SUBTRACTION for Form

What is the SUBTRACTION FOR

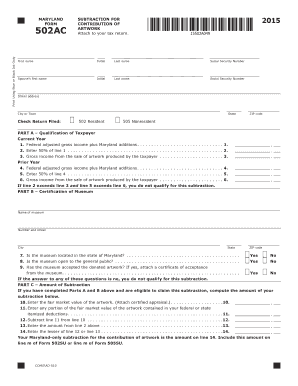

The SUBTRACTION FOR is a specific form used primarily in tax-related contexts to report and calculate deductions that reduce taxable income. This form is essential for individuals and businesses looking to accurately reflect their financial standing and ensure compliance with tax regulations. It outlines various types of deductions, which can include expenses related to business operations, education, and healthcare, among others. Understanding this form is crucial for maximizing potential tax benefits and minimizing liabilities.

How to use the SUBTRACTION FOR

Using the SUBTRACTION FOR involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents that support your deductions, such as receipts, invoices, and statements. Next, carefully fill out the form, ensuring that each section reflects the correct figures and complies with IRS guidelines. It's important to double-check calculations and verify that all necessary supporting documents are attached before submission. This thorough approach helps to avoid errors that could lead to delays or penalties.

Steps to complete the SUBTRACTION FOR

Completing the SUBTRACTION FOR requires a systematic approach. Start by entering your personal information, including your name and Social Security number. Then, proceed to list each deduction category and input the corresponding amounts. Ensure that you provide accurate figures and include any necessary documentation to substantiate your claims. After filling out the form, review it for accuracy and completeness. Finally, submit the form according to the specified methods, whether online, by mail, or in person.

Legal use of the SUBTRACTION FOR

The legal use of the SUBTRACTION FOR is governed by IRS regulations, which dictate how deductions should be reported and the types of expenses that qualify. To ensure compliance, it is essential to follow all guidelines and maintain accurate records of deductions claimed. Failure to adhere to these regulations can result in penalties, including fines or audits. Utilizing a reliable eSignature solution can further enhance the legal validity of your submissions by providing a secure and compliant method for signing and submitting the form.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the SUBTRACTION FOR. These guidelines outline eligible deductions, required documentation, and deadlines for submission. It's crucial to familiarize yourself with these rules to ensure that your form is completed correctly and submitted in a timely manner. The IRS also offers resources and support to assist taxpayers in understanding their obligations and maximizing their deductions.

Filing Deadlines / Important Dates

Filing deadlines for the SUBTRACTION FOR are typically aligned with the overall tax filing deadlines set by the IRS. For most individuals, this date falls on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines related to extensions or amendments, as these can vary based on individual circumstances. Staying informed about these dates is essential for timely and compliant submissions.

Required Documents

To complete the SUBTRACTION FOR accurately, certain documents are required. These may include receipts for deductible expenses, bank statements, and any relevant tax forms that support your claims. Keeping thorough records of all financial transactions throughout the year will facilitate a smoother filing process. Additionally, having these documents readily available can help substantiate your deductions in case of an audit or review by the IRS.

Quick guide on how to complete subtraction for

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Edit and Electronically Sign [SKS] With Ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Select relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature through the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your preference. Modify and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SUBTRACTION FOR

Create this form in 5 minutes!

How to create an eSignature for the subtraction for

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to SUBTRACTION FOR?

airSlate SignNow is a powerful eSignature solution that simplifies the process of signing and managing documents. Its features include customizable workflows and automation, making SUBTRACTION FOR tasks more efficient. By using airSlate SignNow, businesses can reduce the time and errors associated with traditional document signing.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to different business needs and sizes. Whether you're looking for a basic plan for small teams or advanced options for larger organizations, each plan includes features that support easy SUBTRACTION FOR processes. Visit our pricing page to choose the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow provides seamless integration with a variety of popular software applications. This functionality allows you to enhance your SUBTRACTION FOR workflows by connecting with tools like CRM systems, cloud storage, and project management software. Enhance productivity by integrating SignNow with your existing technology stack.

-

Is airSlate SignNow secure for handling documents?

Absolutely! airSlate SignNow utilizes advanced encryption and security protocols to ensure that your documents are protected. This robust security framework is critical for organizations that require safe SUBTRACTION FOR document handling. You can trust SignNow to maintain the confidentiality and integrity of your sensitive information.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking of document status. These capabilities signNowly enhance SUBTRACTION FOR processes by streamlining document management and ensuring timely completion. With our user-friendly interface, you can easily navigate and utilize these features.

-

How can small businesses benefit from using airSlate SignNow?

Small businesses can greatly benefit from airSlate SignNow by reducing costs and increasing efficiency in document management. The platform is designed to simplify SUBTRACTION FOR processes, which allows smaller teams to focus on growth instead of administrative tasks. Start empowering your business with SignNow today!

-

What types of documents can I send and sign using airSlate SignNow?

With airSlate SignNow, you can send and sign a wide variety of documents, including contracts, agreements, forms, and more. This versatility makes it an excellent choice for effectively managing SUBTRACTION FOR documents in any industry. The platform's ease of use ensures that you can handle any document type effortlessly.

Get more for SUBTRACTION FOR

Find out other SUBTRACTION FOR

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will