M1X, Amended Income Tax Return Form

What is the M1X, Amended Income Tax Return

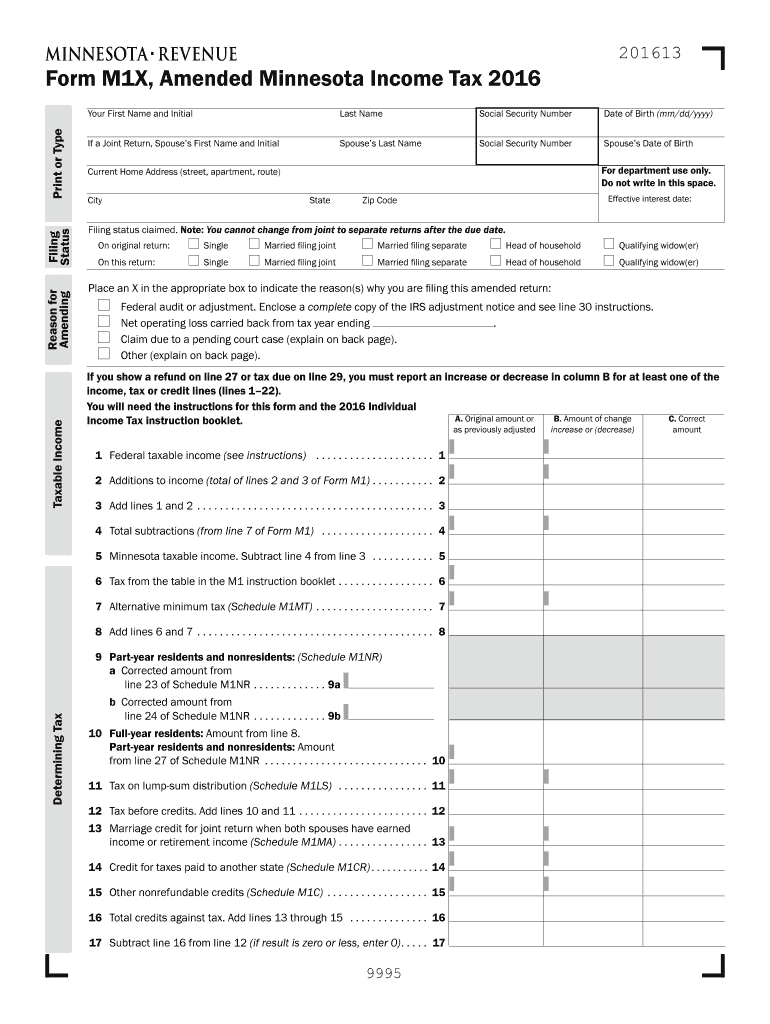

The M1X, Amended Income Tax Return, is a form used by taxpayers in the United States to correct errors or make changes to a previously filed Minnesota income tax return. This form allows individuals to amend their tax information, ensuring that the state has accurate records. The M1X can be utilized for various reasons, including correcting income amounts, adjusting deductions, or claiming additional credits. It is essential to file this form to maintain compliance with state tax regulations and to avoid potential penalties.

Steps to complete the M1X, Amended Income Tax Return

Completing the M1X involves several steps to ensure accuracy and compliance. Begin by gathering your original tax return and any supporting documents that pertain to the changes you wish to make. Next, follow these steps:

- Fill out the M1X form with the corrected information, ensuring that all changes are clearly indicated.

- Provide a detailed explanation for each change made to your tax return.

- Attach any necessary documentation that supports your amendments, such as W-2s or 1099s.

- Review the completed form for accuracy before submission.

Once finalized, the M1X should be submitted to the Minnesota Department of Revenue for processing.

Legal use of the M1X, Amended Income Tax Return

The M1X is legally recognized as a valid means for taxpayers to amend their income tax returns in Minnesota. To ensure that the amendments are accepted, it is crucial to adhere to the guidelines set forth by the Minnesota Department of Revenue. This includes submitting the form within the designated time frame, which is typically within three years of the original filing date. Proper completion and submission of the M1X safeguard against potential legal issues and ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the M1X, Amended Income Tax Return, are critical for taxpayers looking to amend their returns. Generally, you must file the M1X within three years from the original due date of the return you are amending. For example, if your original return was due on April 15, you have until April 15 of the third year following that date to submit your M1X. It is essential to be aware of these deadlines to avoid missing the opportunity to amend your return and potentially receive a refund or correct any discrepancies.

Required Documents

When completing the M1X, certain documents are necessary to support your amendments. These may include:

- Your original tax return that is being amended.

- Any W-2 or 1099 forms that reflect the income you are reporting.

- Documentation for any deductions or credits you are claiming.

- Any correspondence from the Minnesota Department of Revenue regarding your original return.

Having these documents on hand will facilitate a smoother amendment process and help ensure that your M1X is accurately completed.

Examples of using the M1X, Amended Income Tax Return

There are various scenarios where a taxpayer might need to use the M1X. For instance, if you discover that you omitted a significant source of income after filing your return, you would use the M1X to report that income and adjust your tax liability accordingly. Another example is if you received additional tax credits or deductions after your original filing that you were unaware of at the time. In both cases, filing the M1X allows you to correct your tax return and ensure that your tax obligations are accurately reflected.

Quick guide on how to complete 2016 m1x amended income tax return

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, amend, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The Easiest Way to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for those purposes.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1X, Amended Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the 2016 m1x amended income tax return

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is an M1X, Amended Income Tax Return?

The M1X, Amended Income Tax Return, is a tax form used by Minnesota residents to correct errors or make changes to a previously filed M1 tax return. This form allows you to amend information such as income, deductions, or credits. It's important to file an M1X to ensure your tax records are accurate and up-to-date.

-

How can airSlate SignNow help with filing an M1X, Amended Income Tax Return?

airSlate SignNow streamlines the process of filing your M1X, Amended Income Tax Return by providing a secure platform for electronically signing and sending your documents. The user-friendly interface allows you to quickly upload and finalize your amended return, making the filing process efficient and hassle-free.

-

What are the costs associated with using airSlate SignNow for M1X, Amended Income Tax Return?

airSlate SignNow offers a cost-effective solution with various subscription plans that cater to individual and business needs. The pricing is transparent, and you can start with a free trial to evaluate whether the service meets your requirements for managing M1X, Amended Income Tax Return filing and other documents.

-

Is airSlate SignNow compliant with tax regulations for M1X, Amended Income Tax Return?

Yes, airSlate SignNow is committed to compliance with all relevant tax regulations. The platform provides a secure environment that adheres to industry standards, ensuring that your M1X, Amended Income Tax Return is filed in accordance with state and federal guidelines.

-

What features does airSlate SignNow offer for handling M1X, Amended Income Tax Returns?

airSlate SignNow features electronic signatures, document tracking, and customizable templates specifically designed for tax forms, including the M1X, Amended Income Tax Return. These tools enhance efficiency, allowing users to manage their tax documents effectively and securely.

-

Can I integrate airSlate SignNow with other applications for M1X, Amended Income Tax Return?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, making it easy to import data for your M1X, Amended Income Tax Return. This interoperability helps streamline the entire tax filing process, saving you time and reducing errors.

-

How do I know if I need to file an M1X, Amended Income Tax Return?

If you discover errors or omissions in your previously filed M1 return, you should consider filing an M1X, Amended Income Tax Return. Common reasons for amendments include correcting income, adjusting deductions, or claiming additional credits. Always consult your tax professional if you are unsure.

Get more for M1X, Amended Income Tax Return

- Adult medical history form rush copley medical center

- Chicago fire department ride along program form

- By laws of the medical staff new york presbyterian hospital form

- Rex assist form

- Methodist uniform orders

- Westerly hospital medical authorization form

- Medex academy undergraduate application greenville hospital ghs form

- Clinical history form

Find out other M1X, Amended Income Tax Return

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now