Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc 2012

What is the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC

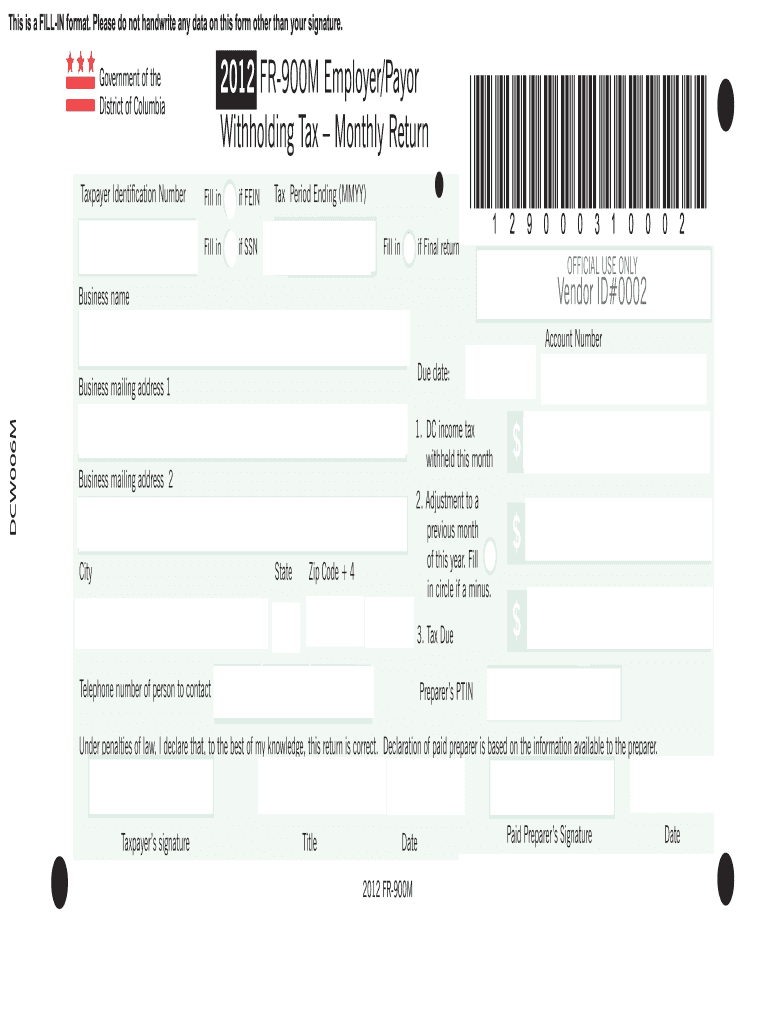

The Form FR 900M is a tax document required by the District of Columbia for employers to report their withholding tax obligations on a monthly basis. This form is essential for businesses that withhold income tax from employee wages and must be submitted to ensure compliance with local tax laws. The FR 900M captures vital information about the amounts withheld, the employer's identification details, and the total tax liability for the reporting month.

Steps to Complete the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC

Completing the Form FR 900M involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including payroll records for the month. Next, accurately fill in the employer's name, address, and identification number. Then, report the total wages paid and the amount of tax withheld for each employee. Finally, review the completed form for any errors before submission. It is crucial to ensure that all figures are correct to avoid penalties.

How to Obtain the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC

The Form FR 900M can be obtained directly from the District of Columbia's Office of Tax and Revenue website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, businesses can access the form through various tax preparation software that supports DC tax forms. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Key Elements of the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC

Several key elements must be included when filling out the Form FR 900M. These include:

- Employer Information: Name, address, and taxpayer identification number.

- Monthly Reporting Period: The specific month for which the withholding is being reported.

- Total Wages Paid: The total amount of wages subject to withholding for the month.

- Tax Withheld: The total amount of tax withheld from employee wages.

- Signature: An authorized representative of the business must sign the form to validate it.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form FR 900M to avoid penalties. The form is typically due on the fifteenth day of the month following the reporting month. For example, the form for January must be submitted by February 15. It is advisable for employers to mark these dates on their calendars to ensure timely submission and compliance with DC tax regulations.

Penalties for Non-Compliance

Failure to file the Form FR 900M on time or submitting inaccurate information can result in significant penalties. The District of Columbia imposes fines for late submissions, which can accumulate quickly. Additionally, incorrect reporting may lead to further audits or inquiries from the tax authorities. It is essential for employers to maintain accurate records and submit the form promptly to avoid these consequences.

Quick guide on how to complete form fr 900m 2012 employerpayor withholding tax monthly return does dc

Your assistance manual on how to prepare your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc

If you’re interested in learning how to create and send your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc, here are some succinct instructions on how to simplify tax processing.

To begin, you simply need to register your airSlate SignNow account to revolutionize how you handle paperwork online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing features.

Follow the steps below to complete your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc in just a few minutes:

- Create your account and begin working on PDFs in moments.

- Utilize our catalog to acquire any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc in our editor.

- Populate the required fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to mistakes in returns and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form fr 900m 2012 employerpayor withholding tax monthly return does dc

FAQs

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

Create this form in 5 minutes!

How to create an eSignature for the form fr 900m 2012 employerpayor withholding tax monthly return does dc

How to make an electronic signature for your Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc online

How to make an eSignature for your Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc in Chrome

How to create an eSignature for putting it on the Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc in Gmail

How to make an eSignature for the Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc straight from your smart phone

How to create an electronic signature for the Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc on iOS devices

How to create an eSignature for the Form Fr 900m 2012 Employerpayor Withholding Tax Monthly Return Does Dc on Android

People also ask

-

What is the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC?

The Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC is a tax document that employers in Washington D.C. must file monthly to report withholding tax. This form provides necessary information about employee wages and withholdings, ensuring compliance with local tax laws. Completing this form accurately is vital for avoiding penalties and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with submitting the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC?

airSlate SignNow can streamline the process of completing and submitting the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC. With our easy-to-use eSignature solution, you can fill out, sign, and send your tax forms securely and efficiently. This reduces the risk of errors and helps you manage compliance seamlessly.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a variety of features specifically designed for tax document management, including customizable templates, secure cloud storage, and audit trails. Our platform ensures that your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC is handled safely. Additionally, our integration capabilities with popular accounting software enhance operational efficiency.

-

Is airSlate SignNow a cost-effective solution for businesses needing to file tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their tax documentation, including the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC. With affordable pricing plans and no hidden fees, our platform helps you save time and resources, making it a smart investment for tax compliance.

-

What integrations does airSlate SignNow support for tax filing?

airSlate SignNow supports a variety of integrations with popular accounting and tax software, making it easy to manage your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC. These integrations allow you to sync data seamlessly and automate workflows, minimizing the manual entry of information and reducing errors.

-

Can airSlate SignNow help with tracking submission deadlines for the Form FR 900M?

Absolutely! airSlate SignNow has features that can help you track important submission deadlines for the Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC. Our notification system alerts you about upcoming deadlines, ensuring that you never miss a filing date and remain compliant with tax regulations.

-

What are the benefits of using airSlate SignNow for filing tax forms?

Using airSlate SignNow for filing your Form FR 900M EmployerPayor Withholding Tax Monthly Return Does DC offers numerous benefits, including enhanced security, streamlined workflows, and a user-friendly interface. This solution allows you to manage documents electronically, signNowly reducing paper usage and improving efficiency. Furthermore, our support team is available to assist you whenever questions arise.

Get more for Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc

- 0612 summons in a civil action page 2 form

- Important notice after all parties have signed this form e mail it in

- County of state of nebraska hereinafter seller whether one or more form

- Instructions for bill of sale team expansion form

- Quitclaim deed city of lincoln form

- City of county of and state of nebraska to wit form

- Seventy third congress first session govinfo form

- Consumer information buying or selling a home nebraska

Find out other Form FR 900M EmployerPayor Withholding Tax Monthly Return Does Dc

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word