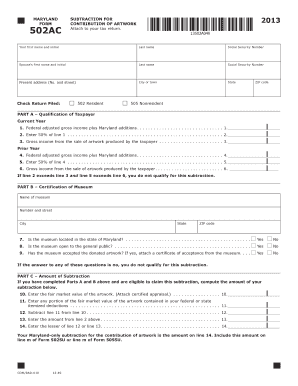

MARYLAND SUBTRACTION for FORM CONTRIBUTION of ARTWORK 502AC

What is the Maryland Subtraction for Form Contribution of Artwork 502AC

The Maryland Subtraction for Form Contribution of Artwork 502AC is a tax form used by individuals and businesses to claim a subtraction from their Maryland taxable income for contributions of artwork to qualified organizations. This form is particularly relevant for artists, collectors, and philanthropists who donate artwork, allowing them to benefit from tax deductions while supporting cultural institutions. The artwork must meet specific criteria and be donated to eligible entities, such as museums or educational institutions, to qualify for this subtraction.

How to Use the Maryland Subtraction for Form Contribution of Artwork 502AC

To effectively use the Maryland Subtraction for Form Contribution of Artwork 502AC, taxpayers must first ensure that their contributions meet the eligibility criteria set by the state. This includes verifying that the artwork is valued appropriately and that the receiving organization qualifies under Maryland tax laws. Once these conditions are met, taxpayers can fill out the form by providing details about the artwork, including its description, fair market value, and the organization to which it was donated. Accurate completion of this form is essential for the successful claim of the subtraction on state tax returns.

Steps to Complete the Maryland Subtraction for Form Contribution of Artwork 502AC

Completing the Maryland Subtraction for Form Contribution of Artwork 502AC involves several key steps:

- Gather necessary documentation, including appraisals of the artwork and proof of donation to a qualified organization.

- Fill out the form by entering personal information, the description of the artwork, and its fair market value.

- Attach any supporting documents that validate the donation and the artwork's value.

- Review the completed form for accuracy before submission.

- Submit the form along with your Maryland tax return by the appropriate deadline.

Legal Use of the Maryland Subtraction for Form Contribution of Artwork 502AC

The legal use of the Maryland Subtraction for Form Contribution of Artwork 502AC is governed by state tax laws that outline eligibility and compliance requirements. To ensure the legality of the subtraction, taxpayers must adhere to the stipulations regarding the type of artwork that qualifies, the organizations that can receive donations, and the documentation required to substantiate claims. Failure to comply with these regulations may result in penalties or disallowance of the tax subtraction.

Eligibility Criteria for the Maryland Subtraction for Form Contribution of Artwork 502AC

To qualify for the Maryland Subtraction for Form Contribution of Artwork 502AC, certain eligibility criteria must be met. These include:

- The artwork must be original and created by the donor or be a significant piece from a recognized artist.

- The donation must be made to a qualified organization, such as a nonprofit museum or educational institution.

- The fair market value of the artwork must be determined by a qualified appraiser.

- The donor must not receive any goods or services in exchange for the donation.

Form Submission Methods for the Maryland Subtraction for Form Contribution of Artwork 502AC

Taxpayers can submit the Maryland Subtraction for Form Contribution of Artwork 502AC through various methods. The form can be filed electronically as part of the Maryland state tax return, which is often the preferred method for its efficiency and speed. Alternatively, taxpayers may choose to submit a paper version of the form through the mail. It is important to ensure that the form is submitted by the tax filing deadline to avoid any penalties.

Quick guide on how to complete maryland subtraction for 2013 form contribution of artwork 502ac

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to swiftly create, modify, and eSign your documents without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland subtraction for 2013 form contribution of artwork 502ac

How to generate an e-signature for a PDF document online

How to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What is the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

The MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC is a specific tax form aimed at individuals who have contributed artwork and are seeking tax deductions. It allows taxpayers to subtract the value of their artwork contributions from their taxable income, thus potentially lowering their tax liability. Understanding this form is crucial for eligible taxpayers looking to maximize their contributions.

-

How can I benefit from using the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

Using the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC can lead to signNow tax savings for individuals who donate artwork. This subtraction enables taxpayers to accurately report their contributions and claim deductions on their state taxes. It not only enhances your tax benefits but also encourages charitable giving in the arts.

-

What are the eligibility requirements for the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

To qualify for the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC, taxpayers must have made a qualifying contribution of artwork to an eligible nonprofit organization. Additionally, the artwork must be valued accurately, and appropriate documentation must be provided. It's essential to consult state guidelines to ensure compliance with all requirements.

-

Are there any costs associated with filing the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

While there are no direct costs for filing the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC itself, there may be associated costs in evaluating and documenting the artwork’s value. Additionally, if you seek assistance from tax professionals or software to file your taxes, those services may come with fees. It's advisable to factor in these potential expenses when planning your contribution.

-

How can airSlate SignNow assist with the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

airSlate SignNow provides a streamlined solution for managing the necessary documentation for the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC. With eSigning capabilities, users can quickly gather the needed signatures for donation receipts or appraisals securely and efficiently. This ensures that all your paperwork is complete and organized for filing.

-

What features does airSlate SignNow offer for handling tax documents like the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are essential for handling tax documents like the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC. Users can easily upload, edit, and share documents while keeping everything organized. These capabilities enhance efficiency and compliance for tax-related paperwork.

-

Can I integrate airSlate SignNow with other tools for managing MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC?

Yes, airSlate SignNow can be seamlessly integrated with various tools and platforms, enhancing your workflow for managing the MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC. Integrations with popular accounting software and cloud storage services make it easy to maintain and access your financial records and tax documents in one place. This can signNowly streamline the preparation for tax filing.

Get more for MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC

Find out other MARYLAND SUBTRACTION FOR FORM CONTRIBUTION OF ARTWORK 502AC

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure