies.

Eligibility Criteria

To qualify for the benefits associated with the PART A Qualifying Residing Artist form, applicants must meet specific eligibility criteria. Generally, artists must demonstrate that they are actively engaged in their artistic practice and that their primary source of income derives from their art. Additionally, residency requirements must be met, which often include living in a particular state or locality for a specified duration. Understanding these criteria is vital for artists to ensure they can successfully complete the form and access the benefits available to them.

Form Submission Methods

The PART A Qualifying Residing Artist form can be submitted through various methods, allowing flexibility for artists. The most common submission methods include online filing, mailing a physical copy to the relevant tax authority, or delivering it in person. Online submission is often the preferred choice due to its convenience and speed, while mailing provides a traditional option for those who prefer physical documentation. Regardless of the method chosen, it is crucial to ensure that the form is submitted by the appropriate deadlines to avoid any penalties.

Key elements of the PART A Qualifying Residing Artist

Several key elements are essential to successfully completing the PART A Qualifying Residing Artist form. These elements include personal identification details, a comprehensive description of artistic activities, and evidence of residency. Additionally, artists should include any relevant financial information that supports their claims for tax benefits. Providing clear and accurate information in these areas is vital for the form's acceptance and for maximizing potential tax advantages.

Quick guide on how to complete part a qualifying residing artist

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow manages all your document handling needs in just a few clicks from any device you select. Edit and eSign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PART A Qualifying Residing Artist

Create this form in 5 minutes!

How to create an eSignature for the part a qualifying residing artist

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a PART A Qualifying Residing Artist?

A PART A Qualifying Residing Artist is an artist who meets specific criteria outlined in the PART A guidelines. These criteria often include residency requirements and a commitment to producing original artwork. Understanding these qualifications is crucial for artists seeking to take advantage of related programs or opportunities.

-

How does airSlate SignNow help PART A Qualifying Residing Artists?

AirSlate SignNow provides an efficient way for PART A Qualifying Residing Artists to send and sign documents electronically. Our platform simplifies the document management process, allowing artists to focus more on their creative work rather than paperwork. This ensures they can streamline contract signing and other necessary agreements.

-

What pricing plans are available for PART A Qualifying Residing Artists?

AirSlate SignNow offers competitive pricing plans designed to suit the needs of PART A Qualifying Residing Artists. We provide various subscription options that cater to different usage levels, ensuring affordability without compromising on essential features. Check our website for specific details on pricing and the most suitable plan for your needs.

-

Can I integrate airSlate SignNow with other tools for my PART A Qualifying Residing Artist needs?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the efficiency of PART A Qualifying Residing Artists. Whether you are using project management tools or CRM systems, our integration capabilities allow you to manage your documents alongside your favorite tools effortlessly. This can signNowly streamline your workflow.

-

What are the key features of airSlate SignNow for PART A Qualifying Residing Artists?

Key features of airSlate SignNow for PART A Qualifying Residing Artists include electronic signatures, document templates, and automated workflows. Our user-friendly platform makes it easy for artists to create, send, and manage documents efficiently. These features not only save time but also enhance the overall experience of document handling.

-

How secure is airSlate SignNow for PART A Qualifying Residing Artists?

Security is a top priority for airSlate SignNow, especially for PART A Qualifying Residing Artists who often handle sensitive documents. We employ advanced security measures, including data encryption and secure servers, to protect your information. You can confidently use our platform knowing that your documents are safe and secure.

-

What benefits does airSlate SignNow offer to PART A Qualifying Residing Artists?

AirSlate SignNow offers numerous benefits to PART A Qualifying Residing Artists, including time savings and improved efficiency in document management. Our platform allows artists to focus more on their art rather than administrative tasks. Additionally, the ease of use ensures that even those who are not tech-savvy can navigate the system effortlessly.

Get more for PART A Qualifying Residing Artist

Find out other PART A Qualifying Residing Artist

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now