MICHIGAN Underpayment of Estimated Income Tax MI2210 Attach to Form MI1040 or MI1041

What is the MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

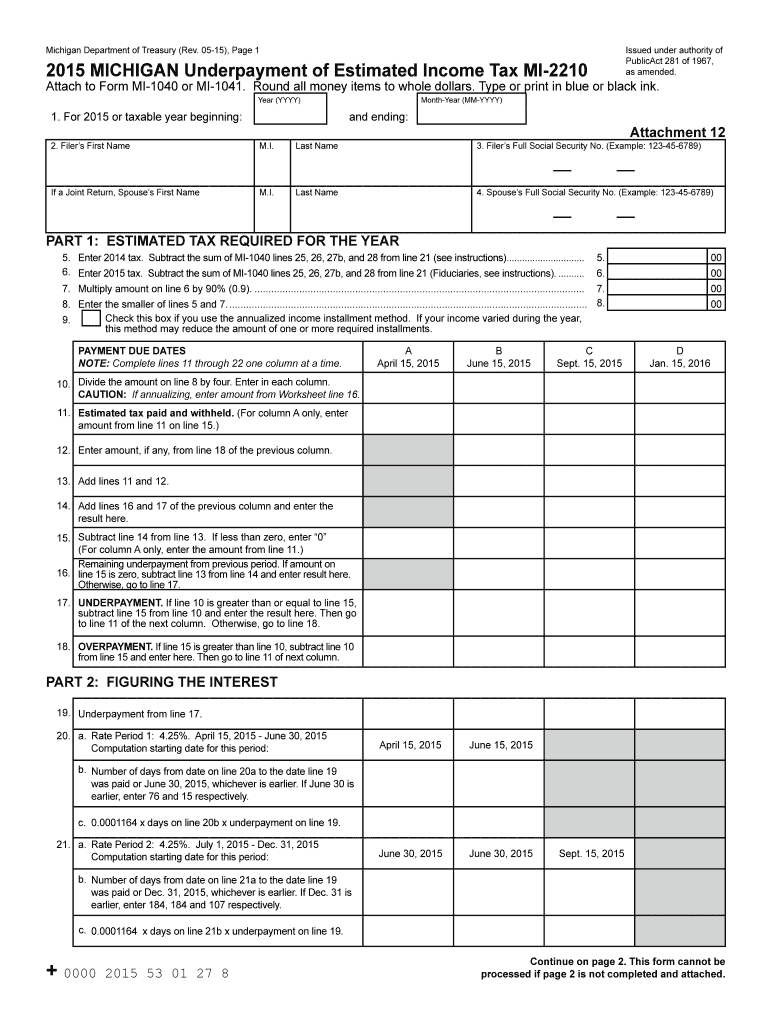

The MICHIGAN Underpayment of Estimated Income Tax MI2210 is a form that taxpayers in Michigan must complete when they have not paid enough estimated income tax during the year. This form is essential for those who owe additional taxes and need to report any underpayment to the state. It is typically attached to either Form MI1040 or MI1041, which are the primary income tax forms for individuals and estates or trusts, respectively. By filing MI2210, taxpayers can calculate the penalty for underpayment and provide the necessary information to resolve their tax obligations.

How to use the MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

To use the MICHIGAN Underpayment of Estimated Income Tax MI2210, begin by determining if you owe a penalty for underpayment of estimated taxes. This involves calculating your total tax liability and comparing it to the amount you have already paid through estimated payments or withholding. If there is a shortfall, you will need to fill out the MI2210 form accurately. Once completed, attach it to your MI1040 or MI1041 when you file your state tax return. Ensure that all figures are accurate to avoid delays or issues with your tax filing.

Steps to complete the MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

Completing the MICHIGAN Underpayment of Estimated Income Tax MI2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of estimated tax payments you have made.

- Complete the MI2210 form, following the instructions carefully to calculate any penalties.

- Attach the completed MI2210 to your MI1040 or MI1041 form.

- Review all forms for accuracy before submitting them to the Michigan Department of Treasury.

Legal use of the MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

The legal use of the MICHIGAN Underpayment of Estimated Income Tax MI2210 is crucial for compliance with state tax laws. By filing this form, taxpayers acknowledge their underpayment and take steps to rectify it. The form must be filled out correctly and submitted alongside the appropriate tax return to avoid penalties. It is also important to retain copies of all submitted documents for your records, as they may be required for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the MICHIGAN Underpayment of Estimated Income Tax MI2210 coincide with the due dates for the MI1040 and MI1041 forms. Typically, individual income tax returns are due on April fifteenth of each year. If you have underpaid your estimated taxes, ensure that you file the MI2210 by this date to avoid additional penalties. It is advisable to check for any specific extensions or changes to deadlines that may apply in a given tax year.

Penalties for Non-Compliance

Failing to file the MICHIGAN Underpayment of Estimated Income Tax MI2210 or not paying the required estimated taxes can result in penalties. The state may impose a penalty based on the amount of underpayment and the duration of the shortfall. This penalty can accumulate over time, increasing the total amount owed. To avoid these penalties, it is essential to assess your tax situation regularly and file the necessary forms accurately and on time.

Quick guide on how to complete 2015 michigan underpayment of estimated income tax mi2210 attach to form mi1040 or mi1041

Effortlessly manage [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow offers all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

Create this form in 5 minutes!

How to create an eSignature for the 2015 michigan underpayment of estimated income tax mi2210 attach to form mi1040 or mi1041

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an e-signature for a PDF file on Android OS

People also ask

-

What is the MICHIGAN Underpayment Of Estimated Income Tax MI2210?

The MICHIGAN Underpayment Of Estimated Income Tax MI2210 is a form used by taxpayers to calculate any penalties due to underpayment of estimated income taxes. If you're liable for underpayment, you must attach this form to either Form MI1040 or MI1041. Understanding this form helps ensure adherence to Michigan tax laws and avoids potential penalties.

-

How do I attach the MI2210 form to my MI1040 or MI1041?

To attach the MI2210 form to your MI1040 or MI1041, simply include it with the other required documents when filing your Michigan tax return. Make sure to complete the MI2210 form accurately to reflect your estimated tax payments. This ensures a smoother processing of your filings and reduces the risk of delays or penalties.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features to streamline eSigning and document management. Users can easily send, sign, and manage documents in an efficient, secure environment. Integrating this solution with your tax forms, including those concerning the MICHIGAN Underpayment Of Estimated Income Tax MI2210, improves workflow and reduces paper clutter.

-

Is airSlate SignNow a cost-effective solution for small businesses?

Yes, airSlate SignNow provides a cost-effective solution tailored for small businesses looking to manage document signing efficiently. The platform offers competitive pricing without sacrificing features, which is essential for businesses, especially when dealing with tax documentation like the MICHIGAN Underpayment Of Estimated Income Tax MI2210. This allows you to save money while maintaining compliance.

-

Can airSlate SignNow integrate with accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for enhanced productivity. This is particularly beneficial for handling forms such as the MICHIGAN Underpayment Of Estimated Income Tax MI2210, as it simplifies the document preparation and submission process. This integration helps ensure that your financial records are accurate and up to date.

-

What are the benefits of eSigning documents with airSlate SignNow?

eSigning documents with airSlate SignNow speeds up the signing process, eliminates the need for printing, and allows for secure storage of documents. These benefits are crucial when dealing with important tax forms, including the MICHIGAN Underpayment Of Estimated Income Tax MI2210. This method not only enhances efficiency but also increases the security of your sensitive information.

-

How can I get support if I have questions about MICHIGAN tax forms?

If you have questions about MICHIGAN tax forms, including the MICHIGAN Underpayment Of Estimated Income Tax MI2210, airSlate SignNow offers extensive customer support. Their team can assist you with understanding and completing your forms accurately. Additionally, a wealth of resources is available online to help guide you through common tax-related queries.

Get more for MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

- Ionia parenting time affidavit form

- Long term care workforce background check application form 2011 2019

- Form stc 12 32c kanawha

- How to get a permit for culverts in livingston parish form

- Lapd officer request form los alamos county losalamosnm

- Manatee county tree removal permit form

- Half price ignition interlock form

- Court order to amend a wisconsin birth certificate form

Find out other MICHIGAN Underpayment Of Estimated Income Tax MI2210 Attach To Form MI1040 Or MI1041

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online