Michigan Nonresident and Part Year Resident Schedule Michigan Nonresident and Part Year Resident Schedule Form

What is the Michigan Nonresident and Part Year Resident Schedule?

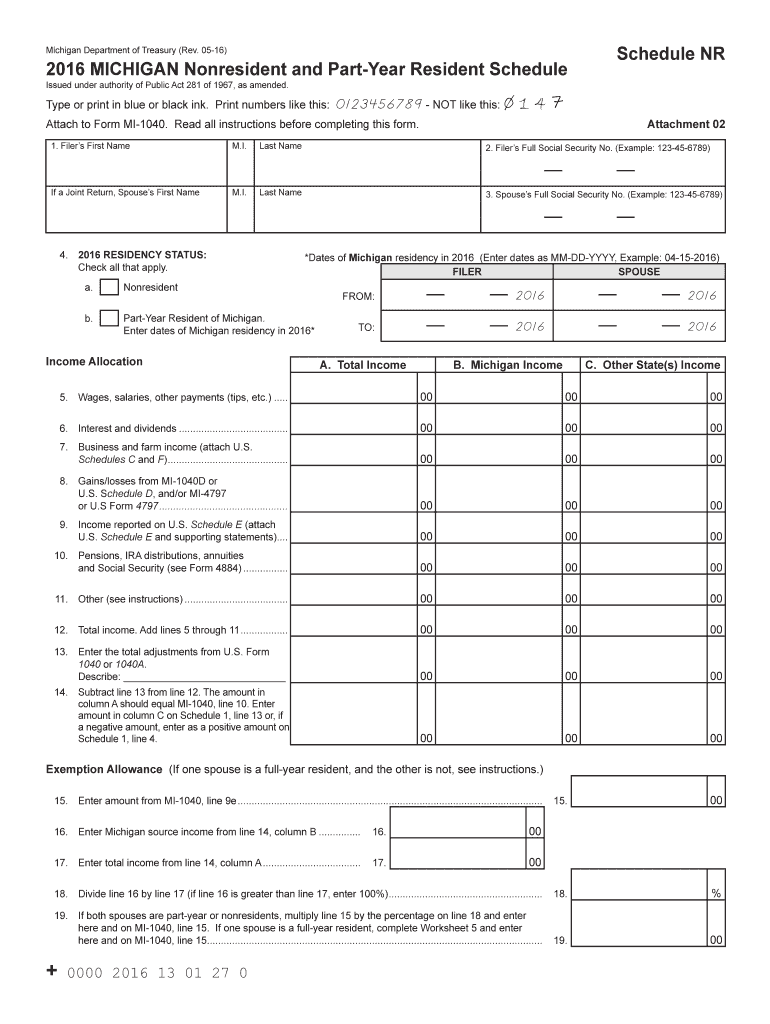

The Michigan Nonresident and Part Year Resident Schedule is a tax form used by individuals who do not reside in Michigan for the entire year but earn income within the state. This form allows nonresidents and part-year residents to report their Michigan-source income and calculate the tax owed to the state. It is essential for ensuring compliance with Michigan tax laws and for determining the correct amount of tax liability based on the income earned while in the state.

Steps to complete the Michigan Nonresident and Part Year Resident Schedule

Completing the Michigan Nonresident and Part Year Resident Schedule involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your total Michigan-source income, which includes wages, business income, and other earnings generated while in Michigan.

- Fill out the schedule accurately, ensuring all income and deductions are reported correctly.

- Calculate your tax liability based on the instructions provided with the form.

- Review your completed schedule for accuracy before submission.

Legal use of the Michigan Nonresident and Part Year Resident Schedule

The Michigan Nonresident and Part Year Resident Schedule is legally binding when completed and submitted according to state regulations. It is important to ensure that all provided information is accurate and truthful, as discrepancies may lead to penalties or audits. The form must be signed and dated by the taxpayer, and electronic signatures are accepted if using a compliant eSignature solution.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Nonresident and Part Year Resident Schedule typically align with the federal tax filing deadlines. Generally, taxpayers must submit their forms by April fifteenth of the following year. However, extensions may be available, allowing additional time to file without penalties. It is crucial to stay informed about any changes to deadlines that may occur due to state regulations or special circumstances.

Required Documents

To complete the Michigan Nonresident and Part Year Resident Schedule, you will need several key documents:

- W-2 forms from employers for income earned in Michigan.

- 1099 forms for any freelance or contract work completed while in the state.

- Records of any other income sources, including business income and investment earnings.

- Documentation of any deductions or credits you intend to claim.

Eligibility Criteria

Eligibility to use the Michigan Nonresident and Part Year Resident Schedule depends on your residency status and income sources. You qualify as a nonresident if you do not maintain a permanent residence in Michigan but earn income from Michigan sources. A part-year resident is someone who has established residency in Michigan for part of the tax year, earning income both within and outside the state during that time. Understanding your residency status is crucial for accurate tax reporting.

Quick guide on how to complete 2016 michigan nonresident and part year resident schedule 2016 michigan nonresident and part year resident schedule

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, adjust, and eSign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to adjust and eSign [SKS] without difficulty

- Find [SKS] and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and possesses the same legal authority as a conventional written signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Michigan Nonresident And Part Year Resident Schedule Michigan Nonresident And Part Year Resident Schedule

Create this form in 5 minutes!

How to create an eSignature for the 2016 michigan nonresident and part year resident schedule 2016 michigan nonresident and part year resident schedule

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is the Michigan Nonresident And Part Year Resident Schedule?

The Michigan Nonresident And Part Year Resident Schedule is a tax form used by individuals who earn income in Michigan but do not reside there full-time. This schedule helps determine the taxable income for these individuals and ensures compliance with Michigan tax laws. Using this schedule correctly is crucial for accurate tax reporting and to avoid potential penalties.

-

How can airSlate SignNow assist with the Michigan Nonresident And Part Year Resident Schedule?

airSlate SignNow provides an easy-to-use platform for eSigning and managing documents related to the Michigan Nonresident And Part Year Resident Schedule. Users can quickly create, send, and sign necessary forms, streamlining the tax filing process. This saves time and reduces the hassle associated with traditional paperwork.

-

Is airSlate SignNow cost-effective for managing my Michigan Nonresident And Part Year Resident Schedule?

Yes, airSlate SignNow offers a cost-effective solution for managing the Michigan Nonresident And Part Year Resident Schedule. With various pricing plans, you can choose one that fits your budget while gaining access to powerful features that enhance document management. Investing in this tool can ultimately save you time and potential tax-related expenses.

-

What features does airSlate SignNow offer for the Michigan Nonresident And Part Year Resident Schedule?

airSlate SignNow includes features like instant eSigning, document templates, and automated reminders that make handling the Michigan Nonresident And Part Year Resident Schedule simple and efficient. The platform is designed to provide a seamless experience, reducing the need for back-and-forth emails or physical document exchanges. These features enhance productivity and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for my Michigan Nonresident And Part Year Resident Schedule?

Absolutely! airSlate SignNow offers integrations with a variety of popular applications that can help facilitate the filing of the Michigan Nonresident And Part Year Resident Schedule. By connecting with tools such as CRM systems or document storage services, you can enhance your workflow and ensure all necessary documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Michigan Nonresident And Part Year Resident Schedule?

Using airSlate SignNow for tax-related documents like the Michigan Nonresident And Part Year Resident Schedule offers numerous benefits, including efficiency, accuracy, and security. The platform minimizes the risks of document loss and ensures your sensitive information is protected with top-notch security measures. Moreover, eSigning saves time, allowing you to focus on other important aspects of your tax preparation.

-

Do I need training to use airSlate SignNow for my Michigan Nonresident And Part Year Resident Schedule?

Not at all! airSlate SignNow is designed to be user-friendly, requiring little to no training for users to get started with the Michigan Nonresident And Part Year Resident Schedule. Its intuitive interface guides you through each step, making it easy to create, send, and sign documents. You can start utilizing its features immediately without extensive instruction.

Get more for Michigan Nonresident And Part Year Resident Schedule Michigan Nonresident And Part Year Resident Schedule

- Journeyman renewal palm beach county form

- Easement consent form

- Pinal county qdro form

- Subpoena packet pinal county pinalcountyaz form

- Medical excuse from arizona superior jury 2009 form

- San patricio county application for employment co san patricio tx form

- Sarasota county special needs shelter application form

- Protest submittal form sarasota county government scgov

Find out other Michigan Nonresident And Part Year Resident Schedule Michigan Nonresident And Part Year Resident Schedule

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization