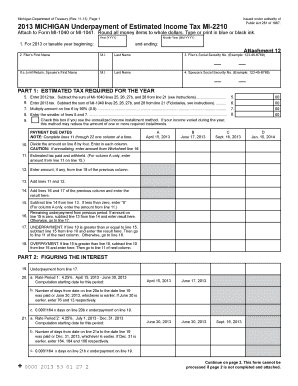

PART 1 ESTIMATED TAX REQUIRED for the YEAR Form

What is the Part 1 Estimated Tax Required for the Year

The Part 1 Estimated Tax Required for the Year form is a crucial document for individuals and businesses anticipating tax liabilities. This form helps taxpayers calculate their expected tax payments for the year, ensuring compliance with federal tax regulations. It is particularly relevant for those who earn income that is not subject to withholding, such as self-employed individuals, freelancers, and certain investment income earners. By accurately estimating tax obligations, taxpayers can avoid underpayment penalties and manage their finances more effectively.

Steps to Complete the Part 1 Estimated Tax Required for the Year

Completing the Part 1 Estimated Tax Required for the Year involves several key steps:

- Gather income information: Collect all sources of income, including wages, self-employment income, and investment earnings.

- Determine deductions: Identify any deductions or credits that may apply, such as mortgage interest or education credits.

- Calculate estimated tax: Use the IRS guidelines and tax tables to compute the estimated tax based on your total income and deductions.

- Complete the form: Fill out the Part 1 form with the calculated amounts, ensuring accuracy to avoid issues later.

- Review and submit: Double-check all entries for correctness before submitting the form electronically or by mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Part 1 Estimated Tax Required for the Year. Typically, estimated tax payments are due quarterly, with deadlines falling on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Failure to meet these deadlines can result in penalties, so taxpayers should mark their calendars and plan accordingly.

Legal Use of the Part 1 Estimated Tax Required for the Year

The legal use of the Part 1 Estimated Tax Required for the Year form is governed by federal tax laws. Properly completing and submitting this form is essential for compliance with the Internal Revenue Service (IRS) regulations. By filing the form, taxpayers affirm their commitment to fulfilling their tax obligations, which helps avoid potential legal issues such as audits or penalties for underpayment. It is advisable to retain copies of submitted forms and any supporting documentation for future reference.

Who Issues the Form

The Part 1 Estimated Tax Required for the Year form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources to assist taxpayers in understanding their estimated tax obligations. It is important to use the most current version of the form, as tax laws and requirements can change annually.

Penalties for Non-Compliance

Non-compliance with the requirements of the Part 1 Estimated Tax Required for the Year can lead to significant penalties. Taxpayers who fail to make timely estimated tax payments may incur a penalty for underpayment, which is calculated based on the amount owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes, further increasing the total liability. To avoid these consequences, it is crucial to adhere to filing deadlines and accurately estimate tax payments.

Quick guide on how to complete part 1 estimated tax required for the year

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features required to create, modify, and eSign your documents swiftly without hold-ups. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on Done to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR

Create this form in 5 minutes!

How to create an eSignature for the part 1 estimated tax required for the year

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR?

The PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR refers to the advance payment of your projected tax liability to avoid penalties. It's essential for businesses to understand their estimated tax obligations to manage cash flow effectively. Utilizing tools like airSlate SignNow can enhance the efficiency of document management related to this tax requirement.

-

How does airSlate SignNow help with the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR?

airSlate SignNow streamlines the process of preparing and signing documents related to the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR. Its eSigning features allow you to quickly send, receive, and store essential tax documents securely. This minimizes the time spent on paperwork and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow provides a range of features that support your tax documentation needs, including eSignatures, automated workflows, and secure document storage. These features enable users to create, sign, and manage important files related to the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR efficiently. This integration of functionality results in a smoother tax preparation process.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage documents, including those related to the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR. With competitive pricing and a variety of subscription options, you can choose a plan that fits your budget and needs. This affordability makes it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely, airSlate SignNow offers integrations with various accounting and tax software, making it easy to include eSigned documents in your financial workflows. This simplifies processes related to the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR, ensuring all your financial documentation is aligned. These integrations save time and reduce errors in your tax management.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides several benefits, including enhanced security, faster processing times, and easier tracking of document status. When preparing for the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR, having an efficient document flow can signNowly reduce stress. It helps ensure that all necessary forms are signed and submitted on time.

-

What type of customer support does airSlate SignNow offer for tax-related queries?

airSlate SignNow offers comprehensive customer support to assist with any queries regarding tax-related documents and processes. Their team is available to help you navigate issues related to the PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR. This support includes both live assistance and a wealth of online resources for troubleshooting and guidance.

Get more for PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR

Find out other PART 1 ESTIMATED TAX REQUIRED FOR THE YEAR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors