Personal Declaration of Estimated Income Tax Maryland Tax Forms

What is the Personal Declaration Of Estimated Income Tax Maryland Tax Forms

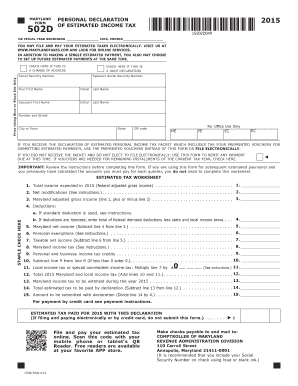

The Personal Declaration of Estimated Income Tax Maryland Tax Forms is a crucial document for individuals who anticipate owing income tax to the state of Maryland. This form allows taxpayers to declare their expected income and estimate the taxes they will owe for the year. It is particularly important for self-employed individuals, freelancers, or anyone whose income is not subject to withholding. By submitting this form, taxpayers can avoid underpayment penalties and ensure compliance with state tax regulations.

Steps to complete the Personal Declaration Of Estimated Income Tax Maryland Tax Forms

Completing the Personal Declaration of Estimated Income Tax Maryland Tax Forms involves several key steps:

- Gather financial information, including income sources and any deductions or credits you may qualify for.

- Calculate your estimated income for the year, taking into account any expected changes in your financial situation.

- Determine your estimated tax liability using Maryland's tax rates and guidelines.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors before submission.

How to obtain the Personal Declaration Of Estimated Income Tax Maryland Tax Forms

Taxpayers can obtain the Personal Declaration of Estimated Income Tax Maryland Tax Forms through various channels. The Maryland State Comptroller's website provides downloadable PDF versions of the form. Additionally, local tax offices may have physical copies available. For convenience, many taxpayers choose to access the form electronically, allowing for easier completion and submission.

Legal use of the Personal Declaration Of Estimated Income Tax Maryland Tax Forms

The Personal Declaration of Estimated Income Tax Maryland Tax Forms holds legal significance as it serves as a formal declaration to the state regarding anticipated tax obligations. When completed and submitted correctly, it establishes the taxpayer's commitment to meet their tax responsibilities. It is essential to adhere to all applicable laws and regulations to ensure the form is considered valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Personal Declaration of Estimated Income Tax Maryland Tax Forms are typically set by the Maryland State Comptroller. Generally, taxpayers must submit their estimated tax declarations by April 15 for the upcoming tax year. Additionally, quarterly payments may be required, with deadlines often falling on April 15, June 15, September 15, and January 15 of the following year. Staying informed about these dates is crucial to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Personal Declaration of Estimated Income Tax Maryland Tax Forms. The form can be submitted online through the Maryland State Comptroller's e-file system, which offers a convenient and efficient way to file. Alternatively, taxpayers may choose to mail the completed form to the appropriate tax office or submit it in person at designated locations. Each method has its own benefits, so selecting the one that best fits your needs is important.

Quick guide on how to complete personal declaration of estimated income tax maryland tax forms

Complete Personal Declaration Of Estimated Income Tax Maryland Tax Forms seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Personal Declaration Of Estimated Income Tax Maryland Tax Forms across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Personal Declaration Of Estimated Income Tax Maryland Tax Forms effortlessly

- Find Personal Declaration Of Estimated Income Tax Maryland Tax Forms and click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Revise and electronically sign Personal Declaration Of Estimated Income Tax Maryland Tax Forms and assure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal declaration of estimated income tax maryland tax forms

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is a Personal Declaration Of Estimated Income Tax Maryland Tax Form?

The Personal Declaration Of Estimated Income Tax Maryland Tax Form is a document that taxpayers in Maryland use to declare their estimated taxable income. This form helps the Maryland Comptroller's office receive timely tax payments throughout the year, avoiding penalties and interest for underpayment.

-

How can airSlate SignNow help with Personal Declaration Of Estimated Income Tax Maryland Tax Forms?

airSlate SignNow simplifies the process of completing and signing Personal Declaration Of Estimated Income Tax Maryland Tax Forms. With our user-friendly platform, users can easily fill out the form, get it eSigned, and send it electronically, ensuring a fast and secure submission.

-

What are the costs associated with using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing documents, including Personal Declaration Of Estimated Income Tax Maryland Tax Forms. Detailed pricing can be found on our website, allowing you to choose a plan that fits your budget.

-

Is it secure to send Personal Declaration Of Estimated Income Tax Maryland Tax Forms via airSlate SignNow?

Yes, sending Personal Declaration Of Estimated Income Tax Maryland Tax Forms through airSlate SignNow is secure. Our platform utilizes advanced encryption and security protocols to protect sensitive information, ensuring that your documents are safely transmitted and stored.

-

Can I integrate airSlate SignNow with other applications for managing tax forms?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage your workflows related to Personal Declaration Of Estimated Income Tax Maryland Tax Forms. You can connect with tools like Google Drive, Dropbox, and many others for a streamlined experience.

-

What features does airSlate SignNow provide for completing tax forms?

airSlate SignNow provides features such as document templates, eSigning capabilities, and real-time tracking for completing Personal Declaration Of Estimated Income Tax Maryland Tax Forms. These features enable users to efficiently prepare and manage their tax documents, maximizing productivity.

-

Is there customer support available for questions regarding tax form processes?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions related to Personal Declaration Of Estimated Income Tax Maryland Tax Forms. Our knowledgeable team is available to provide guidance and address any issues you may encounter during the process.

Get more for Personal Declaration Of Estimated Income Tax Maryland Tax Forms

- Mineral deed individual to individual north dakota form

- Limited liability company 497317440 form

- North dakota disclaimer form

- Verified notice of intention to claim mechanics lien individual 497317443 form

- Quitclaim deed from individual to individual north dakota form

- Nd warranty deed form

- North dakota trust 497317446 form

- North dakota mineral deed form

Find out other Personal Declaration Of Estimated Income Tax Maryland Tax Forms

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online