M1W, Minnesota Income Tax Withheld Revenue State Mn Form

What is the M1W, Minnesota Income Tax Withheld Revenue State Mn

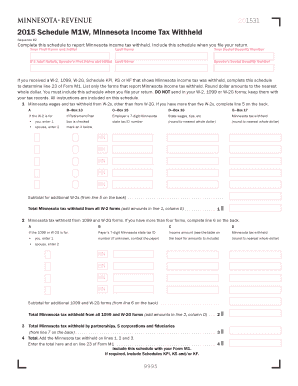

The M1W form is a critical document used by employers in Minnesota to report the income tax withheld from employees' wages. This form is essential for both the employer and the employee, as it ensures that the correct amount of state income tax is remitted to the Minnesota Department of Revenue. The M1W captures details such as the total wages paid, the amount of tax withheld, and the employer's identification information. Proper completion of this form is vital for compliance with state tax laws and helps employees accurately report their income during tax filing season.

How to use the M1W, Minnesota Income Tax Withheld Revenue State Mn

To effectively use the M1W form, employers should first gather all necessary payroll information for their employees. This includes total wages paid and the corresponding state income tax withheld. Once the information is collected, employers can fill out the M1W form, ensuring that all fields are accurately completed. After filling out the form, employers must submit it to the Minnesota Department of Revenue, either electronically or by mail. It is important to keep a copy of the submitted form for record-keeping purposes, as it may be required for future reference or audits.

Steps to complete the M1W, Minnesota Income Tax Withheld Revenue State Mn

Completing the M1W form involves several key steps:

- Gather employee payroll data, including total wages and tax withheld.

- Obtain the M1W form from the Minnesota Department of Revenue's website or through your payroll software.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed M1W form to the Minnesota Department of Revenue by the designated deadline.

Key elements of the M1W, Minnesota Income Tax Withheld Revenue State Mn

Several key elements must be included when completing the M1W form:

- Employer Information: This includes the employer's name, address, and identification number.

- Employee Information: Details about the employee, such as name, address, and Social Security number.

- Total Wages Paid: The total amount of wages paid to the employee during the reporting period.

- Tax Withheld: The total amount of state income tax withheld from the employee's wages.

- Signature: The form must be signed by an authorized representative of the employer.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the M1W form. Typically, the M1W must be submitted by the end of January for the previous calendar year. It is important to check the Minnesota Department of Revenue's website for any updates or changes to deadlines, as these can vary based on specific circumstances or changes in legislation. Timely submission is crucial to avoid penalties and ensure compliance with state tax regulations.

Legal use of the M1W, Minnesota Income Tax Withheld Revenue State Mn

The M1W form serves a legal purpose in documenting the income tax withheld from employees' wages. It is essential for employers to ensure that the information reported on this form is accurate and complete to comply with Minnesota tax laws. Failure to properly file the M1W can result in penalties, fines, and potential audits by the Minnesota Department of Revenue. Employers should maintain records of the submitted forms and any supporting documentation to substantiate their compliance with state tax requirements.

Quick guide on how to complete 2011 m1w minnesota income tax withheld revenue state mn

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1W, Minnesota Income Tax Withheld Revenue State Mn

Create this form in 5 minutes!

People also ask

-

What is the M1W, Minnesota Income Tax Withheld Revenue State Mn form?

The M1W, Minnesota Income Tax Withheld Revenue State Mn form is used to report the amount of state income tax withheld from employees' wages. This form is essential for employers to ensure compliance with state tax regulations and to provide accurate reporting to employees and the Minnesota Department of Revenue.

-

How can airSlate SignNow help with filing the M1W, Minnesota Income Tax Withheld Revenue State Mn?

airSlate SignNow offers an efficient solution for signing and submitting documents, including the M1W, Minnesota Income Tax Withheld Revenue State Mn. By using our platform, you can easily prepare, send, and eSign your forms, ensuring a streamlined process that saves time and reduces paperwork.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features like document templates, electronic signatures, and built-in compliance checks, which are essential for managing tax documents like the M1W, Minnesota Income Tax Withheld Revenue State Mn. These features enhance accuracy and assure you that your submissions meet state requirements.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Yes, airSlate SignNow can be integrated with various accounting software solutions, making it easier to manage documents related to the M1W, Minnesota Income Tax Withheld Revenue State Mn. This integration helps streamline your workflow by directly connecting eSigning activities with your existing financial tools.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation provides benefits such as improved efficiency, enhanced security, and reduced turnaround times. Specifically for the M1W, Minnesota Income Tax Withheld Revenue State Mn, you can ensure timely submissions while maintaining compliance with state regulations.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses dealing with tax forms like the M1W, Minnesota Income Tax Withheld Revenue State Mn. Our pricing plans are affordable, allowing you to manage your tax documents without breaking the bank.

-

How secure is airSlate SignNow when managing sensitive tax information?

airSlate SignNow prioritizes security by using industry-standard encryption and compliance measures to protect your sensitive tax information. When handling forms like the M1W, Minnesota Income Tax Withheld Revenue State Mn, you can trust that your data is safe and secure throughout the entire signing and storing process.

Get more for M1W, Minnesota Income Tax Withheld Revenue State Mn

Find out other M1W, Minnesota Income Tax Withheld Revenue State Mn

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney